The JSE leaped over the 76,500-point mark as commodities rebounded from a selloff in the previous session.

Oil rallied as US and NATO officials reiterated they’ve yet to see evidence of a Russian pullback, with Brent crude gaining 2.50% to last trade at $95.84 a barrel.

Sasol surged 4.61%.

Precious metal prices also bounced after yesterday’s “risk-off” sentiment, with gold gaining 0.63% to last trade at $1,865.52/oz, platinum jumping 3.45% to $1,062.96/oz and palladium adding 1.42% to $2,287.06/oz.

Benefiting from the relief rally were Sibanye-Stillwater (+5.42%), Kumba Iron Ore (+3.97%), African Rainbow Minerals (+3.92%), Anglogold (+3.44%), Northam (+3.36%) and Implats (+3.11%).

Supporting the All Share index’s 0.86% gain to 76,502.59 points were RCL Foods (+3.45%), logistics and fleet-management company Super Group (+3.02%) and global property company Growth Point (+2.86%).

Aluminium producer Hulamin gained 2.17% on a surge in the white metal to near 13-years highs, but South32, owner of the Hillside aluminium smelter in Richards Bay, dipped 1.02% on an analyst report that the company’s fundamentals look weak.

On the downside, Tiger Brands dipped 1.10% after the food maker warned of lower operational revenue due in part to a strike at some of its divisions and a price war among local bread manufacturers.

Heavyweight rand-hedges Richemont (-1.36%) and British American Tobacco (-1.20%) also weighed on the downside, while tech heavies Prosus (-1.06%) and Naspers (-0.58%) slipped despite investors in mainland China boosting their stakes in beaten-down Tencent and Meituan to the highest level in more than seven months on attractive valuations and easing concerns over government crackdowns.

The JSE-listed pair has a 29% exposure to Tencent.

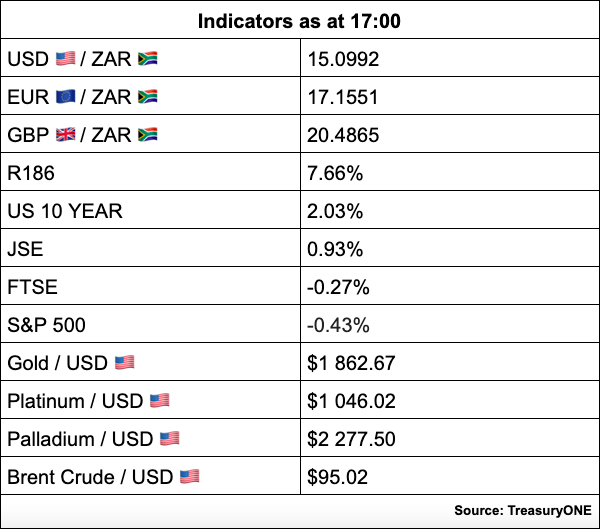

On the forex front, the rand has traded between the R15.00/R15.30 range for most of the week, with every advance toward the R15.00-level being met with a swift retracement and every leap toward R15.30 met with the same reaction, comments TreasuryONE.

“The main theme for the rand at the moment is one of volatile trading but within a very narrow band. It seems that the risk regarding the Russia-Ukraine conflict is starting to dwindle, which will be a bit of a relief for the rand.

We are however heading into the Fed minutes later this evening – should the minutes be more hawkish, we could see the rand trading toward the R15.20 level.”

The local unit was last quoted at R15.04 against the US dollar.