The JSE eked out a small gain of 0.40% on Wednesday with the All Share Index closing on 72,685 points.

There was positive movement for emerging market currencies today with news that Ukraine is seeking a diplomatic solution to the war with Russian forces. “With the first step of a possible resolution insight, we have seen risk entering the markets again and risky assets like the Rand and other EM’s on the front foot,” comments TreasuryONE.

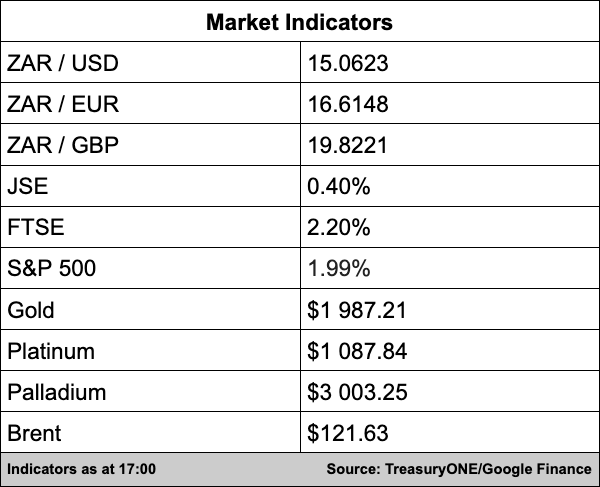

The rand is currently trading at R15.06/$ with the expectation that it will test the R15.00/$ mark tonight after it started the day at R15.27/$.

On the commodity front, some of the previous day’s gains were lost as the news of a possible diplomatic solution to the conflict in Eastern Europe filtered through to the markets.

Platinum and Palladium are both 6% lower than yesterday, with the metals trading at $ 1,079 and $ 2,963 per ounce, respectively. Gold has also fallen from its heights of $2,070 and is currently trading at $1,989.

Brent Crude has lost over 5% for the day and is within touching distance of breaking below $120 per barrel and is trading at $121.05 per barrel.

In the next batch of listed companies reporting year-end results, pharmaceutical company Aspen said revenue grew by 4% for the year ended December 31 with headline earnings also growing by 10% but debt reduction slowed down. Aspen shares climbed a healthy 4.61%.

MTN paid higher dividends than expected with Africa’s largest mobile network operating underpinning its strong performance last year with an 18.3% growth in revenue. The growth came from the group’s Nigerian, South African and Ghanaian businesses, and fintech and data services brought in higher income too.

MTN shares hoped up 2.95% and mobile operating peer, Vodacom added 2.34% to its share price while Blue Label Telecoms and Telkom lost 1.09% and 2.80% respectively.

Telkom said it would delay listing its subsidiary Swiftnet on the JSE citing global impacts on capital markets due to the war in Ukraine as the reasoning. Swiftnet manages towers and masts for Telkom.

On the banking front, Nedbank doubled its profit while headline earnings increased a massive 115% for the year ended December 2021. The bank added 3.68% and said its customer numbers have also increased.

Peers Absa (2.52%), FirstRand (2.59%), Standard Bank (2.22%), and Capitec (1.05%) all closed in the green.

Sun International shares surged 6.26% on the back of the news the hotel and casino chain will report a return to profit when it releases its company financial results next week.