Global equity markets have been bathed in a sea of red today while traders were adding bets on an outsized interest rate increase later this month with surging oil prices fuelling inflation expectations, reports Bloomberg.

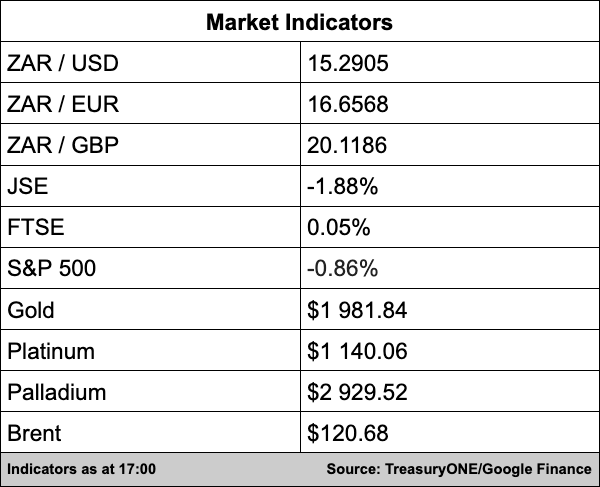

The All Share Index lost 1.92% to close Monday on 73,296 points.

In the currency markets, the rand shrugged off most of the international “risk-off” news and a stronger dollar.

The local unit fought its way back below the R15.30/$ mark as the dollar gave up some ground.

“The stronger move in EM was seen across most EM currencies, but we have seen the Russian Ruble continue its free fall as the currency has lost another 23% today and is trading at 144 against the US dollar,” comments TreasuryONE.

Despite the worldwide turmoil the has been strong resilience from the rand the Brazilian real.

Volatility has been evident in the metal sector.

Palladium was up over 10% for the day and trading at $3,440 but has since dropped to nearly 3% down from this morning’s open and is currently on $2,905. Gold traded at a high of $2,002, which were the highest level we saw since May 2020, but did not sustain this momentum and dropped to $1,980 during the afternoon.

Restriction of crude imports from Russia into the US, oil prices reached record highs with Brent Crude touching $139 per barrel earlier this morning.

Crude prices are sitting at $120 this afternoon.

Heavyweights Naspers and Prosus struggled again with exposure to Russian businesses causing a headache but the former managed to eke out a small gain of 0.07% while Prosus did the same, adding 0.80%.

In a massive move, Prosus said it would be writing off its R10 billion stake in Russian internet company, the VK Group.

Prosus also said it had asked its directors on VK’s board to tender their resignations.

Sasol couldn’t continue its excellent run against the backdrop of rising oil prices and lost 1.13% while Vivo Energy gained 0.36%

The Foschini Group slumped 3.21% after it reached a deal to buy Coricraft and Dial-a-Bed owner Tapestry Home Brands for R2.35 billion TFG reportedly beat out competition from Pepkor for Coricraft and Dial-a-Be reports Bloomberg.

Meanwhile, Pepkor gave up 5.67%, with retail peers Lewis (-2.78%), Mr Price (-7.14%) and Massmart (-7.09%) all falling well into the red.

Massmart reported a loss of R2.2 billion for the year ended 26 December a loss growth of 25.7% from a R1.8 billion loss in 2020.

The company said it had been severely impacted by the July riots and lost 110 days of liquor trade due to various alcohol bans during the year.

The retailer scrapped paying dividends for the third year running based on the results.