(Bloomberg) — Western nations agreed to unleash new sanctions to further isolate Russia’s economy and financial system after initial penalties failed to persuade President Vladimir Putin to withdraw his forces from Ukraine.

A decision to penalize Russia’s central bank and exclude some Russian banks from the SWIFT messaging system, used for trillions of dollars worth of transactions around the world, was announced Saturday in a joint statement by the U.S., European Commission, France, Germany, Italy, U.K. and Canada. The agreement includes measures to prevent the Russian Central Bank from deploying its international reserves to undermine sanctions.

“Political leaders made the right decision to cut selected Russian banks off of SWIFT as they did in 2012 when they cut Iranian banks off of SWIFT,” said Leonard Schrank, who was CEO of the organization for 15 years, including when the U.S. Treasury Department created a classified program to tap SWIFT data to track the flow of terrorist financing after the Sept. 11 attacks.

The move is aimed at Russian banks that have already been sanctioned by the international community, but can be expanded to other Russian financial institutions if necessary, officials said. One official said the White House is looking at exemptions for transactions involving the energy sector, which the U.S. administration has sought to exclude to prevent oil prices from surging.

More penalties against the central bank could come this weekend, according to a U.S. official. Russia has about $640 billion in reserves.

The decision to cut banks off from SWIFT marks a rapid escalation for the U.S. and its allies, who had spent weeks signaling that such a move was a “nuclear option,” unlikely to win broad support.

But the ferocity of Russia’s assault has rallied public support in the West to do more to prevent Russia from using the plumbing of the modern financial system and isolate it as a pariah similar to Iran, Venezuela and North Korea.

“The speed and unity to take this unprecedented financial action will give Putin pause,” said Josh Lipsky of the Atlantic Council. “The SWIFT move was largely expected, but striking at the central bank will reverberate in Moscow and beyond.”

It’s not clear how severe an impact the moves will have — especially with European nations still dependent on Russian energy supplies — or whether they will do much to help Ukraine in the coming days. Biden said it would take weeks or longer for the pain of sanctions to be felt. Saturday’s move suggests Western nations want to accelerate the process.

The move “won’t send the entire Russian economy into immediate shock,” Lipsky said. “But it removed all the potential to backstop the large commercial banks.”

Central Bank Blow

The decision to hit the central bank is a first for an economy the size of Russia’s. The U.S. has previously sanctioned the central banks of adversaries such as Iran and Venezuela for funneling money that supported destabilizing activities in their respective regions. North Korea’s central bank is also blacklisted.

Sanctioning Russia’s central bank could have a dramatic effect on the Russian economy and its banking system, Elina Ribakova, deputy chief economist for the Institute of International Finance, said before the latest round of penalties was announced. “This would likely lead to massive bank runs and dollarization, with a sharp sell-off, drain on reserves and, possibly, a full-on collapse of Russia’s financial system.”

Authorities haven’t determined the full list of banks that will be hit by the SWIFT sanctions. A U.S. official briefing reporters on condition of anonymity said they will be carefully chosen to maximize the impact on Russia and minimize the effect on EU nations.

SWIFT, based in Belgium, said that while it is a neutral global cooperative with members in 200 countries, it’s obliged to comply with EU and Belgian regulations. “We are engaging with European authorities to understand the details of the entities that will be subject to the new measures,” the organization said in an email. “We are preparing to comply upon legal instruction.”

The Russian banks that will be restricted from SWIFT include the five lenders that already face sanctions — including Sberbank and VTB Group — which collectively account for about half of the country’s banking assets. Russia had more than 360 licensed banks at the start of the year.

It’s not clear how severe the central bank restrictions will be, but they are likely to limit Russia’s ability to draw on its credit lines at the IMF and may affect its ability to access about $20 billion believed to be at the Bank for International Settlements, an institution popularly known as the “central bank of central banks.”

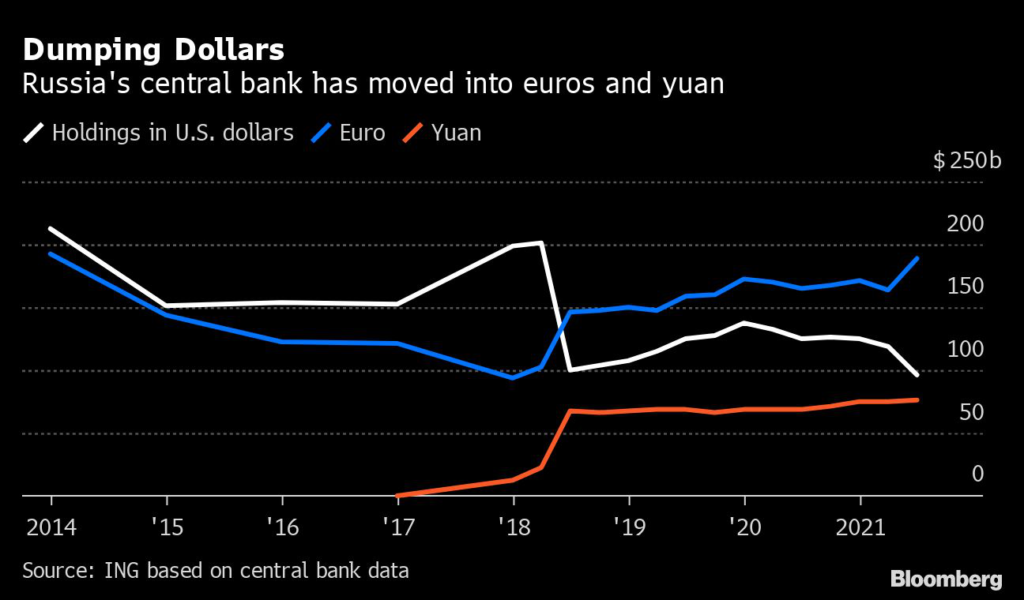

Russia has been steadily reducing its reliance on foreign currency, but its central bank still had 16.4% of its holdings in dollars at the end of June 2021, according to the latest official data, down from 22.2% a year earlier. The euro’s share was up at 32.2%.

By targeting the central bank, the West could complicate the enactment of monetary policy and remove a potential source of cash to support the banking sector. Inflation is running at more than double the central bank’s target, despite 525 basis points in interest-rate hikes over the past year.

Losing access to funds abroad would also handcuff Russia’s recent efforts to shore up the ruble by selling hard currency. The direct interventions, announced after Putin ordered his military attack, marked the first time the Bank of Russia has waded into the market since 2014.

Russia still holds about $300 billion of foreign currency offshore — enough to disrupt money markets if it’s frozen by sanctions or moved suddenly to avoid them, according to Credit Suisse Group AG strategist Zoltan Pozsar.

Russia’s businesses also face other costs from the conflict. Russian airlines have been barred from flying over at least 10 European countries, forcing carriers such as Aeroflot PJSC to fly longer, more expensive routes and restricting the number of destinations.

Together with a no-fly zone in and around the conflict, Russian airlines must now head south as far as Turkey to get to countries such as France or the Netherlands.

Billionaires’ Yachts

Saturday’s agreement also includes establishing a task force to identify and freeze assets of Russian oligarchs, government officials and companies. That includes yachts, jets, cars and luxury apartments in the West that belong to Russian billionaires, according to a U.S. official who spoke on condition of anonymity.

Nor can Russia necessarily count on Chinese financial institutions to cushion the blow of Western penalties, despite increased diplomacy between Moscow and Beijing. At least two of China’s largest state-owned banks are restricting financing for purchases of Russian commodities, Bloomberg reported on Friday.

Russian banks can still resort to alternative systems such as email to send payment instructions, Julia Friedlander, senior fellow at the Atlantic Council, said before the announcement.

Still, “it’s like a kick in the shins,” she said. “Transactions with Russia would be slower and more expensive. A sudden cut-off will also hold a lot of current assets in limbo, for corporations and banks.”

(Adds new lede quote in 3rd paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.