(Bloomberg) — A Chinese chipmaker blacklisted by Washington as a technology thief more than three years ago is finally getting a chance to prove it was wrongly accused.

Fujian Jinhua Integrated Circuit Co. goes to trial Monday in San Francisco to fight criminal charges of economic espionage and conspiracy to steal trade secrets from Idaho-based Micron Technology Inc.

A victory for the company could help it break free of the choke hold the U.S. has put on China’s ambitions to manufacture semiconductors, crucial components in everything from laptops to smartphones and servers. A loss could result in a fine of more than $20 billion, as well as an order requiring Jinhua to forfeit chips and income derived from the allegedly stolen technology.

For the Biden administration, the challenge is to win a conviction in a case inherited from former President Donald Trump’s trade war with China. The Justice Department’s decision to press forward with prosecuting Jinhua — even after it last week halted Trump’s “China Initiative” program that launched the case — demonstrates the tactical and strategic complexities of tackling intellectual property theft, said Mark Schultz, a professor at the University of Akron School of Law.

“The Biden Administration recognizes the threat but is looking for a more effective approach,” Schultz said. The trial “provides a rare window into the problem, and thus a rare chance for the Department of Justice to publicize it and try to establish a deterrent effect,” he said.

The case against Jinhua involves more serious allegations than some of the “China Initiative” cases that targeted professors for low-level offenses like visa fraud and drew criticism that they were fanning discrimination against Asian-Americans.

Read More: The Chipmaker Caught in U.S. Assault on China’s Tech Ambitions

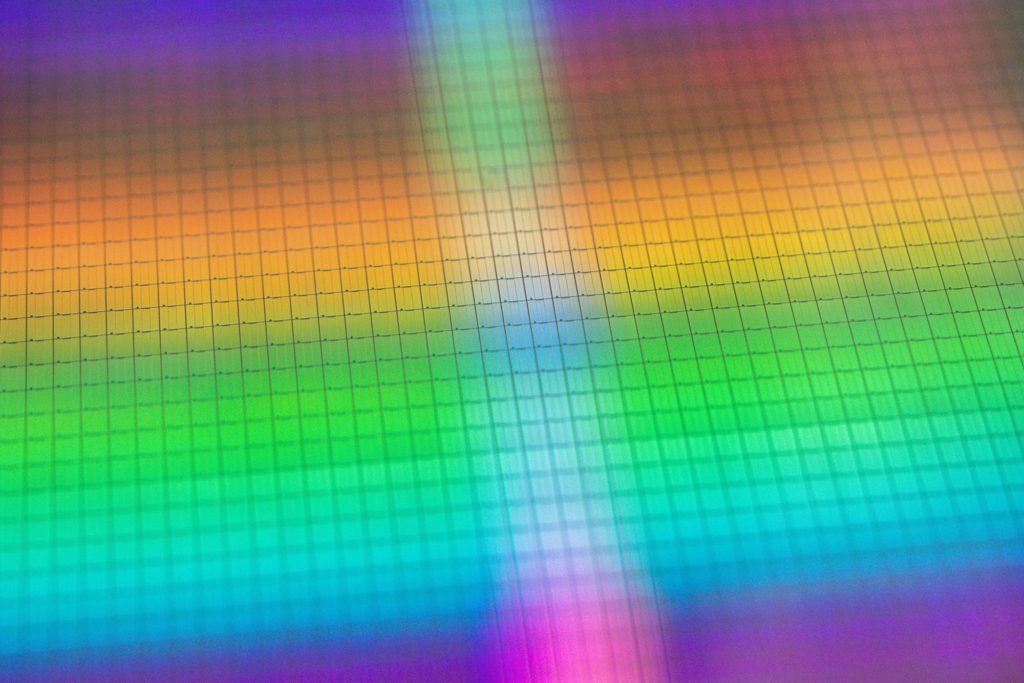

The chips at issue in the trial are dynamic random access memory, or DRAM, not the semiconductors that are in short supply and have held up shipments of personal computers. In 2018, Jinhua’s $6 billion plant was within months of full-scale DRAM production and a critical step toward ending China’s reliance on $380 billion of annual chip imports.

That’s when the U.S. put Jinhua on the Commerce Department’s so-called Entity List and filed the criminal case in San Francisco. The move blocked its purchases of chipmaking gear, and stirred an exodus of American and European suppliers and engineers from Jinjiang, where Jinhua is based on the southeastern coast of China. The U.S. is home to the majority of the makers of machinery used to manufacture chips, including companies such as Applied Materials Inc.

Even if Jinhua prevails, the government-backed company will still have to contend with the curbs on technology vital to chip production.

“An acquittal would lead to a strong rhetorical argument that the company shouldn’t be on the Entity List,” said Daniel Olmos, a criminal defense lawyer who specializes in economic espionage and trade secret theft. But even if the U.S. loses the criminal case, “the government will likely continue to think Fujian Jinhua is a bad actor,” he said.

Jinhua has pleaded not guilty. Jack DiCanio, the company’s lawyer, and the Justice Department declined to comment.

Heading into trial, Jinhua appears to have the benefit of U.S. District Judge Maxine Chesney’s skepticism of the government’s case. In a recent hearing, the judge said the trial’s outcome is likely to turn on the actions of Stephen Chen, who was identified in court papers as Jinhua’s president at the time.

Read More: U.S. Deploys New Tactics in Prosecution of Chinese Chipmaker

Prosecutors claim Chen orchestrated an illegal transfer of Micron’s memory design in a chip manufacturing deal between Taiwan’s United Microelectronics Corp. and Jinhua. Chen, a Taiwanese national, is accused of conspiring with two other Taiwanese engineers who previously worked for Micron before moving to UMC.

All three are charged as defendants in the case, but haven’t been expected to appear for trial ever since the U.S. issued warrants for their arrest in 2020. The U.S. doesn’t have extradition treaties with Taiwan or China.

Nonetheless, Chesney said at a hearing that Chen is a “point person in this trial, he’s pivotal.”

The U.S. needs to show that he was involved in the theft or use of Micron’s trade secrets, she said. Statements from Chen “have to provide that guilty state of mind, if you will, to Jinhua — to the extent that Jinhua can be held responsible for it,” the judge added. “You want to say Mr. Chen is Jinhua.”

Chesney is set to hear evidence into April without a jury and decide the outcome of the trial herself.

How and Why the U.S. Says China Steals Technology: QuickTake

At the trial the U.S. has the cooperation of UMC, which in 2020 pleaded guilty to trade-secret theft in the same case and paid a $60 million fine.

In court filings, Jinhua has pointed to UMC’s cooperation with the U.S. and noted that the company pleaded guilty to the “narrow charge” of possessing a single alleged Micron trade secret. As part of the plea deal, the U.S. dropped the economic espionage and conspiracy charges against UMC.

“Despite UMC’s full cooperation and the government’s free access to UMC’s documents since it pled guilty more than a year ago, the United States has not identified a single document, email, or witness statement among the over six million documents produced to date reflecting an agreement between UMC and Jinhua to steal or improperly obtain Micron confidential information,” Jinhua said in the filing.

The Jinhua case could put UMC in a delicate position when it comes to its China operations and businesses. UMC operates two plants in China mostly to service local customers. How Beijing will view the Taiwanese company in light of its collaboration with the U.S. government to prosecute a Chinese peer will be critical to UMC’s future development in China.

The case is U.S. v. Fujian Jinhua, 18-cr-00465, U.S. District Court, Northern District of California (San Francisco).

(Updates with potential fine in third paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.