(Bloomberg) — Apollo Global Management Inc., the buyout firm, on Friday may find out if its acquisition of insurer Athene Holding Ltd. bought it a ticket into the S&P 500 Index.

The merger removed an impediment to Apollo’s inclusion in the U.S. stock-market benchmark by creating one class of voting shares, replacing the multi-tier structure that had made it ineligible. With a market capitalization of more than $37 billion, it’s one of the largest U.S. companies eligible to be added to the S&P 500 — a possibility that Apollo raised in connection with the acquisition.

That has left analysts speculating that the New York-based company may be included in one of the index’s shakeups, the next of which may be announced after markets close Friday as part of S&P Dow Jones Indices’s quarterly weighting changes. Some stocks may be bumped to make way for new entrants, with over 10% of the S&P 500 companies now below the minimum threshold for inclusion.

Shares that are added to the S&P 500 typically see increased liquidity and sometimes rise because funds that track the benchmark need to buy them.

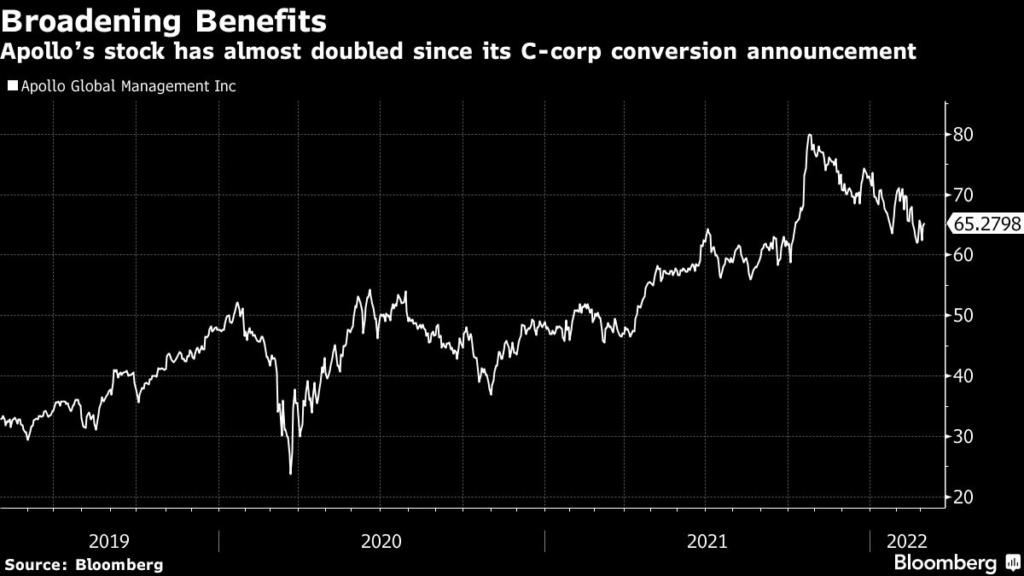

BMO Capital Markets analyst Rufus Hone sees the possible addition of Apollo to the S&P 500 as a significant potential catalyst for the stock. “Unlike prior index inclusion catalysts brought about by Apollo’s conversion from a publicly traded partnership to a corporation in 2019, which were fairly well telegraphed,” he said, “we think addition to the S&P 500 is not priced in.”

Wells Fargo analyst Finian O’Shea said in a note that if Apollo is added to the S&P 500 “the percentage of total shares in the stable hands of index-oriented investors likely would increase by roughly 10 percentage points to the low 20s from the current low teens.”

New entrants to the S&P 500 must have a market value above $13.1 billion and meet profitability, liquidity and share-float standards.

Representatives for Apollo weren’t immediately available for comment.

Some other candidates for entry include Camden Property Trust and Steel Dynamics Inc., two S&P MidCap 400 Index members whose share-price gains have pushed their market values above the level needed to join the S&P 500. Thirteen of the 19 stocks added to the S&P 500 over the past year have come from the MidCap 400.

S&P Dow Jones Indices said it cannot comment on potential index changes.

Separately, S&P Dow Jones announced Friday that it will remove Russian stocks from its indexes after the country was hit by sanctions over its invasion of Ukraine. MSCI Inc. and FTSE Russell have already decided to drop Russian stocks from many of their indexes.

This will clearly cause some scrambling for asset managers, but it shouldn’t take too long to straighten out. “ETFs and index providers have been able to manage changes driven by sanctions fairly well,” Citigroup Inc. strategist Scott Chronert said.

“In 2019, Venezuelan paper was phased out of indices over five months,” he said. “Timing was quicker with respect to the removal of Chinese military-industrial complex companies from equity indices. That took just two months.”

(Adds S&P’s decision to cut Russian stocks from its indexes.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.