The JSE tanked alongside global markets as equities and currencies took strain from the Russian invasion of Ukraine.

A rally in commodity counters curbed the slide, causing the JSE to limit losses to 1.72% to 73,697.11 points. Oil boiled over $105 a barrel for the first time since 2014, triggering fears of a disruption to energy exports at a time of already tight supplies.

Local motorists are bracing to feel the pain at the pump.

Bloomberg reports Russian stocks crashed 33% to clock the fifth-worst plunge in equity market history in local currency terms as investors sold the nation’s assets following the Russian offensive.

Bloomberg reports the military action prompted emergency central bank action and investors braced for the toughest round of Western sanctions yet, wiping out as much as $259 billion in stock-market value.

Investors taking shelter in safe-haven assets boosted metals prices and locally listed mining stocks.

The top-10 major movers were all commodity items.

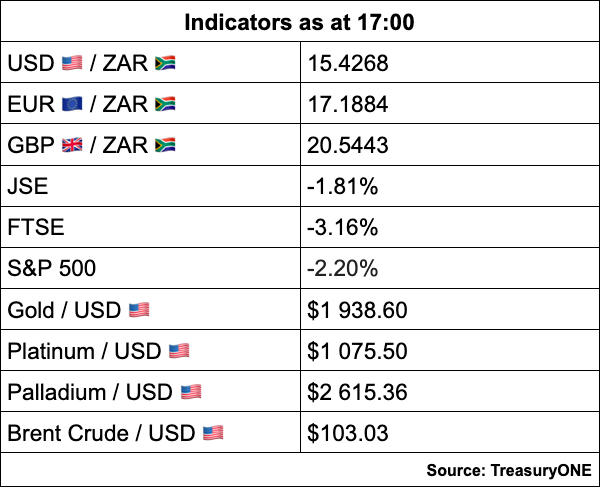

“Gold has benefited substantially from the tensions due to its safe-haven status. The price per troy ounce traded at $1,973 at one stage this morning but has dropped back to $1,1933 this afternoon.

Crude prices are up over 6% today, with Brent Crude trading at $105 at one stage,” comments TreasuryONE.

Platinum, however, has come under pressure with the precious metal currently down 1.28% to $1,080.50, while palladium soared over 6% to last trade at $2,627.5.

Leading the gains was Implats (+11.57%), with Harmony soaring 9.54%, Sibanye-Stillwater 8.24%, Angloplat 7.99%, Gold Fields 7.91%, Anglogold 6.99%, Northam 5.10%, RBPlat 5.05%, Sasol 4.29% and South32 2.04%.

RBPlat, which has recommended that shareholders accept a R43bn buyout offer from Implats, also announced today that it expects profits to rise by at least half in its year to end-December on higher production and buoyant prices.

The losses were broad based but tech stocks took the biggest knock.

Naspers and subsidiary Prosus, which together have a 12% weighting in the All Share index, have shed 5.58% and 6.44% respectively. Peer Bytes Technology gave op a massive 9.15%.

Other companies with huge global exposure also tanked, with Steinhoff (-10.37%), Mondi (-8.75%), Richemont (-6.00%) and Ninety One (-6.11%) feeling the pain.

Spur, which posted a 119% jump in half-year earnings to R59m, gave up its over 3% gain to end the day 2% in the red.

On the forex front, the rand broke above R15.50 against the US dollar for the first time in a month, but clawed back some losses to last trade 2.22% weaker at R15.47/$.

Its emerging market peer the Russian ruble has been under massive pressure, with the currency down nearly 10% at one stage to trade at an all-time low. “The tensions remain the key factor driving markets at the moment, and we will need to closely look at how these events unfold over the next couple of days,” says TreasuryONE.

The dollar, regarded as a safe-haven currency, gained nearly 1.5% against most of its major peers, with the pound and euro both trading under severe pressure.

“Volatility is through the roof. With the dollar firmly on the front foot and tensions continuing to rise in Ukraine, we could expect the rand to remain on the back foot.”