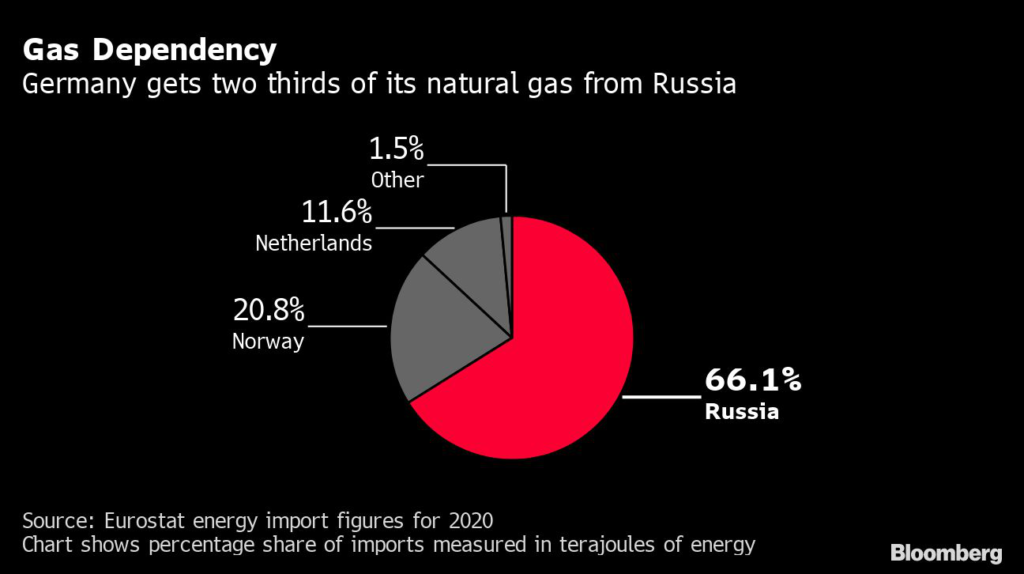

(Bloomberg) — One of the biggest European buyers of Russia’s natural gas won’t sign any new contracts with the country for long-term supply.

Germany’s Uniper SE will continue to receive fuel under its existing contracts, which play an essential role in Europe’s gas supplies, the Dusseldorf-based company said in a statement on Monday. It also plans to restart the divestment process of Unipro, which operates five power plants in Russia, and will recognize an impairment loss of its loans toward the Nord Stream 2 AG pipeline of 987 million euros ($1.1 billion).

Uniper shares have dropped about 40% since Russia invaded Ukraine and the utility is following companies including BP Plc and Shell Plc in limiting its exposure. The German utility relies on Russia for more than half of its natural gas under long-term contracts and its power-generation business in Russia accounted for almost a fifth of earnings last year.

War Exposes Europe’s Failure to Heed Warnings Over Russian Gas

Companies in Europe are avoiding dealing with Russia on concerns that sanctions will be extended to energy supplies as Russia continues its offensive in Ukraine. The U.S. is mulling a ban on Russian oil imports, while Russia threatened to cut natural gas supplies to Europe via an important route as part of its response. That has companies including Uniper concerned about the prospect of an energy shock.

“Due to the existing contracts with Russia or Russian companies, we bear a special responsibility not only for ourselves, but also for large parts of German industry and many people in Germany and across Europe,” Uniper Chief Executive Officer Klaus-Dieter Maubach said in the statement. “Two things need to be done now: maintain the existing energy flows, and at the same time find ways and means to make the gas supply for Germany and Europe more diverse.”

Uniper’s portfolio includes about 200 terawatt-hours of supply from Russia, the majority of its long-term supply, and the company said it is prepared to use its gas storage facilities in the events of curtailments of gas flows from Russia. Under current market prices, the contracted volumes would be worth about 45 billion euros, following a more than 14-fold surge in prices over the past year.

“Uniper currently has no structural price risk in its gas portfolio, as the supply volumes have been sold to customers in advance,” Chief Financial Officer Tiina Tuomela said. “A possible interruption of Russian gas supplies would affect the German gas import system and thus also Uniper. At this point in time, we assess the probability of such a restriction as low.”

Although Europe remains on edge for potential disruptions, gas exports from Russia, which account for about a third of Europe’s demand, are currently not covered by international sanctions. Physical flows have not been impacted yet.

Uniper has also decided to restart the divestment process of Unipro, in which it is the majority owner with a 83.73% stake. The process started last year, but was halted as the conflict escalated. Now, it will be restarted “as soon as it is feasible”, the company said.

Unipro, which operates five power plants with a total capacity of 11 gigawatts, will also not receive any new investments or funds from the German company. Uniper’s talks with Russian company Novatek PJSC on ammonia imports were also put on hold.

Uniper has asked for an extension of a credit facility it has with Germany’s development bank KfW Bank to work as a back-up amid high volatility in the commodities market, it said. The facility has not yet been drawn and expires at the end of April.

The European gas benchmark skyrocketed almost 80% on Monday, in some of the most chaotic trading the market has ever seen, after the U.S. said it was considering curbs on imports of Russian oil, fueling fears natural gas will follow suit.

Extreme price movements have forced Uniper to borrow billions of euros from its Finnish parent Fortum Oyj and Germany’s development bank KfW IPEX-Bank to pay down margin calls, the collateral that exchanges require to back up trades.

Finnish Utility Fortum Halts All New Investments in Russia

Uniper’s investment in the Nord Stream 2 pipeline to Russia is likely lost after Germany put the gas link on hold. Uniper is a financier to the polemic pipeline and decided to record a full impairment loss on the project financial claim. This non-operating impairment loss won’t impact adjusted earnings this year, it said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.