As long as the war rages on in Ukraine, we can expect rising costs to pinch our wallets but fear-mongering around rising fuel prices that could hit R40/L to fill up your car’s petrol tank is unfounded say, local economists.

The price of Brent crude oil has surged in recent weeks and topped $140 a barrel over the weekend, reaching its highest levels since 2008 and with the US in consultation with European nations to ban oil imports from Russia.

But European counterparts are less keen on an outright ban of Russian oil with German chancellor Olaf Sholtz saying Russian oil had been deliberately exempt from sanctions placed on the country.

“Supplying Europe with energy for heat generation, mobility, electricity supply and industry cannot be secured in any other way at the moment,” said Sholtz.

Currently, Germany imports 55% of its gas and 40% of its oil from Russia.

Britain and the Netherlands joined calls on Monday to not ban Russian fossil fuels.

Sanctions on Russian oil could also lead to the fuel shortages we saw in 1973 when fuel was not only expensive but restrictions were placed on the hours it was allowed to be sold and on driving such as keeping below 80km/h on highways.

On home soil, the idea that the fuel price could double from its current R20/L mark would have to see the price of Brent topping $400 a barrel, reports TimesLIVE.

South Africa’s fuel price is comprised of various levies and as long as those are left unchanged the fuel price increase will be far less dramatic than initially reported.

Economist Azar Jammine told TimesLIVE he expected the price to rise to R24/L at petrol pumps.

And while we’ll more than likely see a price hike, it’s good news that it will be less steep than first thought as the Reserve Bank is likely to raise the interest rate by another 75 bps this year, higher than the 25 bps expected at the end of March.

The Bureau for Economic Research (BER) now forecasts that headline Consumer Price Inflation (CPI) will average 5.5% in 2022 – up from its initial 5% forecast in January.

The BER cites rising fuel costs and food prices brought on by the crisis in Eastern Europe as a factor for the rise.

What’s more, we’ve seen the return of load shedding yesterday with a breakdown at Medupi Unit 3 on Monday afternoon.

Blackouts are set to be with us until 5:00 on Wednesday and if you need a load shedding schedule here’s a handy one.

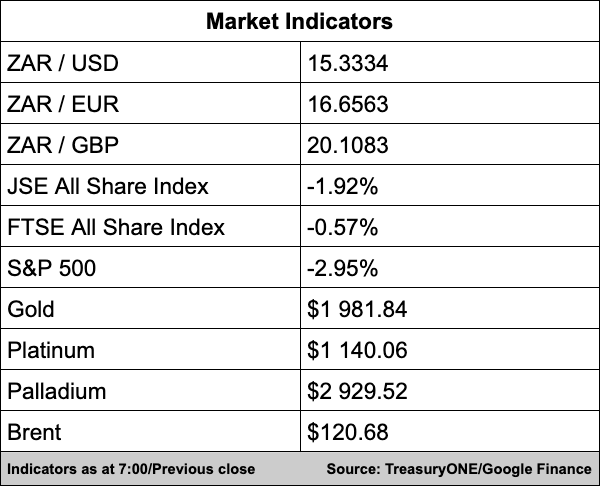

In the markets, currency and commodity markets are finding some respite this morning after a bruising day on Monday.

The rand is trading flat this morning at R15.35/$ and remains resilient amidst all the turmoil and a strong dollar.

“We still believe that the strong rally in commodity prices will underpin the rand’s resilience and that the range, for now, remains R15.00 to R15.50 in the short term, barring any new headlines on the Russia/Ukraine front,” comments TreasuryONE.

This morning we have gold softer at $1,990, while platinum and palladium are both around 0.8% stronger at $1,132 and $3,024, respectively.

Brent is trading off its best levels at $125 a barrel

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Finally, Icasa to begin first spectrum auction in almost a decade – Fin24

Prosus Expects $769 Million Writedown on Its Stake in Russia’s VK – Bloomberg

South Africa energy minister backs oil, gas hunt despite opposition – BusinessTech

Global Business

Moderna announces first African vaccine facility in Kenya – Fin24/AFP

The BRICS bank set up to dilute Western influence has stopped doing business with Russia – Business Insider SA

These Are the Companies Cutting Ties With Russia Over Ukraine – Bloomberg

Markets

Asian markets fall again, oil builds on gains as Ukraine war rages – AFP

Dollar, Euro Down as Worries about Ukraine’s Conflict Economic Impact Grow – Investing.com

Wall St slides as oil prices surge, Nasdaq confirms bear market – Reuters

Cryptocurrency

Russian Crypto Trading Continues Even as Sanctions Tighten – Bloomberg

Coinbase Blocks 25,000 Crypto Wallets Linked to Russia Users – Bloomberg

Biden to Sign Crypto Order as Industry Faces Sanctions Pressure – Bloomberg

Video

Bizarre but true – Ukraine War is boosting the Rand.

Here’s why – Andre Cilliers – BizNews

War in Ukraine | Russia’s nuclear power exports – eNCA

Why the stock market goes down (4 Reasons) – FinMeUp Investing