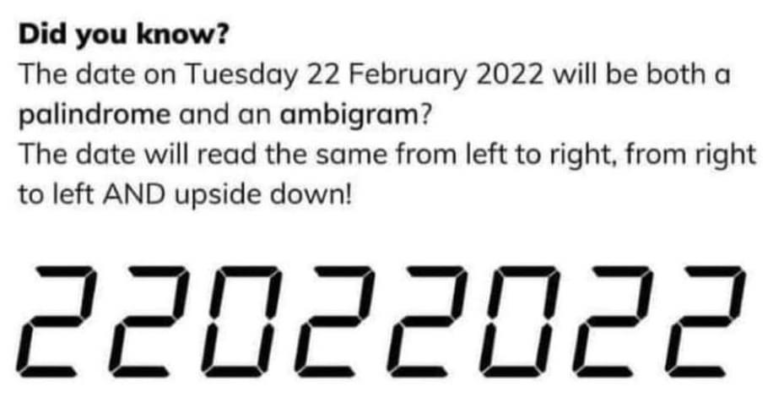

To lighten the mood on this heavy Tuesday, here’s an (in)significant titbit.

Today the world hits an “unprecedented milestone” that carries absolutely no historical significance or any cosmic message. Yet it does speak volumes about our brains and cultures, writes The Conversation as it unpacks the meaning of Twosday, so dubbed because of the date 22/2/22.

On the heavy side, Russian President Vladimir Putin’s recognition of the independence of Moscow-backed rebel regions Donetsk and Luhansk in eastern Ukraine has upped the stakes of a potentially catastrophic war with Ukraine’s government and accelerated the crisis the West fears could unleash a major world war.

In an address where he, for the first time ever, officially announced that he does not regard Donbas as part of Ukraine, he lashed out at his ex-Soviet neighbour, calling Ukraine a failed state and “puppet” of the West.

According to AFP, he said it was necessary to “take a long overdue decision, to immediately recognise the independence” of the two regions.

This precursor to the full invasion of Ukraine has set off a series of evasive measures in the West: the US has moved its Ukraine embassy staff to Poland; the Biden administration is coordinating with allies on a new set of sanctions that will include barring US financial institutions from processing transactions for major Russian banks; and the UN Security Council has held a rare emergency meeting last night in New York to address the escalating Russian military deployment to Ukraine.

Meanwhile, Ukraine president Volodymyr Zelenskyy said in a televised address early this morning that his government won’t react to provocation from Russia, but added that “we will not give anything to anyone”.

The markets reacted as expected: Investors fled to safe-haven gold, pushing the price of the yellow metal above $1,900/oz, while oil surged to a seven-year high above $97 a barrel.

“We could see prices surpass the $100-a-barrel mark very quickly and it even has an upside of $10 a barrel if we start seeing most sanctions being placed on Russian oil exports,” Sri Paravaikkarasu, Asia oil lead at FGE, told Bloomberg.

Both platinum and palladium advanced to $1,087 and $2,400 respectively.

Stock indices plummeted.

US futures have opened sharply weaker this morning, with the S&P losing 1.40%, the Nasdaq 2.1% and the Dow 1.25%. In the Far East, the Nikkei traded 1.80% weaker, while Shanghai lost 1.43% and Hang Seng a massive 3.30%.

Locally, the All Share index lost 1.1% yesterday to close at 75,528.

On the forex front, the dollar firmed quite sharply, causing emerging market currencies to soften. The Russian ruble extended its losses after falling the most since March 2020 the previous day.

“The rand is hovering just below R15.20 after having closed at R15.12 last night. A breakthrough in the R15.20/R15.25 level could see further weakness up to R15.35 levels,” comments TreasuryONE.

Tomorrow’s local budget speech, where Finance Minister Enoch Godongwana is expected to reduce the fiscal deficits and rein in debt in his maiden Budget speech, is likely to be overshadowed by the geopolitical tensions.

It should not immediately impact the rand, according to the forex trading house.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Unemployment in Gauteng ‘at its worst’, (another) war room established, Makhura announces – Daily Maverick

South Africa’s new driver licence system is a money-making scheme: Outa – Business Tech

How hard can it be to claw back R200K from Dudu Myeni? – Daily Maverick

Global Business

Ukraine crisis: Tanks and armoured personnel carriers near Donetsk – Reuters witness – Sky News

Almost 40% of UK FTSE 100 board roles now held by women – BBC New

Bank warns staff not to delete WhatsApps amid scrutiny – Bloomberg/Fin24

Markets

Asia stocks fall as Ukraine-Russia tensions climb – BBC News

Ruble sinks most in two years as Putin recognizes separatists – Bloomberg/DM

Markets brace for heavy falls as Russia-Ukraine crisis escalates – Reuters/SABC

Opinion/in-depth

China and Africa: Ethiopia case study debunks investment myths – The Conversation

ANALYSIS | Kathryn Rawson: The Khoisan – perpetually fighting for independence – News24

Why African family businesses are failing at multigenerational wealth – Billionaires Africa

Video

David Shapiro on Sasol and Amplats bumper financials – analysis – Biznews

Budget 2022 – Will it be enough to revive South Africa’s economy? – BDTV

Medicinal cannabis part of Gauteng’s R45 billion agricultural development hub – EWN

Image: Wikimedia Commons