Tech-heavyweights Naspers and Prosus and top-value commodity stocks have placed a drag on the JSE, while global equities slumped amid rising tensions with Russia after Ukraine said several government and bank websites had been subject to a cyberattack.

Locally, the rand traded in a relatively narrow range, despite the geopolitical tensions in eastern Europe and Finance Minister Enoch Godongwana’s maiden Budget Speech.

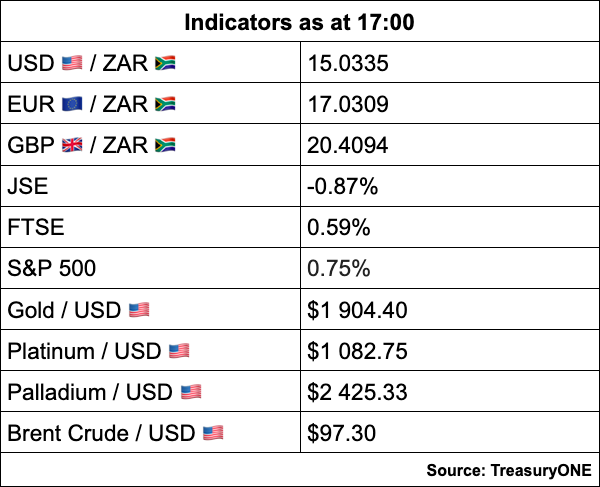

“Overall, it seems like the market has taken the budget speech as a positive and we are trading slightly stronger this afternoon testing R15.00,” TreasuryONE commented on the local markets close at around 17:00.

Since then the Russian effect on the ruble has filtered slightly through to the local unit, last trading at R15.09 against the US dollar.

“Russia’s invasion on pro-separate states, Donetsk and Luhansk, remains a concern and with the sanctions announced earlier today, we see the ruble remaining on the back foot. The resilience of the rand remains a key factor at the moment and we don’t see the rand breaking out of the R14.90-R15.20 range, unless the situation in Russia escalates dramatically,” says the forex trading house.

Bloomberg reports that options pricing suggests there’s a 50% chance the ruble will sink to a record low against the dollar within the next two months – dipping below levels from 2016 when the economy was mired in a recession.

The JSE hasn’t been spared the hit from escalating tensions in the Russia/Ukraine standoff, with the All Share index ending the day down 0.88% at 74,987.05 points.

Top-value stocks led the losses, with Naspers’ 2.01% and Prosus’ 3.84% causing the most damage. The latest Political Party Funding Declaration Report published by the Electoral Commission of South Africa (IEC), has shone a light on the ANC’scorporate donors, with Naspers highlighted as the third biggest donor with a R1m contribution.

The biggest contribution of R15m came from the Shell-linked Batho Batho Trust and R5.9m came from Harmony Gold Mining (-0.46%).

Discovery (-0.13%) donated R150,000 and 3Sixty Health Solutions R800,000, according to the report.

Heavyweight commodity stocks taking a beating were BHP (-4.78%), Anglo American (-2.24%), Sasol (-2.18%), Gold Fields (-0.77%) and Sibanye-Stillwater (-0.64%).

This despite the market remaining bullish on gold and palladium jumping just over 3% for the day, trading at $2,420/oz.

Copper has softened to below $10,000 a tonne while platinum was trading at $1,085/oz at the local markets close. Brent Crude was steady above $97 a barrel and with the elevated fuel price at the moment, the government’s decision to keep the fuel levy for 2023 fiscal year the same has been welcomed, says TreasuryONE.

On the upside, the gains were broad-based, with RCL Foods gaining 4.53%, tin producer Alphamin 4.08%, retailer Steinhoff 3.58%, diversified miner South32 3.39% and mobile operator MTN 3.18%.

Among the counters reporting on financials, Wilson Bayly Holmes-Ovcon (WBHO) (-27.11%) lost more than a quarter of its price, wiping off R1bn in value, as the construction group announced it was pulling the plug on its Aussie unit.

Peer Murray & Roberts added to its 8.52% slump in the previous session, dipping another 1.30% after it warned that Covid-19 continues to affect its operations.

Investec gained 0.59% after the bank that focuses on high net worth individuals in South Africa said it is seeking to more than double its client base in the next three to four years, outpacing growth in a moribund economy.