(Bloomberg) — India’s economic activity showed mixed signals in January, with most indicators pointing to a moderation in growth after a surge in omicron cases brought back some of the pandemic-related restrictions.

While five of the eight high-frequency indicators compiled by Bloomberg News came in weak last month, the rest signaled a steady recovery.

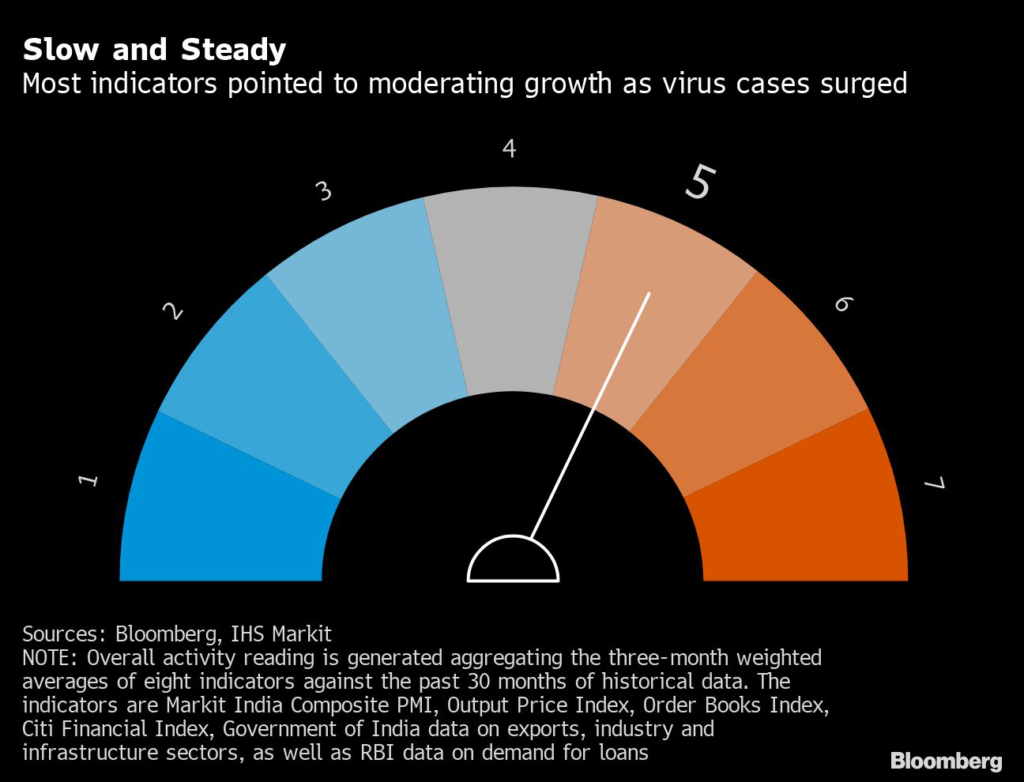

A three-month weighted average view of the readings, however, helped keep the needle on a dial measuring the so-called ‘Animal Spirits’ unchanged at 5 for a seventh month.

As omicron cases took off in January, fiscal and monetary policy makers remained accommodative to support the economy’s recovery this month.

While gross domestic product data for the October-December period is due Monday, authorities will probably look to get the latest pulse check from leading indicators such as purchasing managers’ surveys next week.

Below are details of the dashboard.

(For an alternative gauge of growth trends, follow Bloomberg Economics’ monthly GDP tracker — a weighted index of 11 indicators.)

Business Activity

IHS Markit’s PMIs showed activity at Indian factories and services companies expanded in January, albeit at a slower pace, as new order inflows weakened.

That pulled the composite index down toward the 50 dividing line between expansion and contraction.

Exports

Exports growth moderated to 25% in January from a year ago, slowing from the 39% pace seen in December.

Imports also slowed to 23.5% from 38.5% as gold purchases dropped, helping narrow the trade deficit to $17 billion.

Consumer Activity

Passenger vehicle sales fell for a fifth straight month, declining more than 10% in January, but industry associations are optimistic given an easing shortage of semi-conductor chips that hurt production.

In other signs of consumer activity, bank credit growth slowed to 8.21% at the end of January from 9.2% in December-end. Liquidity conditions continue to remain in surplus.

Industrial Activity

Factory output growth eased to a 10-month low of 0.4% in December from a year earlier as manufacturing contracted.

Output of eight infrastructure industries, which makes up 40% of the industrial production index, improved to 3.8% in December from 3.4% in November. Both reports are published with a one-month lag.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.