Global stock markets fell across the board Friday and energy prices soared as investors feared the risk of an escalation after Russia attacked the largest nuclear power plant in Ukraine.

Europe’s main stock markets plunged more than three percent for much of the day after Asian indices closed sharply lower.

Wall Street followed suit, with the Dow dropping by more than one percent in early trading.

The euro sank close to a two-year low under $1.10 as the Ukraine conflict clouds the eurozone’s economic recovery from the coronavirus pandemic.

The greenback benefited also from its status as a haven investment.

“European markets are closing in on bear market territory in heavy selling at the end of the week as investors grow increasingly fearful of recessionary and escalation risks,” OANDA analyst Craig Erlam said.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said earlier “investors have been rattled by the turn of the fighting in Ukraine, after a nuclear plant was attacked which has heightened worries about the potential escalation of the crisis.”

Oil prices shot up again around five percent on fears of supply disruptions to Russian crude but were still below the almost $120 per barrel reached Thursday.

– ‘Economic clinch point’ –

Hopes for an Iran nuclear deal that would allow Tehran to restart crude exports to the world market capped crude’s gains, analysts said.

European and UK gas prices surged to record peaks Friday on supply disruption fears as a result of key supplier Russia’s ongoing attack on Ukraine.

Europe’s reference Dutch TTF gas price struck 213.895 euros per megawatt hour in afternoon deals, while UK gas prices hit 508.80 pence per therm.

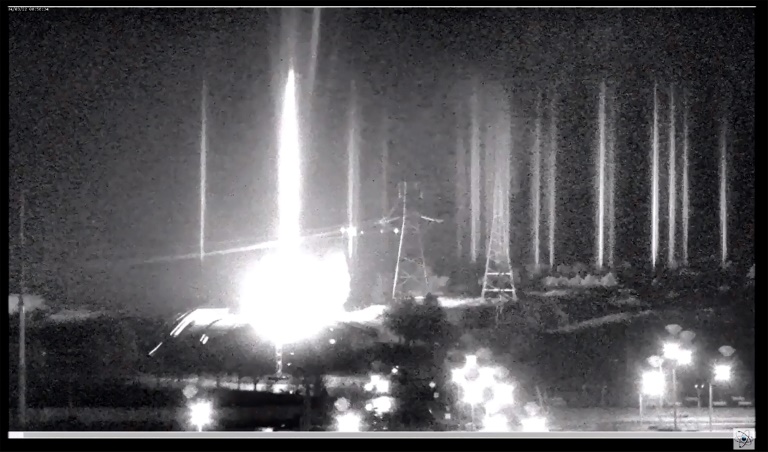

Ukrainian President Volodymyr Zelensky has meanwhile demanded still tougher sanctions against his Moscow foes after Russian forces attacked and seized the Zaporizhzhia nuclear power plant, but Kyiv said no radiation leak was detected.

Western countries have hit Russia’s economy hard including by closing airspace, freezing assets and excluding seven banks from the SWIFT interbank messaging network.

The impact is already impeding Moscow’s ability to shore up the beleaguered ruble and purchase imports.

Russia’s invasion of its neighbour Ukraine has sent global stock markets slumping over the week, during which time commodities including wheat, metals and particularly oil have soared.

That has fuelled concerns that the global economic recovery from Covid-19 will be derailed, especially with surging prices adding to worries about decades-high inflation.

To combat rocketing costs, Federal Reserve boss Jerome Powell this week said he intends to raise US interest rates this month, though he tempered expectations of a half-point rise.

“The economic clinch point of this war is commodity prices,” said City Index analyst Fiona Cincotta.

“Higher energy prices, slowing growth, and surging inflation are not a good outlook.”

In New York, the Dow, S&P and the Nasdaq all fell after opening as worries about the worsening picture of the Russia-Ukraine conflict overshadowed a strong US jobs report.

US employers added 678,000 workers to their payrolls in February, driving the unemployment rate down to 3.8 percent in a monthly report that was better than expected.

– Key figures around 14:45 GMT –

London – FTSE 100: DOWN 2.7 percent at 7,044.13 points

Frankfurt – DAX: DOWN 3.2 percent at 13,265.48

Paris – CAC 40: DOWN 3.4 percent at 6,159.85

EURO STOXX 50: DOWN 3.3 percent at 3,617.10

New York – Dow: DOWN 1.1 percent at 33,414.84

Tokyo – Nikkei 225: DOWN 2.2 percent at 25,985.47 (close)

Hong Kong – Hang Seng Index: DOWN 2.5 percent at 21,905.29 (close)

Shanghai – Composite: DOWN 1.0 percent at 3,447.65 (close)

Euro/dollar: DOWN at $1.0918 from $1.1069 late Thursday

Pound/dollar: DOWN at $1.3226 from $1.3350

Euro/pound: DOWN at 82.50 pence from 82.89 pence

Dollar/yen: DOWN at 115.27 yen from 115.45 yen

Brent North Sea crude: UP 4.1 percent at $114.97 per barrel

West Texas Intermediate: UP 5.1 percent at $113.12 per barrel

burs-lc/kjm