(Bloomberg) — Many of the tech sector’s lockdown winners have long surrendered their outsize pandemic gains, but cybersecurity stocks aren’t among them.

The resilience in Zscaler Inc., Crowdstrike Holdings Inc. and Fortinet Inc. is a display of bright growth prospects for these firms amid simmering geopolitical tensions, more employees adopting hybrid working models and the ongoing digital shift, analysts say. Zscaler has fallen 25% from a November peak, but remains up more than 300% over the past two years, while Crowdstrike and Fortinet are still up more than 160%.

That’s in stark contrast to meltdowns seen in Peloton Interactive Inc., PayPal Holdings Inc. and Netflix Inc., which have posted declines of between 43% and 81% from record highs after people chose to go back socializing rather than spend hours online.

“The need for security is different than any other pandemic play,” said Hilary Frisch, an analyst at ClearBridge Investments LLC.

“Anytime there is a new threat announced, or there’s a hack or ransomware attack, that’s effectively an advertisement for cybersecurity as something that companies and other organizations need to be investing in,” said Frisch, who is “heavily invested” in the space and prefers Palo Alto Networks Inc., Datadog Inc., Fortinet and Splunk Inc.

Indeed, Fortinet, a maker of network-security systems, demonstrated this month that sales growth remains strong, helping support its shares amid pressure from higher interest rates.

Even though such stocks aren’t fully immune to fears about Federal Reserve tightening that’s weighed on those with high valuations, a Nasdaq index of cybersecurity related firms has outperformed the Nasdaq 100 Index by two percentage points so far this year. That’s despite boasting a price-to-projected earnings ratio that’s more than 40% richer.

“We have witnessed a cybersecurity earnings season so far that is robust across the board,” said Wedbush Securities analyst Daniel Ives. “While the Fed driven risk-off environment remains, the underlying growth stories around cyber security are unmatched to what we have seen the last decade.”

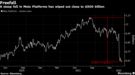

Tech Chart of the Day

Facebook-owner Meta Platforms Inc. is close to wiping out $500 billion in market capitalization from its September record. The social media giant has lost more than a third of its market value this year as poor earnings and questions over its strategic shift to the metaverse has prompted investors to dump the stock. It was valued at more than $1 trillion at peak.

Top Tech Stories

- Amazon.com Inc. has agreed to accept Visa’s cards across its global network, settling a feud that threatened to damage the financial giant’s business and disrupt e-commerce payments

- Nvidia Corp., which walked away from a $40 billion acquisition of Arm earlier this month, failed to impress investors with its latest forecast, a sign of the lofty expectations for the most valuable U.S. chipmaker

- Intel Corp. Chief Executive Officer Pat Gelsinger, who took the job in February 2021, gives himself an A- grade for his first year running the chipmaker. Investors are proving to be tougher graders

- Elon Musk waded further into the political controversy over vaccine mandates that’s gripped Canada for weeks, tweeting a meme making a satirical comparison between Prime Minister Justin Trudeau and Adolf Hitler

- ElasticRun, an e-commerce startup that provides supply chain and credit services to India’s mom-and-pop shops, or kiranas, raised $330 million in a funding round led by SoftBank Vision Fund 2 and Goldman Sachs Group Inc.

(Updates chart.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.