(Bloomberg) — The Biden administration is asking crypto exchanges to help ensure that Russian individuals and organizations aren’t using virtual currencies to avoid sanctions leveled on them by Washington, according to people with direct knowledge of the matter.

The White House’s National Security Council and the Treasury Department have sought help from operators of some of the world’s largest trading platforms to thwart any attempts to sidestep the stiff restrictions levied by the U.S. and its allies after Russia invaded Ukraine last week, said the people. The effort comes as the Biden administration grapples with how to police the asset class amid concerns that tokens can be used to avoid the heavily-regulated traditional financial system.

Spokespeople for the Treasury Department and White House declined to comment on discussions with crypto exchanges. A White House official said that cryptocurrencies aren’t a substitute for the heavily used U.S. dollar in Russia, but that American authorities are aggressively continuing to fight any misuse of digital assets to avoid sanctions.

The efforts to cut off crypto as a sanctions workaround follow the sweeping penalties imposed on Russia by the U.S. and its allies, including a move to bar some banks from the SWIFT messaging system that connects financial institutions worldwide. The moves also underscore the significant role that digital assets are playing in a conflict testing global security.

Kyiv has already used Twitter to draw in millions of dollars worth of crypto donations to bolster defenses against Moscow’s army. At the same time, Ukrainian Vice Prime Minister Mykhailo Fedorov has used Twitter posts to request tips on crypto wallets linked to politicians with Kremlin ties and urged major digital asset exchanges to block addresses of all Russian users.

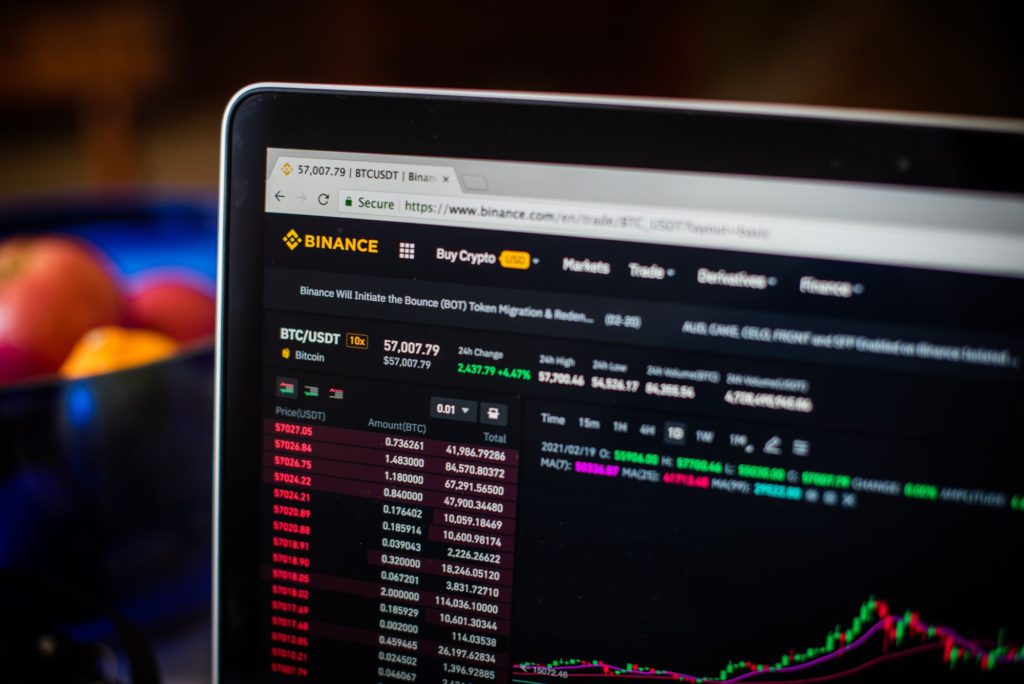

Thus far, American officials have urged major crypto exchanges, including the world’s biggest run by Binance Holdings Ltd., to take a targeted approach focused only on those whom have been sanctioned, in part because of legal concerns, said the people, who asked not to be named discussing private conversations. FTX Trading Ltd. and Coinbase Global Inc. are also working with the administration.

A spokesperson for Binance said the exchange isn’t moving to block all Russian users, but has taken steps to identify crypto wallets of sanctioned individuals and is prepared to act against any with accounts. FTX is consulting with officials in the U.S. and Bahamas, where the firm is headquartered, on the proper course of action and plans to keep applying laws related to sanctioned countries, the firm said in a statement.

A Coinbase representative said the company is blocking transactions to or from prohibited addresses identified by Treasury’s Office of Foreign Assets Control, or that the exchange has otherwise marked as possibly being controlled by sanctioned individuals or entities.

Meanwhile, wealthy Russians are coming under increasing pressure to find ways to move their money after the U.S. and European allies moved to disconnect some Russian banks from SWIFT. The U.S., European Commission, France, Germany, Italy, U.K. and Canada have also announced measures to prevent the Russian Central Bank from using international reserves to undermine sanctions.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.