(Bloomberg) — The hottest inflation in four decades has prompted some employers to open the spigot on pay, but plenty still won’t budge — leaving workers in the lurch with a pay cut.

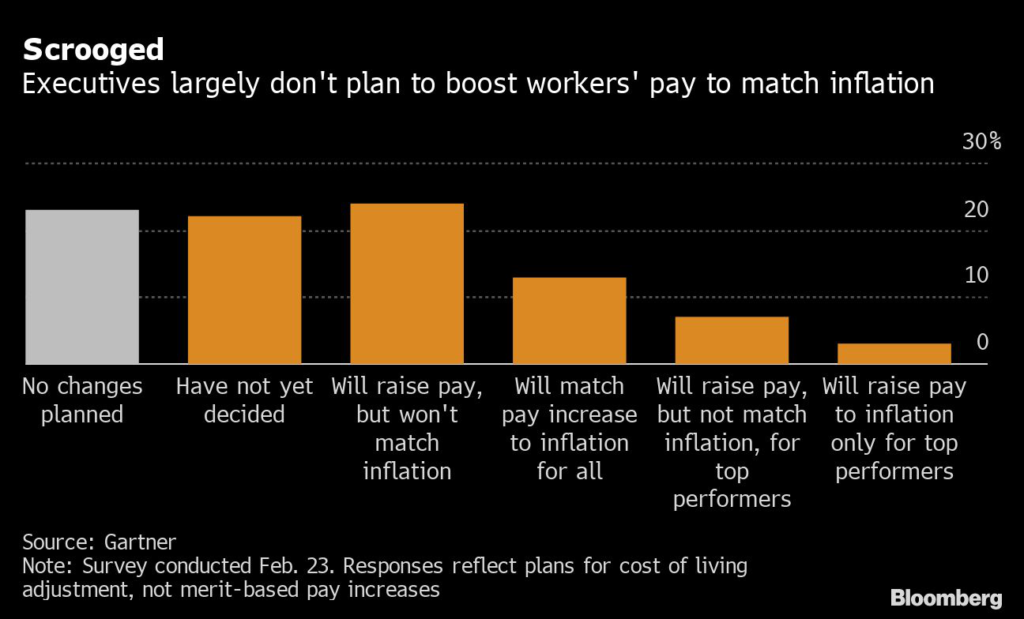

Nearly 1 in 4 executives said they’re not making any changes to pay in response to inflation, according to a poll by Gartner Inc., an increase from the 18% who said so in December. That reluctance — fueled in part by expectations that inflation will ease — comes amid a tight labor market and rising prices for everything from gas to guacamole. More than 6 out of 10 workers are concerned about their salary keeping up with inflation, a survey from the Conference Board found.

“Some companies that had been planning on making that pay adjustment decided not to do it,” Brian Kropp, Gartner’s head of human-resources research, said in an email. “The two most common reasons for pulling back are that they started to believe that inflation would not be as permanent and therefore didn’t need to bake it in, or realized they couldn’t actually afford it given how their financials played out.”

Companies are still doling out merit-based increases but typically aren’t hiking pay based on inflation alone, according to the Gartner survey.

To be sure, wages have risen recently, particularly for lower-paid or hourly roles, and companies of all stripes are expanding their compensation budgets this year. Target Corp., McDonald’s Corp. and Amazon.com Inc. have all boosted their starting or average hourly wages over the past year, while on the higher end of the pay scale, JPMorgan Chase & Co. and Citigroup Inc. have raised junior bankers’ pay to keep them from fleeing to cryptocurrency or fintech startups.

One gauge from the Federal Reserve Bank of Atlanta shows a 5.1% annual pace of wage gains, the best in two decades. Workforce consultant Willis Towers Watson found that 98% of companies globally will increase salaries in 2022, at an average rate of 3.4%, the fastest since 2008.

But inflation is running much faster. Consumer prices rose 7.5% in January from a year ago following a 7% annual gain in December, according to the Labor Department. The typical U.S. household is spending an additional $276 a month on goods and services because of rising inflation, according to Moody’s Analytics Inc. When adjusted for inflation, average hourly earnings fell 1.7% in January from a year earlier, the 10th straight decline.

It helps explain why 62% of workers polled by the Conference Board are worried that their pay won’t keep up with inflation. That figure rises to 72% among millennials, the generation born between 1981 and 1996 that comprise the fastest-growing part of the U.S. labor force.

Gartner’s survey, conducted in late February, also found that about 1 in 4 executives planned to boost pay, but not at a level that would keep pace with inflation. Just 13% said they planned to increase compensation at a rate commensurate with inflation for all employees.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.