(Bloomberg) — Supply Lines is a daily newsletter that tracks Covid-19’s impact on trade. Sign up here.

Port congestion in China is slowing the delivery of everything from iron ore to electronics, forcing companies to rely more on stockpiled inventories of goods.

It’s taking a week to 10 days longer to deliver iron ore supplies into China compared with before the pandemic, according to charterers and shipowners. That’s because of tightened Covid-19 quarantine requirements for vessels and reduced manpower at ports, they said.

Adding to the problem is the situation in Hong Kong, as it battles one of its most challenging Covid-19 outbreaks. The city’s harsh measures to control the spread of the omicron variant is delaying shipments of electronics and petrochemicals through its port.

An average of 23 container ships per day waited to berth at Hong Kong in January, up from 18 vessels in December, according to data from logistics intelligence firm project44. That’s one of the biggest jumps in congestion at Asian ports, which could worsen as Hong Kong attempts to test the entire city.

The shipping delays come at a sensitive time for iron ore, as China steps up a sweeping plan to cool rising prices. Top commodities trading firms have been asked to draw down inventories and co-operate with a probe into hoarding.

The campaign has caused prices for the steel-making raw material to plummet 15% this week.

With port stockpiles at the highest since 2018, the impact of shipping delays on prices could be muted. Still, it could add some volatility to iron ore amid an uncertain outlook for demand and calls by authorities for some traders to release “excessively high stockpiles.”

Today’s Events

(All times Beijing unless noted)

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Today’s Chart

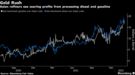

Oil soaring to near $100 a barrel is doing little to slow down demand from the biggest buyers as refineries in Asia look to boost processing rates to cash in on a boom in fuel-making profits. A significantly reduced stream of Chinese fuel exports in recent months has left Asia shorter on supply and more sensitive to disruptions as consumption recovers with countries easing virus restrictions.

On The Wire

- China Finds a New Way to Dominate the U.S. In South America

- China’s Covid-Zero Policy Gives a Polish to Gold: David Fickling

- Cnooc’s $13 Billion Oil, Gas Deals Show China’s Supply Fears

- Bayer Sees Opportunity in China GMO Seed Market, Executive Says

The Week Ahead

Monday, Feb. 21

- China sets monthly loan prime rates, 09:15

- China new home prices for January, 09:30

Tuesday, Feb. 22

- Nothing major scheduled

Wednesday, Feb. 23

- China Photovoltaic Industry Association holds online 2021 review and 2022 outlook briefing, 09:00-17:00

Thursday, Feb. 24

- Bloomberg’s China economic survey for February, 10:00

- EARNINGS: HKEX

- USDA weekly crop export sales, 08:30 EST

Friday, Feb. 25

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.