(Bloomberg) — China’s National People’s Congress kicked off its annual gathering in Beijing on Saturday, with a speech from Premier Li Keqiang outlining key economic targets for the year.

The legislative meetings, which run for about a week and draw around 3,000 delegates, are the biggest political event before a twice-a-decade party leadership reshuffle slated for the second half of the year.

Here’s a summary of what we learned so far from the congress:

China Signals More Policy Support With 5.5% Growth Target

China’s government signaled more stimulus is on the cards by setting an aggressive economic growth target, calling for confidence amid rising domestic strains and global instability stemming from Russia’s invasion of Ukraine.

China’s GDP Target Will Be Challenging to Meet, Economists Say

The economic growth target of around 5.5% is a challenging one, and will push the government to boost infrastructure investment, stimulate property demand and provide more monetary easing, economists say.

China to Set Up Financial Stability Fund, Steady Home Prices

China plans to set up a financial stability fund and adopt measures to keep housing prices stable, as policy makers ramp up efforts to prevent systemic risks.

China Defense Budget Rises 7.1%, Fastest Pace in Three Years

Defense spending is projected to grow 7.1% this year, the fastest pace since 2019 as President Joe Biden moves to strengthen the U.S.’s position in the Indo-Pacific region.

China Shuns Energy Use Target to Focus on Securing Fuel Supply

The government declined to set a new hard target for energy use and will focus on securing fuel supplies as the world’s biggest oil, gas and coal importer navigates unprecedented tumult in global markets.

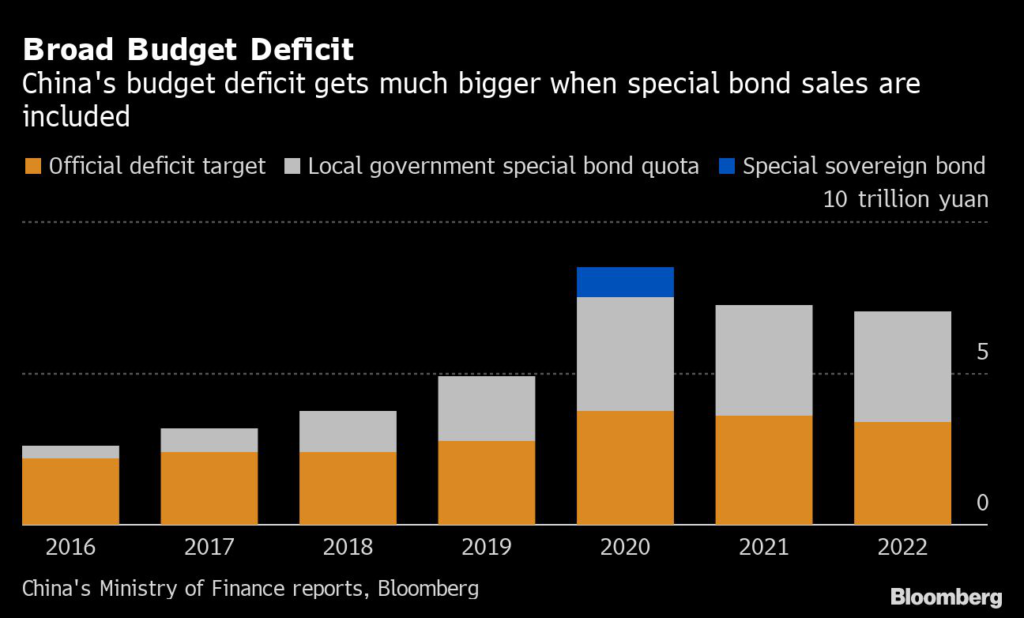

China’s 2022 Budget: A Breakdown of the Key Numbers

China plans to increase government spending in 2022 to shore up a slowing economy but also cut the budget deficit, with the government drawing on savings from previous years to pay for the rise in expenditure.

China Reassures Role of Venture Capitalists After Tech Crackdown

Beijing sought to reassure investors that venture capital still has a role to play in the technology sector after a year-long crackdown on online gaming, tutoring and other areas hammered the shares of its biggest companies including Alibaba Group Holding Ltd. and Tencent Holdings Ltd.

China Plans to Address $59 Billion Renewable Subsidy Debt

The Ministry of Finance said it will work to address funding shortfalls in subsidies for renewable power after years of mounting debt from inadequate payments.

CHINA REACT: Budget Hides Firepower for GDP Growth Stability

The message from the National People’s Congress is clear — China’s government is determined to prevent growth slipping too much this year. The 5.5% growth target — down from 6% in 2021 — signals an intent to stabilize an economy facing fierce pressures from a property slump and new risks from the Russia-Ukraine war.

China Seeks to Ease Simmering Social Issues in Political Year

China vowed to address the public’s biggest concerns while also boosting spending on public security – twin moves that underscore the paramount importance the ruling Communist Party places on stability this year.

China to Boost Fuel Stockpiles to Avoid New Supply Squeeze

The government aims to step up efforts to build storage facilities for oil and other key fuels as it attempts to tame price swings and avoid any new supply crunch.

Evergrande Billionaire Founder Is Said to Miss Political Meeting

The billionaire chairman of beleaguered property giant China Evergrande Group will miss an annual policy meeting of China’s top political advisory group, according to people familiar with the matter.

China’s Policy Show Offers Little Cheer on Climate Progress

There wasn’t much new for climate watchers to celebrate at the start of China’s annual policy meeting, as Beijing staked out a flexible energy policy that won’t hinder its efforts to spur economic growth.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.