(Bloomberg) — Tenneco Inc.’s agreement to go private through a plan led by Apollo Global Management Inc. gives the maker of mufflers and aftermarket auto parts a chance to move past years of upheaval with the help of new investors.

Apollo and its private equity affiliates will pay $20 a share, almost twice Tenneco’s Feb. 22 closing price, the companies said in a statement Wednesday. Based on the number of shares outstanding, the cash transaction has an equity value of about $1.6 billion. The companies valued the deal at $7.1 billion including debt.

Tenneco is “a company that we’ve followed and admired for a long time — a global player” in original-equipment and aftermarket auto parts, Michael Reiss, partner at Apollo Global, said in a telephone interview. “It’s a large platform that we think we can invest behind, use our capital and knowledge around the automotive sector to help execute on its global strategy, and increase its flexibility to better position all of the various business units.”

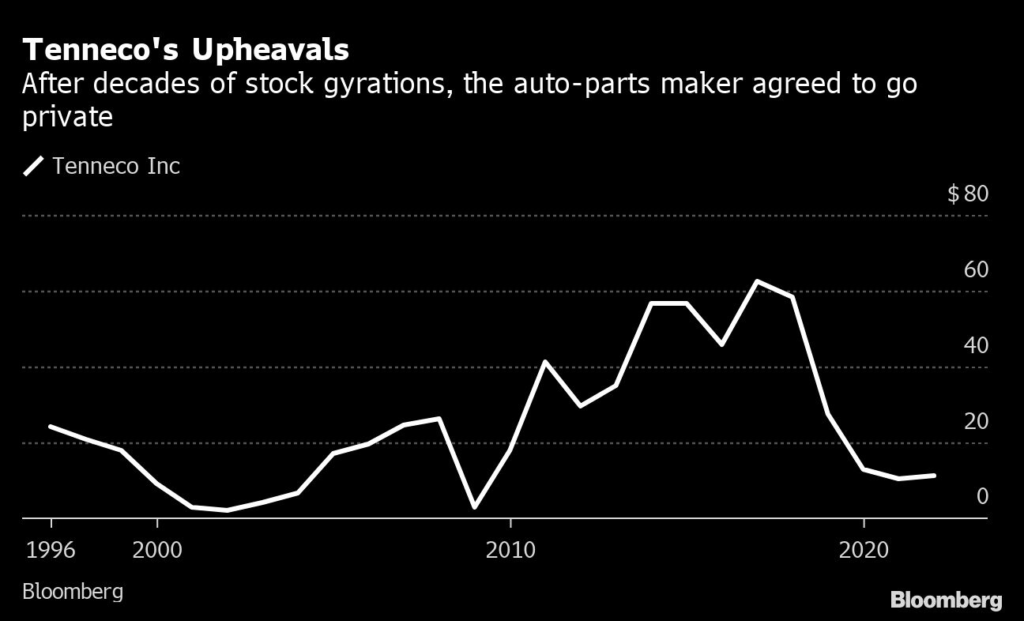

The sale wraps a tumultuous stretch for Lake Forest, Illinois-based Tenneco, which has endured activist investor pressure, board shakeups and an 85% drop in the stock price over the past five years. For Apollo, the newly acquired business fits into a portfolio that includes Canadian automotive molder ABC Technologies Holdings Inc., which it took majority control of less than a year ago.

Tenneco will continue to operate under that brand name following the deal, according to the companies. The deal, which has been unanimously approved by Tenneco’s board, is expected to close in the second half of the year. Lazard served as financial adviser to Tenneco, while Rothschild & Co. acted as lead financial adviser to Apollo Funds alongside BofA Securities and Citi.

Separately, Tenneco on Wednesday reported an adjusted loss of 11 cents a share in the fourth quarter, well short of Wall Street’s expectations. Sales of $4.39 billion exceeded the average of analysts’ estimates compiled by Bloomberg.

Tenneco shares soared 93%, the largest intraday climb in almost 13 years, as of 12:25 p.m. in New York. Apollo shares were little changed after earlier rising as much as 1.7%.

After years of dilution, Icahn Enterprises LP remains a top holder in Tenneco with a nearly 5% stake, according to the latest filings tracked by Bloomberg.

Dramatic Saga

The Apollo deal marks the latest twist in Tenneco’s saga. The company agreed in 2018 to acquire Federal-Mogul, a rival parts manufacturer backed by activist Carl Icahn, for $5.4 billion with the intention of subsequently breaking the company apart. That plan was upended by deep strains in Tenneco’s business, leading to the resignation of co-CEO Roger Wood in early 2020.

Around the same time, Dan Ninivaggi, a former Icahn Automotive Group executive, called for sweeping board changes, cash-raising steps and a possible sale of the company. In a January 2020 letter to the board, he said Tenneco “has never created a penny of shareholder value.” The stock has been on a steady slide from the mid-$60s in 2017 and early 2018.

More recently, semiconductor shortages caused by the pandemic have wreaked havoc on the automotive industry. But Reiss, who also serves on the board of ABC Technologies, sees significant upside after the impact of Covid-19 and chip delays declines.

“From a macro perspective, we will benefit from the auto demand recovery from trough levels,” Reiss said. “We have flexibility. There are organic growth opportunities where we can better help accelerate new products, new customers and then M&A both small and large.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.