(Bloomberg) — The crisis in Ukraine is sending Asia’s stock investors searching for hedges and shunning names that may get hammered, while they also consider the implications of a drawn-out war.

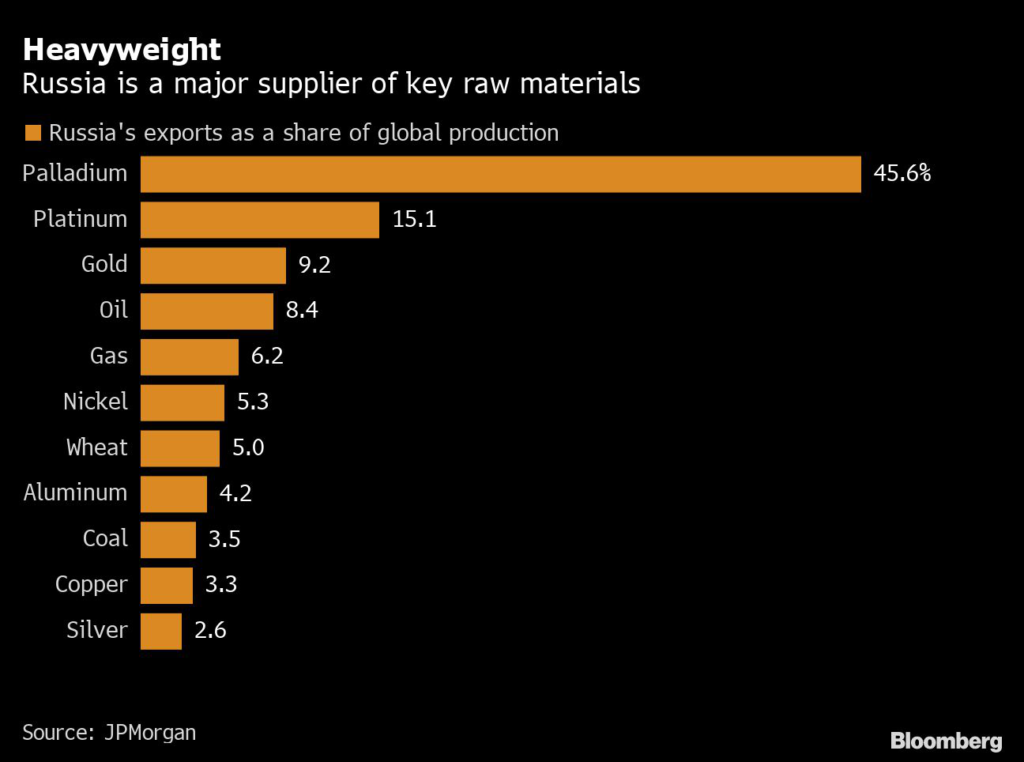

So far, Asia’s commodity and shipping stocks are emerging as safer bets given concerns about shortages of raw materials as Russia is a major exporter. Strategists at Goldman Sachs Group Inc. advocate a rotation to commodity-heavy Australia and recommend being overweight on the energy sector.

Meanwhile, shares of companies that get a chunk of their revenue from Russia, such as Japan Tobacco Inc., are at risk of lower profits. The longer-term ripple effects will also be more complex: higher costs of basic goods will continue to squeeze consumers, limiting spending power. It also hurts margins for firms that are unable to pass on costs.

Acknowledging the fast-evolving situation, here’s a look at Asian shares that are affected by the Russia-Ukraine conflict.

Commodities

Raw material prices traded higher following the invasion, with the Bloomberg Commodity Index touching 2014 highs this week. In Asia, energy and oil producers continued a rally that started last year given economies reopening following the pandemic. Australia’s Woodside Petroleum Ltd. and Santos Ltd., for example, outperformed the broader MSCI Asia Pacific benchmark, which slid about 4% this week. In Malaysia, Dialog Group Bhd was up 1.8%.

“Higher energy and grain prices bode well for Asia’s net exporters like Malaysia, which benefits from record gas and palm oil prices,” said Wai Ho Leong, a strategist at Modular Asset Management.

Ukraine Crisis Burnishes Malaysia Palm, Energy Stock Prospects

Transport

Asian shipbuilders and shipping firms are also poised to rally further as European countries may seek seaborne sources of natural gas as tensions escalate. That may mean more business for Korean shipbuilders including Daewoo Shipbuilding & Marine Engineering Co. and Hyundai Heavy Industries Co., which were up at least 10% this week.

Meanwhile, large consumers of oil like airlines have already seen sharp declines in share prices. A Bloomberg gauge of Asia’s airlines slid more than 5% this week, dragged lower by India’s InterGlobe Aviation Ltd., China Eastern Airlines Corp. and Japan Airlines Co.

Food

Food stocks may also gain as Ukraine and Russia account for more than a quarter of the global trade in wheat and a fifth of corn sales. Potential supply disruptions mean emerging market food suppliers will see increased demand, said Nirgunan Tiruchelvam, the head of consumer equity research at Tellimer in Singapore.

Firms like Singapore-listed Wilmar International Ltd. and Thailand’s Charoen Pokphand Foods may benefit, he added. Shares were down 5.7% and 1% this week respectively.

Read: ‘The Sky’s the Limit’: Food Inflation to Worsen on Ukraine

Russia-Ukraine Exposure

Shares of companies that count Russia and Ukraine as their end markets have plunged. Russia-based United Co. Rusal International’s shares slumped 22% in Hong Kong this week. The company gets about a fourth of its annual revenue from Russia, according to data compiled by Bloomberg.

Among other firms with exposure, Japan Tobacco and Hitachi Ltd. each fell more than 6% this week.

Russia accounted for 7% of Japan Tobacco’s sales and 18% of its operating profit in 2021, Citigroup Inc. analyst Nobuyoshi Miura wrote in a note. The standoff may only have a “limited impact” on sales volumes but ruble weakness could hurt the company’s profits, he wrote.

For electronic products maker Hitachi, Jefferies Financial Group Inc. analyst Bolor Enkhbaatar estimates shares may “overreact” due to its ownership of a unit called GlobalLogic. The subsidiary has software development hubs in Ukraine and accounts for about 1% of its revenue, he wrote in a note.

Chipmakers

Ukraine’s status as a major producer of neon gas — used in semiconductor manufacturing — and the U.K.’s ban on hi-tech exports to Russia have made chipmakers vulnerable at a time when pandemic-induced disruptions were already weighing on the supply chain.

The sector’s shares have dropped even as the Semiconductor Industry Association said Russia’s invasion of Ukraine doesn’t represent a threat to chip supply.

Shares of bellwether Taiwan Semiconductor Manufacturing Co. fell more than 5% this week, while Samsung Electronics Co. is down about 3%. Among chip equipment makers, Tokyo-listed Lasertec Corp. and Disco Corp. slid about 3% and 4%, repectively.

Banks

Bank stocks are also on the traders’ radar amid stiffening Russia sanctions given some of the lenders’ exposure to the country.

While the definition of exposure varies by bank, Japan’s Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. each had about $2 billion to $4 billion at stake as of September, according to data from those banks.

“Banking stocks are likely to be sold with investors growing conscious of a potential pull back in yields due to a weaker economy, and their exposure to Russia,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities Co.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.