(Bloomberg) —

Autonomous vehicles are mostly electric so far. That’s one of the main conclusions of BloombergNEF’s just-published annual report analyzing the state of AV testing programs in the U.S.

and China.

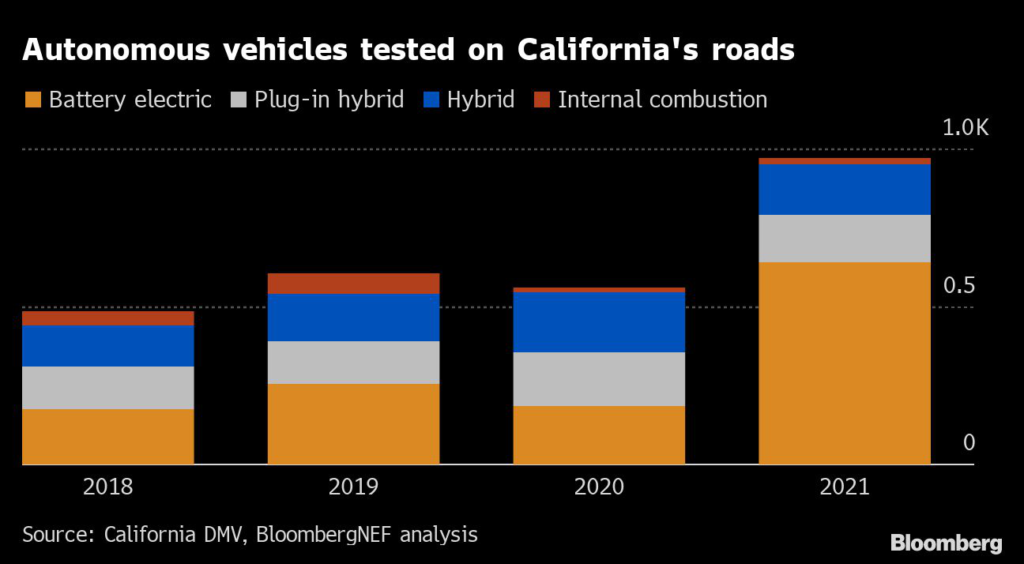

California still is by far the largest autonomous vehicle test bed in the world, and 81% of the almost 1,000 AVs operating in the state last year either were fully electric or plug-in hybrid.

That’s a big jump from 2020, when only 63% were plug-in vehicles. Non plug-in hybrids represented about 17% of the AV fleet last year, and traditional combustion engines were negligible at just 2%.

Those EVs are also traveling more miles than their ICE counterparts.

The plug-in share of total miles traveled by AVs in California came in at 87% last year, up from 81% in 2020. Battery-electric vehicles alone accounted for 78% of total miles driven, largely due to Waymo’s fleet of Jaguar I-Paces and Cruise’s Chevrolet Bolts.

Outside of Cruise and Waymo, the vehicle drivetrain mix includes Zoox’s fleet of Toyota Highlanders, which are are mix of internal combustion and hybrid, as well as the popular Lincoln MKZ used by China-based AV developers like Didi, Pony.ai, Baidu, and WeRide.

AV test programs in Shanghai and Beijing are starting to catch up to California.

Autonomous vehicles in those two Chinese cities racked up a total of 2.1 million miles in 2021, compared to 4 million in California. The total in China more than doubled from the previous year and incorporate a broader array of vehicle types, including street-cleaning vehicles and heavy trucks handling shipping containers at ports.

The exact winning business models for AVs still aren’t clear, but passenger vehicles are among the most difficult applications to solve, and other vehicle types stand a better chance of reaching commercialization sooner.

Regardless of the vehicle segment, the drivetrain that autonomous vehicles use really matters if AVs are to deliver on the lofty promises that have been made in recent years.

If AVs run on internal combustion engines, or even if they were to transition to EVs slower than the broader automotive market, any local air quality benefits would be eliminated, and hitting climate targets would become more difficult.

Autonomous vehicle developers are acutely aware of the regulatory hurdles that could arise if the public turns against the technology.

There are already well-founded concerns that AVs could clog up urban streets, and developers are keen to ensure they’re at least not contributing to worsening air quality.

There are many important caveats on anything to do with autonomous vehicle testing data.

It’s early days still and disclosures are patchy, so it’s best not to read too much into what’s happening. But the links between EVs and autonomous vehicles early on are encouraging.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.