The JSE ended the week on the front foot, with glittering golds outshining losses in heavyweight tech counters as the crisis in Ukraine kept investors on edge. The All Share index closed 0.28% stronger at 76,368.34 points.

Although off an eight-month high above $1,900 an ounce, the tensions in Eastern Europe have helped gold track stronger to end the week on a high of $1,895/oz.

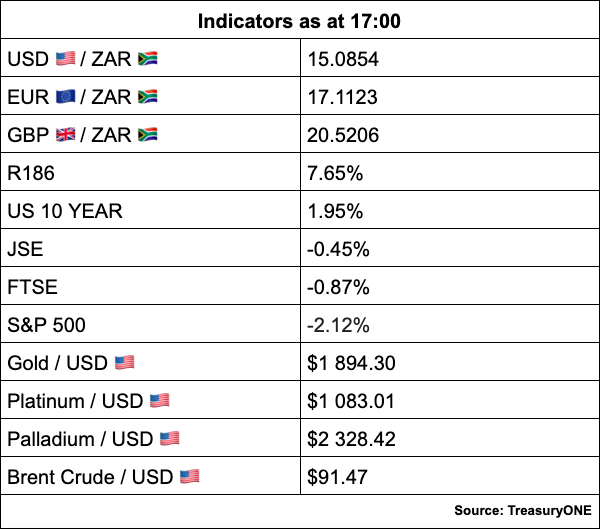

“Tensions in Eastern Europe have helped safe-haven assets like gold, but the dollar has not yet benefited from this,” comments TreasuryONE.

This boosted gold stocks, with Harmony (+7.53%) leading the charge. The gold miner warned in a trade update after the local market closed that it expects basic earnings for the six months to end-December to be between 68% and 72% lower than the comparable first half last year, reflecting higher operating and exceptional costs.

Following suit were Gold Fields (+5.85%), Pan African Resources (+5.41%), DRDGold (+2.57%) and Anglogold Ashanti (+1.27%).

Industrial metals Kumba Iron ore (+0.95%), Thungela Resources (+3.21%), Alphamin Resources (+1.13%) and ArcelorMittal (+1.42%) were all higher.

Platinum counters Implats gained 1.73% and Angloplat 1.43% despite platinum (-1.14%) and palladium (-2.64%) both trading on the back foot, last quoted at $2,310.38/oz and $1,078.07/oz respectively.

On the oil front, Brent crude also slipped as traders weighed the heightened geopolitical tensions over Ukraine against the potential for Iranian barrels to be added to the market, reports Bloomberg. The news wire observed that prices of commodities from gas to metals and food have swung this week with every twist and turn in the standoff between the West and Russia.

Paring losses, Brent was last quoted 0.70% lower at $92.29 a barrel. Sasol was down by a similar margin.

Losses in Naspers (-1.23%) and Prosus (-2.07%) kept the gains in check. Financial services also weighed on the downside, with Old Mutual losing 0.87%, FirstRand 0.30% and Absa 1.46%.

Retailers Pepkor and Dis-Chem lost 2.38% and 2.29% respectively.

On the forex front, the rand has lost some ground this afternoon after clocking four days of gains. After dipping to as low as the 200-day moving average at R14.90 yesterday, the local unit followed some weakness in the Russian ruble to trade back toward the R15.10-mark against the US dollar, comments TReasuryONE.

“With Monday being a US holiday, we could see the rand remain on the weaker front as traders close up positions ahead of the long weekend.”