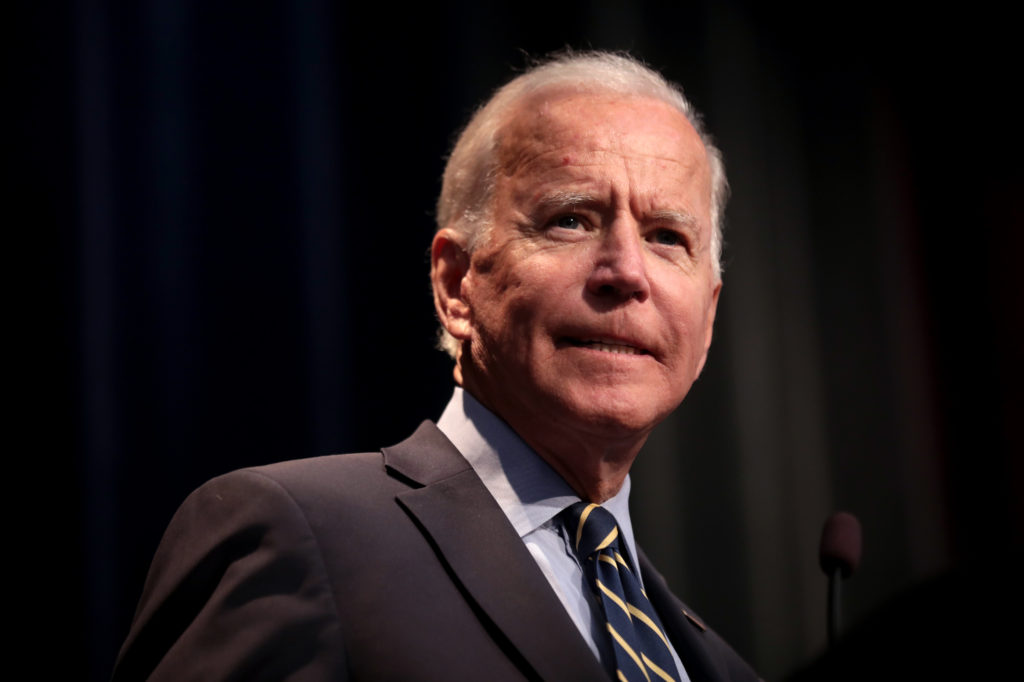

There is no love lost between the US and its allies and Russia, and President Joe Biden’s failure to woo his Russian counterpart Vladimir Putin to pull back some 130,000 troops massed near Ukraine has sent the world starting a countdown to war.

Russia has accused the US of stoking hysteria.

Bloomberg reports that while Ukraine says it “understands all the current risks and is ready for any developments”, it does not perceive the danger to be as significant as the US says.

Ukrainian President Volodymyr Zelenskiy said in a televised briefing on the weekend that panic was “the best friends for enemies”.

In a last-ditch attempt to stave off an invasion that could start World War III, German Chancellor Olaf Scholz is flying to Kyiv today to meet with Zelenskiy and tomorrow with Putin as diplomatic efforts intensify to de-escalate the crisis through dialogue and the threat of sanctions on Russia if it invades Ukraine.

This comes as the US said intelligence indicates Russia may attack Ukraine before the Olympics end on February 20.

Russian officials have repeatedly denied there are plans to do so.

The markets seem to be pricing in war, with investors fleeing to safe-haven currencies and assets.

In Asia and Europe stock futures sagged as the warnings that Russia could invade Ukraine at any time sent oil prices to seven-year peaks, boosted bonds and belted the euro.

The price of Brent hit $96.16 this morning amid increased supply concerns.

The defensive mood was apparent in precious metal prices. “Gold jumped by 1.86% on Friday, closing at $1,860, while palladium firmed 2.35%.

This morning we have gold trading a touch softer at $1,854, platinum is up at $1,033 and palladium a further 2.6% stronger at $2,370,” comments TreasuryONE.

“There was a significant risk-off move and flight to safe-haven assets late on Friday as fears of a Russian invasion of Ukraine grew.

The dollar firmed against its major peers, oil and gold jumped while equity markets fell. The rand, which had traded on the front foot for most of Friday, closed weaker at R15.20 while the Russian ruble also slipped heavily,” according to the forex trading house.

Bloomberg reports the ruble slumped to a two-week low early today as tensions over Ukraine weighed on the currency, even after the central bank on Friday delivered its third 100 basis-point interest-rate hike in less than a year.

This moved the rand to start the new week on a weaker footing and is currently quoted at R15.23.

TreasuryONE warns traders of a “choppy day as markets digest any fresh news”.

Let’s hope Scholz can reach out to Russia, with love.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Exposed: Zweli Mkhize’s R6m ‘cut’ from PIC’s R1.4bn deal using Unemployment Insurance Fund money – Daily Maverick

Gauteng officials suspended over R588m refurbishment of AngloGold Ashanti Covid hospital – Daily Maverick

Good news for South Africa’s state of disaster – BusinessTech

Global Business

A Russian security guard is accused of ruining a R15 million painting by drawing eyes on it – Business Insider

Splunk jumps on report that Cisco made $20 billion-plus offer – Bloomberg

Saudi Arabia transfers $80bn in shares to wealth fund for green projects – The Guardian

Markets

Asia stocks skid on Ukraine fears, oil at 7-year peak – Reuters

Ukraine tension reins in euro, drives rush to safe-havens – Reuters

Rand’s remarkable resilience inflicts pain on its doubters – Bloomberg/Fin24

Opinion/In-depth

Moody’s has bought a leading African rating agency: why it’s bad news – The Conversation

Call to action: Know how every cent misspent, squandered, stolen or unused hurts vulnerable people – Daily Maverick

The secret to creative breakthroughs, hot streaks and success – Bloomberg/Fin24

Video

Retail chain jumps on Tinder Swindler hype – eNCA

The trillion rand property collapse 2.0 – Magnus Heystek’s R500k+ Hartbeespoort mistake – Biznews

See the true cost of your cheap chicken – NYT Opinion

Image: Wikimedia Commons