(Bloomberg) — Investors are growing jittery about spillover effects from the Ukraine war into another corner of the developing world.

The put-to-call ratio on the largest exchange-traded fund that buys Taiwanese equities — or the amount of outstanding bearish options contracts relative to bullish ones — has jumped to the highest since October. That signals traders are concerned about the nation’s stocks, which may suffer if China uses Russia’s invasion of Ukraine as a distraction to ramp up tensions with Taiwan.

“Investors are worried China might invade Taiwan,” said Lu Yu, a money manager at Allianz Global Investors in San Diego. “I feel like it’s a spillover effect. I don’t think it’s likely right now.”

READ: Ukraine Invasion Unnerves Global Funds Bracing for Taiwan Risk

U.S. Commander of Pacific Air Forces General Kenneth S. Wilsbach said two weeks ago the nation was concerned that China will take advantage of the tensions between Russia and Ukraine and “try to do something” in the Indo-Pacific region. Still, Taiwan’s president played down concerns that the conflict in Europe could trigger a similar crisis in Asia.

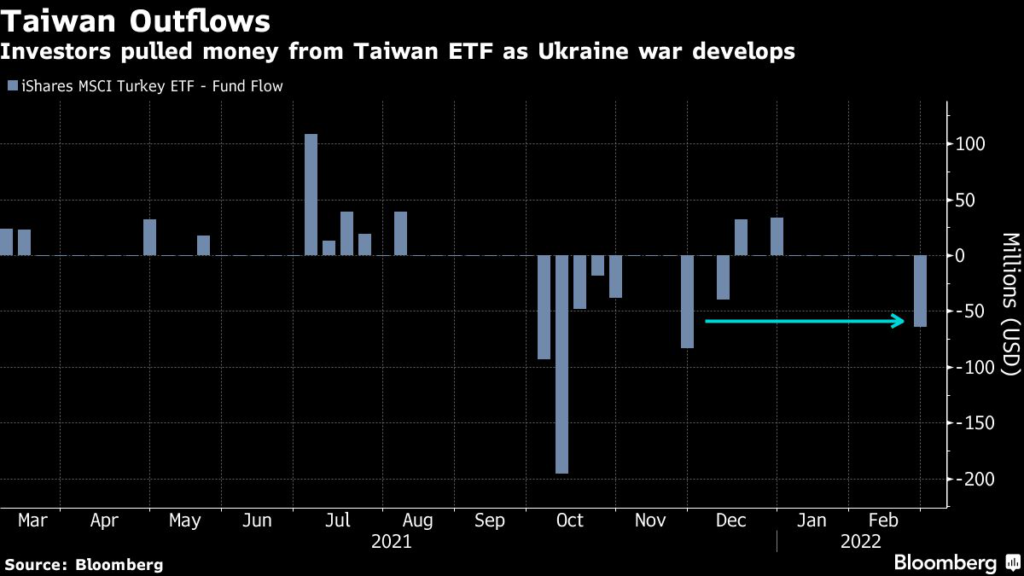

Traders also pulled $64 million from the $7 billion iShares MSCI Taiwan (EWT) last week, a stark contrast from the $626.2 million of inflows that U.S.-listed ETFs focused on emerging markets received the week ended on Feb. 25, according to data compiled by Bloomberg. Shares of the fund fell as much as 1.3% on Monday.

READ: Russia, China Tech Cocktail May Leave EM Managers in Tatters

Shares of the Taiwan ETF rallied by 25% last year, as demand for hardware producers and semiconductors, in particular, normalized after the pandemic shock, said Malcolm Dorson, a money manager at Mirae Global Investments in New York. The MSCI Taiwan Index was down 2.6% in February, trouncing losses greater 3% in the S&P 500 Index and the broad emerging-market stocks benchmark.

“Incremental supply generally follows periods of high demand and pricing,” he said. “With new supply coming on, higher interest rates, and lower expected global growth, it makes sense for investors to take some money off the table.”

(Updates with share performance of fund)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.