(Bloomberg) —

If you watched Super Bowl LVI on Sunday, you probably noticed a slew of automobile ads. You may have noticed that several featured icons of from various generations of popular entertainment, like Arnold Schwarzenegger, Dr.

Evil and Tony Soprano’s now grown-up children.

There was no missing the fact that a number of the ads were for electric vehicles. In fact, Super Bowl car commercials were almost entirely for EVs, with only a Porsche ad and Toyota’s spot for the Tundra pickup truck featuring The Joneses the exceptions.

In 2018 there were 12 Super Bowl car ads, none of which featured an electric vehicle; this year, seven of nine ads featured a vehicle with a plug.

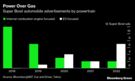

As Ira Boudway and Kyle Stock reported for Hyperdrive last month, EV advertisements have been increasing for the past two years.

Data from marketing analytics startup EDO shows that EV ads were 7.5% of auto advertising spend in the U.S. in 2021, more than triple the level of 2019. At the same time, total EV ad airings increased four-fold, as did total EV ad impressions.

That is a trend, for sure—but the Super Bowl is something different.

Viewing during the big game is highly social (in real life and on social media). Ads are hotly anticipated, eagerly and instantly reviewed, and, as such, are priced accordingly. Super Bowl ads are a moment to create brand awareness, or create a new concept of a familiar brand.

They are a chance to create not just an impression of product lines today, but a sense of where products—and consumers—might be going.

That was especially true with this slate of EV ads. The Chevrolet Silverado spot, for instance, features a model that will not be available for more than a year, sometime in 2024.

GM’s ad features a raft of new models without calling any of them out specifically; BMW’s spot for its arriving-soon iX features a certain former governor of California. These are efforts to create awareness and attention—and in that, they succeeded.

EDO crunched the data on Super Bowl LVI EV ads, and every single one of them – including Hyundai’s spot which ran before kickoff—outperformed the Super Bowl median in driving viewers to look up the brand.

In the case of Polestar, it outperformed by nearly 23 times; Kia, with its robot dog ad, outperformed by a factor of 10.

Kevin Krim, the president and chief executive of EDO, said Polestar’s spot was so effective because it satisfied three rules for a smashing Super Bowl ad.

First, it was truly new (Polestar is not Chevrolet, nor Tesla). Second, its creative elements were very well-executed. As Krim said, it had “striking visuals, and was both quiet and had pulse-pounding music.” Third, it “deliberately poked the eye of the celebrity complex.”

Of course, a company needs to do more than just poke eyes.

It needs to deliver on its intriguing promise with a product. And just as importantly, it needs to sell it, and selling cars is about more than automaker intentions. As Krim notes, automotive advertisements come in three tiers.

Tier one is the automakers themselves, and Super Bowl spots; Tier 2 is controlled by regional or multi-state dealer associations; Tier 3 is local company TV buys. Just because the Big Three want to sell EVs, doesn’t mean that every local dealer has ready buyers for them.

That said, I see reason to follow the automakers’ commitment to EVs down through dealers and to consumers.

One reason is what is called “conquest marketing”—the ability to win over new consumers to your brand. Ford noted late last year that more than 70% of customers reserving its electric Mustang Mach-E and F-150 Lightning models were “new to Ford.” That’s a powerful signal to other brands to try for the same.

A 2021 survey by Alix Partners found that 19% of U.S.

consumers were very likely to buy a battery-electric vehicle as their next car, up from 5% in 2019. That’s plenty of room for conquest, so to speak. Alix Partners also noted that in the U.S., 36% of those interested in EVs say that “friends and family is their biggest purchase-influencer”—the same friends and family gathered to watch the Super Bowl, and talk about it afterwards.

Two final thoughts.

The first is that today’s EV buyers are exactly the demographic that automakers and dealers want to target. Half of all U.S. EV buyers in the first three quarters of 2021 are in management, professional, or technical occupations, and 60% of U.S.

EV buyers are under the age of 50. That age cohort explains the stars of Super Bowl ads—be they 90s action heroes, comedic leads, or flawed-yet-compelling North Jersey families (admittedly, Schwarzenegger is a bit of an exception).

The second is that a thorough electrification of road transport—or what most car buyers will call “getting an EV”—is about more than your next car.

It’s also about your next next car. It’s about a whole host of things beyond just the vehicle itself, from people’s brand impressions to their family needs to the infrastructure needed to support tens and then hundreds of millions of EVs on the road.

Chevrolet released a behind-the-scenes video alongside its Silverado spot, which could stand alone as an ad in its own right.

In it, star Jamie-Lynn Sigler says “for me, personally, we’re making the transition into electric vehicles.” Sigler implies that it is a process, not just a purchase, and I think she is right.

Nathaniel Bullard is BloombergNEF’s Chief Content Officer.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.