(Bloomberg) — Global markets are throwing up a jumble of unusual correlations as commodity flows and the world economic outlook are upended by the war in Ukraine and the ostracism of Russia.

Examples include oil soaring alongside Treasuries and gold bursting higher with the dollar. The former was evident in the past 24 hours amid a jump in Brent crude to as high as $113 a barrel and a plunge in the U.S. 10-year yield to below 1.70%, compared with a level of 2% before Russia invaded its neighbor.

Quite how long such unexpected tandem moves can last is moot. Winning trades lie ahead for those who figure out when and how they will unravel.

The “big one” for analyst Kyle Rodda at IG Markets Ltd. is the Gordian knot of bonds and commodities: a stampede for havens is crushing yields but a commodity surge on fears of conflict-related supply disruptions threatens to stoke already historic levels of inflation.

“Eventually something has got to give,” Rodda said. “I reckon its bonds when markets have to price in higher inflation. For the time being, this is a sign of a discombobulated market trying to discount the almost unpredictable.”

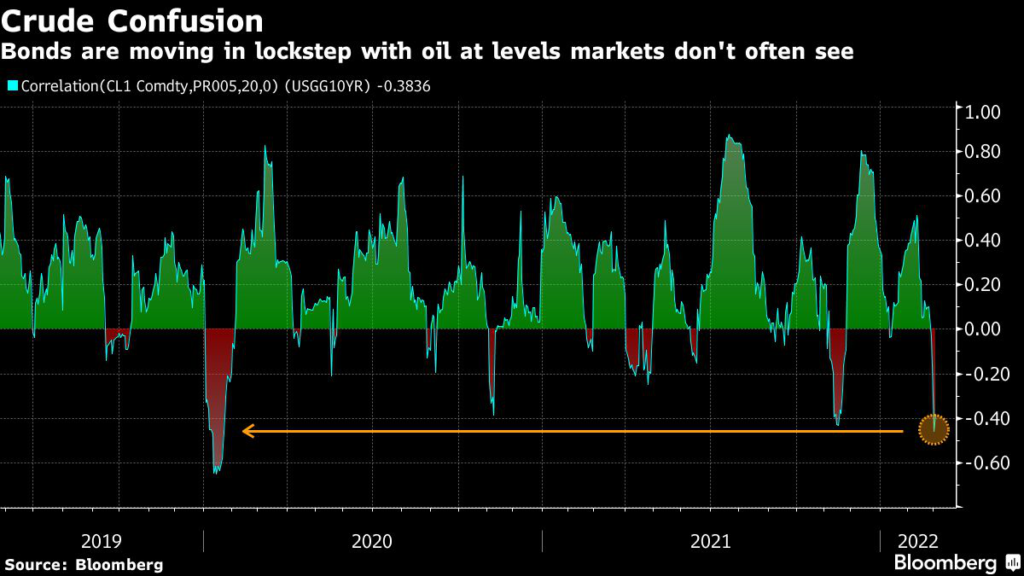

The charts below capture some changing short-term, 20-day cross-asset correlation coefficients, with 1 being the highest possible reading.

Bonds, Oil

Soaring oil has stoked worries about global growth and driven haven flows to Treasuries. But if costlier energy brings inflation back into the vanguard of investor concerns, bonds could be in the firing line.

Gold, Dollar

Bullion prices and the dollar typically move in opposite directions but the flight to safety has bolstered both assets of late. That serves to highlight the key question of whether gold has seen the best of its recent rally.

Bitcoin, Stocks

The expulsion of some Russian banks from established global payment networks triggered bets on Bitcoin and other digital tokens as potentially filling some of that gap. That’s weakened the strong recent tie between Bitcoin and global stocks. Critics who view the largest cryptocurrency as fundamentally highly speculative might be skeptical of its breakout.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.