(Bloomberg) — Stocks retreated, while bonds climbed as traders weighed the latest developments after a wall of sanctions against Russia for the invasion of Ukraine.

The S&P 500 resumed losses after briefly turning green. Demand for Treasuries was led by short-maturity issues that are more sensitive to changes in Federal Reserve policy, with the yield on two-year notes sinking to 1.44%. Airlines slumped as Moscow banned carriers from 36 nations from its airspace in retaliation to a similar move from European states. Oil trimmed gains on reports that the U.S. and its allies are considering releasing about 60 million barrels of crude from emergency stockpiles to quell supply fears. Bitcoin rallied about 10%.

Russia halted trading of stocks in Moscow, London-listed shares of Russian companies cratered, with depositary receipts for Sberbank of Russia sinking as much as 77%, and energy giant Gazprom dropping 62%, before paring the loss. Traders struggled to price the ruble, with the currency losing a third of its value in offshore trading at one point. Quotes were infrequent and volatile at the start of the session, with low liquidity making it difficult to match buyers and sellers.

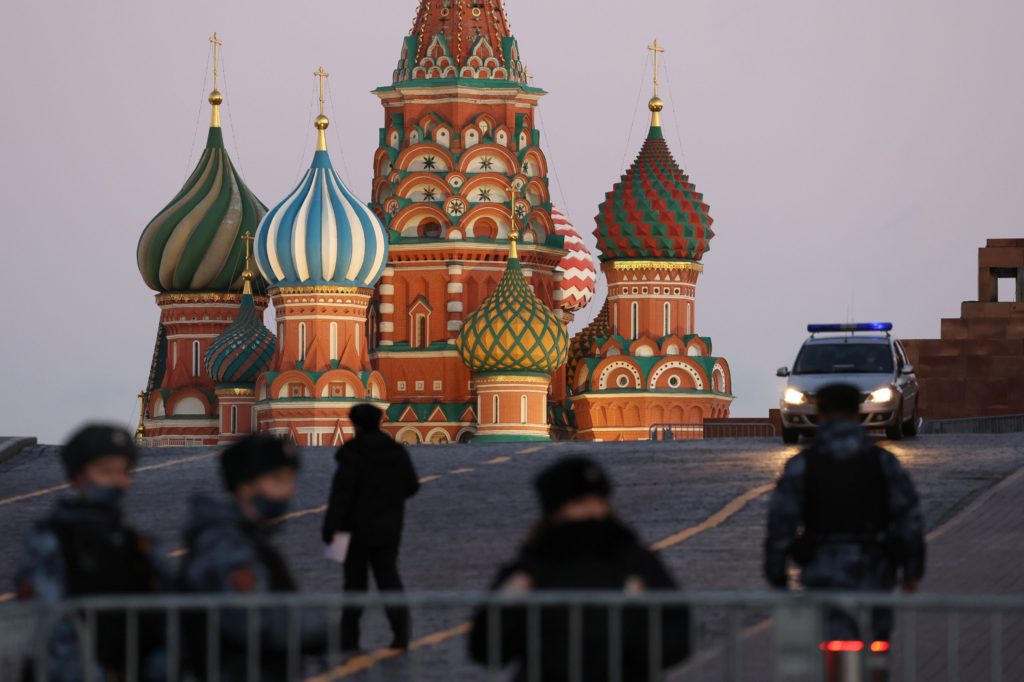

Concerns are growing that a decision to freeze the Russian central bank’s assets and exclude some of the nation’s biggest lenders from critical international payment systems may increase stress in global funding markets. President Vladimir Putin banned all Russian residents from transferring foreign currency abroad, including for foreign debt, part of a package of retaliatory measures for U.S. and European sanctions over his invasion of Ukraine.

Comments:

“The situation in Ukraine remains highly unpredictable with no simple off-ramp. Investors are advised to stretch their time horizon, as events in the region continue to create challenges in the near term,” said Robert Teeter, managing director of Silvercrest Asset Management.

“This invasion simply adds another risk to the mix that’s unlikely to disappear quickly,” wrote Morgan Stanley strategists led by Mike Wilson, referring to the Russian invasion of Ukraine. “In a world where valuations remain elevated and earnings risk is rising, last week’s tactical rally in equities will likely run out of momentum in March as the Fed begins to tighten in earnest and the earnings picture deteriorates,”

“We do not view this as a time to de-risk,” said Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management. “Drawdowns based on geopolitical events have been brief: If we look at S&P 500 performance following key military conflicts since 1945, markets were usually down within the first week. But on 14 of the 18 occasions they were up within three months, with a median performance of around 2%.”

What to watch this week:

President Joe Biden State of the Union address, Tuesday

Reserve Bank of Australia policy decision, Tuesday

Fed Chair Jerome Powell testifies to Congress on monetary policy, Wednesday and Thursday

OPEC+ meeting, Wednesday

Eurozone CPI, Wednesday

Bank of Canada rate decision, Wednesday

ECB publishes the account of its February meeting, Thursday

U.S. unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.6% as of 12:19 p.m. New York time

The Nasdaq 100 fell 0.2%

The Dow Jones Industrial Average fell 0.8%

The MSCI World index fell 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.4% to $1.1219

The British pound was little changed at $1.3412

The Japanese yen rose 0.5% to 115.02 per dollar

Bonds

The yield on 10-year Treasuries declined 10 basis points to 1.86%

Germany’s 10-year yield declined 10 basis points to 0.13%

Britain’s 10-year yield declined five basis points to 1.41%

Commodities

West Texas Intermediate crude rose 4.7% to $95.87 a barrel

Gold futures rose 0.5% to $1,896.10 an ounce