The JSE turned positive just before the closing bell on a rally in commodity stocks as investors rushing to safe-havens boosted metal prices.

This was against the global grain where the Ukraine crisis rippled through world markets, causing volatility even before US markets began to trade following a long weekend.

Behind the mayhem is Russia’s recognition and mobilisation of troops in two self-proclaimed separatist republics in eastern Ukraine – basically a signal of the start of the Russian invasion of Ukraine.

Gold was pretty much a lone star as investors rushed to safer investments. Bloomberg reports bullion is just shy of hitting the highest level since June 2021.

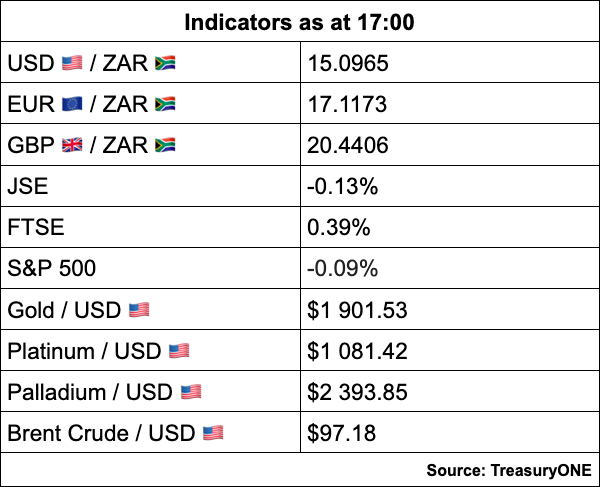

“Gold still hovers above $1,900, with the safe-haven status allowing for some gains on the yellow metal.

Platinum and palladium remain on the front foot, trading 1% stronger on the day,” comments TreasuryONE.

On oil, the forex trading house reports that the supply concerns continue to weigh on crude prices, with Brent Crude trading above $99 a barrel at one stage.

“Since then, the price of Brent crude has retreated to $97.70.”

Copper prices too continue to trade at elevated levels, “with the imbalance of supply and demand causing spot prices to rise over the past few months, and yet again trading around the $10,000 per tonne”.

As a result, the JSE All Share index ended the day up 0.17% at 75,653.84 points on a late spurt in Sasol (+5.65%) and a 3.09% jump in the FTSE/JSE Precious Metals & Mining Index as mining stocks stacked up the gains.

Leading the returns were African Rainbow Minerals (+5.64%), Sibanye-Stillwater (+5.16%), Northam (+4.98%) and Implats (+3.49%), with support from Thungela Resources and Angloplat (both +2.93%), Anglogold (+1.62%), Anglo American (+1.61%), Harmony (1.53%) and BHP (0.21%).

Bucking the trend were Kumba Iron Ore, losing 2.31% despite posting record earnings of R64.6bn in 2021 and South32, which completed the acquisition of a 45% stake in Sierra Gorda copper mine in Chile, the world’s largest producer of the metal.

On the losing side, engineering group Murray & Roberts slumped 8.52% after saying it will return to profit in half-year to end-December, but warned that Covid-19 continues to affect its operations.

Other big losers were equipment and services company Barloworld (-6.70%), financial services counters Old Mutual (-2.72%), Sanlam (-2.44%) and Coronation Fund Managers (-2.43%), and property group Growthpoint (-2.27%).

On the forex front, the rand ignored a rout in the Russian ruble, its emerging market peer, to last trade at R15.04/$.

“The ruble remains vulnerable with the expectation of sanctions being placed on Russia and is still firmly on the back foot and trading 4% weaker over the past week.

We have not yet seen much of the risk-off sentiment spill over and impact the rand as we await tomorrow’s budget speech from Finance Minister Enoch Godongwana,” comments TreasuryONE.

The forex trading house says risk-off sentiment helped the dollar trade firmer this morning but has slipped during the course of the day.

“The dollar losing some ground during most of the day has helped the euro trade back above 1.1350.”