(Bloomberg) — Initial public offerings in the Gulf are proving resilient to the volatility hurting deals in other markets, as high oil prices, stable economies and abundant liquidity fuel activity.

Pharmacy retail chain Nahdi Medical Co. gathered enough demand to cover what is set to be Saudi Arabia’s biggest IPO since oil giant Aramco within hours of opening its books, Bloomberg News reported. In Dubai, the road-toll collection system and utility Dubai Electricity & Water Authority are also gearing up for large listings.

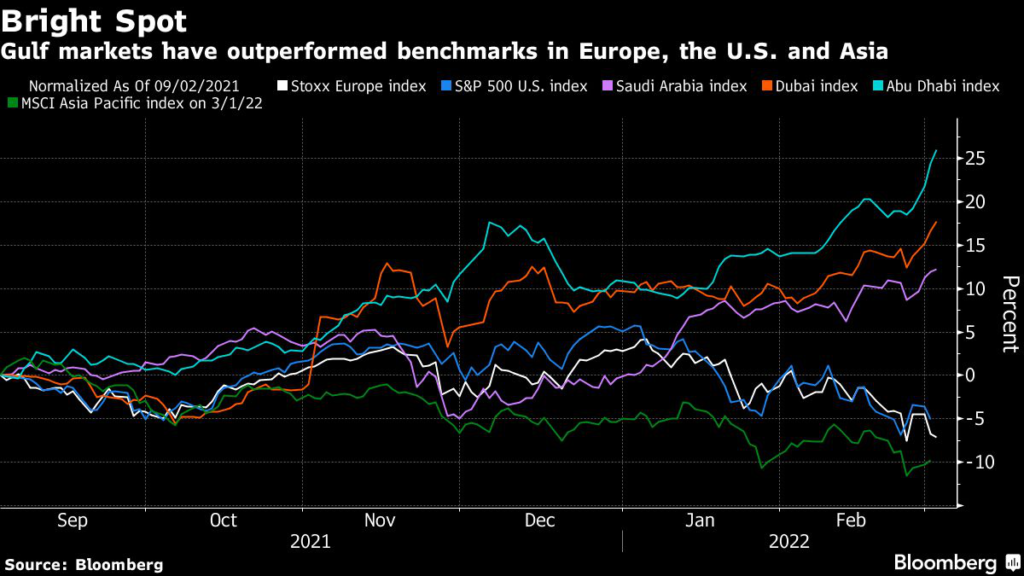

No IPO plans in the region have been derailed by market volatility so far, while appetite for listings in Europe, the U.S. and Asia has all but dried up.

Read More: IPO Market Grinds to a Halt Amid Ukraine Invasion Volatility

Russia’s invasion of Ukraine has effectively shut IPO markets, exacerbating an already slow start to the year. Several companies pulled deals, while those that went ahead had to temper valuation expectations as equity benchmarks in Europe, Asia and the U.S. sagged. The Gulf is a rare exception, as surging local stock markets on the back of soaring oil prices support dealflow.

“We don’t have any indications yet that regional investors’ interest has changed,” said Samer Deghaili, head of capital markets for the Middle East, North Africa and Turkey at HSBC Holdings Plc. High oil prices, economic recovery and reforms in the region are attracting international and local buyers alike, he said. “It’s music to their ears.”

Bets on Middle Eastern IPOs this year are paying off, gaining on average 29% compared with Europe’s returns of 17% so far, according to data compiled by Bloomberg. Saudi digital security firm Elm Co., which drew orders from institutional investors for almost 70 times the shares on offer, has surged 54% since listing last month.

Still, there’s a risk the volatility stoked by war in Ukraine and the scope for tougher sanctions on Russia could bleed into the Gulf. Souring sentiment along with supply chain constraints may affect investor demand for IPOs in the Middle East.

“All of this poses a risk to the global economic outlook as countries recover from the pandemic,” said Salah Shamma, Franklin Templeton’s Dubai-based head of equity investment for the Middle East and North Africa, noting that direct economic impact for the Gulf will likely be contained given the limited exposure to Russia and Ukraine.

And not all of the region’s IPOs have been slam dunks, either. Its biggest deal, Abu Dhabi Ports Co PJSC, has given up nearly all of its gains since its February debut, while Saudi stock East Pipes Integrated Co for Industry has shed 7.9% of its value since listing.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.