(Bloomberg) —

Russian forces intensified their bombardment of Ukraine’s capital Kyiv, the U.S. said, with NATO defense ministers looking to bolster defenses as the Kremlin’s assault takes a heavy toll on the civilian population of its neighbor.

U.S.

stocks fell for a fourth day and Brent crude rose to $129 a barrel, the highest since 2008, after another volatile session on energy markets. Starbucks Corp. and Coca-Cola Co. joined the steady stream of companies suspending or pulling out of Russia, as Fitch Ratings said a bond default is “imminent” because of the country’s financial isolation after the Ukraine invasion.

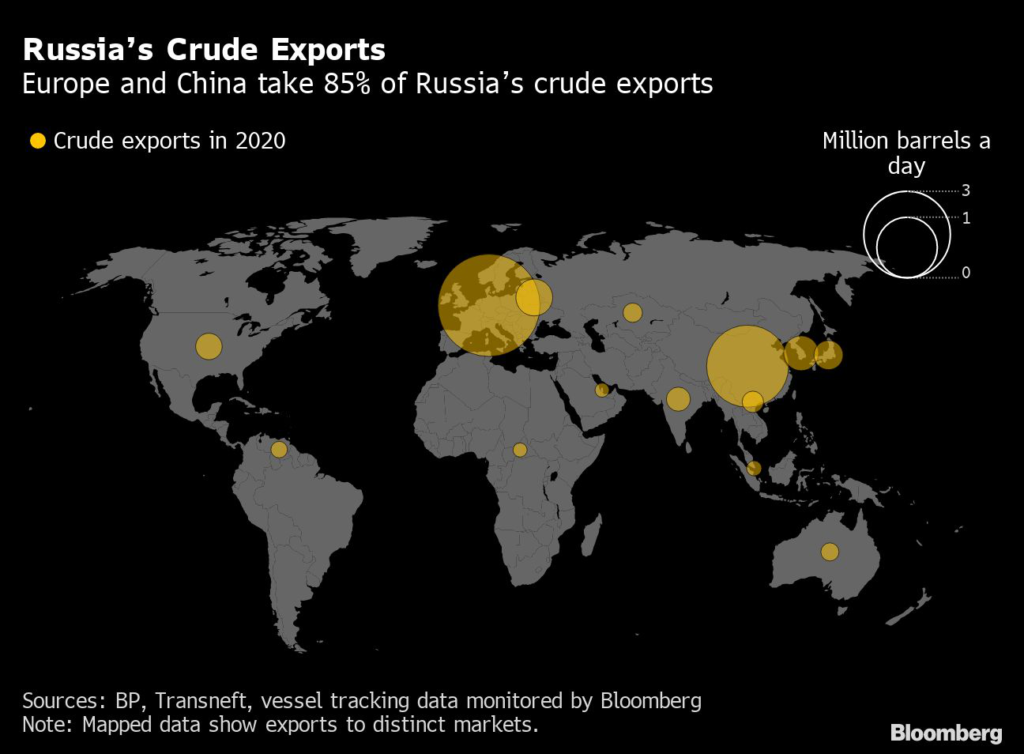

In Washington, President Joe Biden announced import curbs on Russian oil, liquefied natural gas and coal.

Russian President Vladimir Putin signed an order restricting trade in unspecified goods and raw materials, with the economy under growing pressure from sanctions.

Key Developments

- U.S.

and U.K. Ban Russia Oil Imports, Amping Up Squeeze on Putin

- Biden Says U.S. Will Ban Russian Fuels to Pressure Putin on War

- Metal Traders Reel as Nickel Chaos Recalls Market’s Darkest Days

- McDonald’s, Coca-Cola Hit Pause on Russia Amid Backlash

- Putin Misjudged Ukraine But He Persists, U.S.

Spy Chief Says

- Europe on Wartime Mission to Ditch Russian Fossil Fuel

All times CET:

Stocks Climb as Rally in Crude Moderates (3:57 a.m.)

Asian shares rose along with U.S.

and European equity futures Wednesday, bringing some respite from the volatility sparked by Russia’s invasion of Ukraine. Inflation risks put sovereign bonds on the back foot.

Crude climbed but at a slower pace, as the market digested the U.S.

move to ban imports of Russian fossil fuels to punish the nation for the war. The U.K. will prohibit Russian barrels too but spare natural gas and coal. West Texas Intermediate oil was around the highest since 2008 at close to $125 a barrel.

Wheat Tumbles as Traders Weigh Supply (3:12 a.m.)

Wheat futures slumped by almost 5% as traders assessed the global supply outlook with war ravaging one of the world’s top grain-growing regions.

The war in Ukraine has effectively shut off more than a quarter of the world’s supply of a food staple used in everything from bread to cookies and noodles.

Ukraine and Russia are also major suppliers of corn, barley and sunflower oil.

Wheat Tumbles as Traders Weigh Supply With War Raging in Ukraine

Stocks Stabilize as Traders Mull Oil Jump (2:37 a.m.)

Asian shares and U.S.

equity futures stabilized as investors took stock of the U.S. and U.K. ban on Russian oil, which bolstered the rally in crude. Inflation risks put sovereign bonds on the back foot.

Oil pushed higher on the U.S.

move to ban imports of Russian fossil fuels in retaliation for the invasion of Ukraine. The U.K. will prohibit Russian barrels too but spare natural gas and coal. West Texas Intermediate crude scaled $125 a barrel, around the highest since 2008.

Defense Secretary Speaks with U.K., French Counterparts (2:12 a.m.)

Defense Secretary Lloyd Austin discussed how NATO members can strengthen the alliance’s eastern flank on separate calls with his U.K., French and Slovak counterparts, according to a Pentagon statement.

“The allies committed to closely coordinating security assistance in support of the Ukrainian Armed Forces as they defend themselves, their country and their people,” the statement said.

Austin discussed Russia’s invasion with U.K. Secretary of State for Defense, Ben Wallace, French Armed Forces Minister, Florence Parly, and Slovak Defense Minister, Jaroslav Nad.

Congress Puts Off Vote on Russia Oil Ban (1:15 a.m.)

A planned House vote on legislation banning the imports of Russian oil into the U.S.

has been delayed even as President Joe Biden moved ahead with executive action amid growing political pressure to do so.

Democrats now expect to hold the vote Wednesday, bringing it to the floor alongside a $1.5 trillion omnibus spending bill, a Democratic aide said.

Squabbling between the two political parties emerged late Tuesday and slowed passage of the bipartisan bill.

Pelosi Delays Vote on Banning Russian Crude Oil Imports

Fitch Cuts Russia Bond Rating, Sees ‘Imminent’ Default (11:39 p.m.)

Russia’s sovereign debt rating was cut to the second-lowest level by Fitch Ratings, which said a bond default is “imminent” because of the country’s financial isolation after the Ukraine invasion.

Fitch cited a Russian measure that would require some creditors who hold foreign-currency-denominated Russian bonds to be repaid in rubles, which have plunged in value since the war began.

Russia Central Bank Imposes New Foreign-Exchange Curbs (11:27 p.m.)

Russia’s central bank banned banks from selling cash currency to citizens who do not already have FX accounts for a period of six months starting March 9, as it seeks to halt the ruble’s plunge.

FX account-holders can take out up to $10,000 in cash, but additional withdrawals will be in rubles at market exchange rates.

The move comes after Bank of Russia last week ordered brokers to charge 30% on currency conversions and banned cash transfers out of Russia above $10,000.

Russians have rushed to take out cash in both foreign currency and rubles as markets slumped.

Paypal Suspends Russia Service After Starbucks, Coca-Cola (11:09 p.m.)

PayPal Holdings Inc. said it’s suspending services in Russia, joining U.S.

companies including Starbucks Corp. and Coca-Cola Co. on the list of businesses to pull out of the country.

The coffee chain’s licensee will provide support to the almost 2,000 partners in Russia who depend on the company for their livelihood, Starbucks said Tuesday in a statement posted on its website.

The company had said last week that it would donate royalties from sales in Russia to relief efforts in Ukraine.

U.S. May Hit Chinese Firms That Defy Sanctions (10:12 p.m.)

The U.S. could take “devastating” action against Chinese companies that defy sanctions on Russia, Commerce Secretary Gina Raimondo told the New York Times in an interview.

She said the administration could “essentially shut” down firms such as chip-maker Semiconductor Manufacturing International Corp.

if they continue to supply advanced technology to Russia. The U.S. and allies have imposed export curbs in response to the invasion of Ukraine that aim to cut Russia’s access to such equipment.

Russia Issues Vague Order About Export Restrictions (9:05 p.m.)

Putin signed an order to restrict trade in some goods and raw materials in response to sanctions from the U.S.

and other countries, but left out key details about which products might be affected.

The president said his cabinet still needs to define such items, according to a government statement. The Kremlin instructed the government to prepare a list of countries that the restrictions will apply to in two days.

Apart from limits on taking currency out of the country, Russia’s retaliatory sanctions have so far been vague, including the creation of an ‘unfriendly country’ list and a threat to cut off natural gas supplies to Europe through the Nord Stream 1 pipeline.

Russia is a major shipper of oil, gas, grain and metals.

Poland Says It Could Send MiG-29 Jets to U.S. Base (9:02 p.m.)

Poland’s Foreign Ministry said the government is ready to transfer all its MiG-29 fighter jets to the U.S.

air base at Ramstein, Germany, and place them at the disposal of the U.S.

The move would presumably be part of a plan to eventually get the jets into Ukrainian territory. But it’s not clear that the U.S.

or NATO nations would support such an effort because moving the jets into Ukraine from Germany would likely be seen by Russian President Vladimir Putin as an act of aggression. Pentagon officials didn’t immediately comment on the proposal.

Civilian Evacuation in Sumy Underway (8:45 p.m.)

Tuesday evacuations in the northeastern town of Sumy have included 61 buses of civilians to Poltava, while 1,000 foreign students are traveling by train to the border city of Lviv, Kyrylo Tymoshenko, a top Ukrainian official, said Tuesday on Telegram.

Meanwhile, Sumy residents have also been able to drive their cars using the humanitarian corridors.

Russia announced a ‘silence’ period on Wednesday to open humanitarian corridors from Kyiv, Chernihiv, Kharkiv, Sumy and Mariupol, Interfax reported, citing an official at Russian humanitarian coordination headquarters.

Congress Readies Billions in Ukraine Aid (8:38 p.m.)

Congress plans to boost Ukraine aid to more than $13 billion.

The money, an increase from the Biden administration’s initial request for $10 billion, will help deal with a mounting humanitarian crisis affecting Ukraine’s neighbors and bolster funding for the Pentagon, which will help replenish weapons and other materiel provided to Ukraine.

Senate Republican leader Mitch McConnell said the funding includes loan guarantees to countries such as Poland to buy U.S.-made warplanes after they donate their Russian-made aircraft to Ukraine.

The funding is to be included in an estimated $1.5 trillion annual budget bill the House is expected as soon as Wednesday.

Russian Forces Intensify Kyiv Bombardment, U.S.

Says (8:04 p.m.)

Russian forces have intensified their bombardment of Kyiv, a key strategic target in their invasion, with isolated fighting inside the capital city, a senior U.S. defense official told reporters.

But the bulk of Russian forces are still about 60 kilometers (37 miles) from Kyiv, the official said.

Russia has also succeeded in isolating Mariupol, a southern port city, but hasn’t taken it yet, according to the official, who spoke on condition of anonymity.

Zelenskiy Calls NATO ‘Afraid of Controversial Things’ (7:13 p.m.)

U.S.

stocks gained after Agence France-Presse re-reported comments from Ukrainian President Volodymyr Zelenskiy that he made late Monday in an interview with ABC News. AFP reported that “in a nod to Russia, Ukraine says no longer insisting on NATO membership.”

In the interview with ABC News, Zelenskiy said: “Regarding NATO I have cooled down regarding this question a long time ago after we understood that NATO is not prepared to accept Ukraine.

The alliance is afraid of controversial things and confrontation with Russia. I never wanted to be a country that is begging something on its knees. And we’re not going to be that country, and I don’t want to be that president.”

Zelenskiy’s comments don’t indicate he has abandoned the country’s hope of one day becoming a member of NATO.

The military alliance says it has an open-door policy but has made clear that major obstacles remain to Ukraine joining and it won’t happen anytime soon.

BBC to Resume English-Language Reporting From Russia (6:31 p.m.)

The British broadcaster suspended English-language reporting from Russia at the end of last week.

The BBC said in a statement it had since considered the implications of recently-passed media laws in Russia alongside the “urgent need” to report from inside the country.

Ruble Trading to Resume as Russia Stock Market Stays Shut (6:21 p.m.)

Russia’s stock market trading halt is being extended in a bid to protect domestic investors from the impact of sanctions.

Trading on the foreign exchange, money and repo markets will resume Wednesday. The exchange has not been conducting trading or settlements across all its markets since March 5.

Swedish Premier Says a Push to Join NATO Would Add to Instability (5:30 p.m.)

“If Sweden would choose to file an application to NATO in this situation it would further destabilize this part of Europe,” Prime Minister Magdalena Andersson said at a briefing.

“My assessment is clear: sticking to Sweden’s long-standing, consistent policy is what serves our security best.”

Italy Prepared to Back More EU Sanctions Against Russian Banks (5:20 p.m.)

The goal with a third package of EU sanctions would be to pressure Russia into a cease-fire, Foreign Minister Luigi Di Maio said an interview with Bloomberg.

The EU won’t give in to “Russia’s blackmail” on energy, Di Maio said, referring to a threat to cut natural gas supplies via the Nord Stream 1 pipeline.

Di Maio has traveled to Algeria and Qatar in recent days to discuss more gas supplies from those countries. Italy gets 40% of its gas imports from Russia.

German Refinery Limits Supplies, Continental Halts Russian Plants (3:22 p.m.)

OMV AG is limiting the supply of heating oil and diesel from its refinery near Munich in southern Germany in a fresh sign of strains in energy supplies.

The company has also stopped its normal practice of releasing daily spot prices.

Continental AG is halting operations in Russia where it employs about 1,300 people, DPA reported. All shipments to and from Russia have also been stopped, the agency said.

U.S.

Senators Seek to Bar Russia Selling Gold to Dodge Sanctions (1:52 p.m.)

A bipartisan group of U.S. senators has introduced a bill to impose secondary sanctions on anyone buying or selling Russian gold in an effort to block one of Moscow’s remaining possible avenues for offsetting the collapse of its currency.

A number of senators launched the legislation to stop anyone transacting with or transporting gold from Russia’s central bank holdings or selling gold physically or electronically in Russia.

Russia’s gold stockpile was valued at $132.3 billion at the end January.

EU Urged to Vaccinate Ukrainian Refugees for Covid (1:33 p.m.)

EU countries should work to help vaccinate Ukrainian refugees against Covid-19 and other preventable diseases, the bloc’s infectious diseases agency said in a report Tuesday.

The report pointed out that only 35% of Ukraine’s population was fully vaccinated against Covid, well below the EU’s average of more than 70%.

“Vaccination acceptance also needs to be assessed and addressed among those fleeing Ukraine,” the European Centre for Disease Prevention and Control said.

China Considers Buying Stakes in Russian Firms (12:31 p.m.)

China is considering buying or increasing stakes in Russian energy and commodities companies, such as gas giant Gazprom PJSC and aluminum producer United Co.

Rusal International PJSC, according to people familiar with the matter.

Beijing is in talks with its state-owned firms, including China National Petroleum Corp., China Petrochemical Corp., Aluminum Corp.

of China and China Minmetals Corp., on any opportunities for potential investments in Russian companies or assets, the people said. Any deal would be to bolster China’s imports as it intensifies its focus on energy and food security — not as a show of support for Russia’s invasion in Ukraine — the people said

China Willing to Coordinate With Europe (12:34 p.m.)

President Xi Jinping said China is willing to coordinate with Europe on the crisis in Ukraine, holding a video call Tuesday with the leaders of France and Germany.

Xi’s comments, carried on state media, echo the narrative from China in recent days that it supports a mediated solution to the conflict and for Russia and Ukraine to hold talks.

China has indicated growing concern about the humanitarian crisis in Ukraine and the safety also of Chinese citizens there.

Xi repeated China’s view that further sanctions on Russia would damage other countries and the global economy, state media reported.

China has largely sought to avoid taking a position in the conflict and has not condemned Russia for its actions.

Xi Says China Willing to Coordinate With Europe on Ukraine:TV

Shell to Stop Spot Purchases of Russian Crude (11:44 a.m.)

Europe’s largest oil company made a U-turn on buying Russian oil in a move that shows how toxic the nation’s barrels have become.

Just days after purchasing a cargo of the country’s flagship crude — and saying it did so to keep fuel supplies up — Shell Plc announced it is halting spot purchases and phasing out all buying.

Shell also said its refineries will cut the amount of oil passing through them, meaning less fuel for consumers.

Shell’s trade on Friday drew heavy criticism, including from Ukrainian Minister for Foreign Affairs Dmytro Kuleba took to Twitter to ask the company whether the oil smelt like “Ukrainian blood for you?” On Monday, Total said its traders would also stop buying Russian crude.

Shell Says Will Stop All Spot Purchases of Russian Crude Oil

EU Aims to Sanction 14 More Wealthy Russians (11:27 a.m.)

The bloc will stop short of more far-reaching steps like penalizing ports, according to several diplomats.

The latest round of sanctions would also target at least one entity as well as more than 100 members of the upper house of the Russian Parliament, who have voted in favor of measures backing the war.

Number of Ukrainians Fleeing Reaches 2 Million (10:39 a.m.)

The UNHCR said on its website that some 1.2 million alone had fled to neighboring Poland since Feb.

24, with Hungary taking in more than 190,000.

Zelenskiy Ready to Discuss Fate of Separatist Areas (10:35 a.m.)

President Volodymyr Zelenskiy indicated he was prepared to discuss territorial matters, including the future of two separatist areas in eastern Ukraine that Russia recognized as independent as a prelude to Putin’s invasion.

But he made clear he is not ready to meet Putin’s demands, which are for a rewrite of Ukraine’s constitution to give those territories full independence.

“We can discuss and find compromise on how these territories will live on,” Zelenskiy said in an interview with ABC TV on Monday that was aired in part by Russia media on Tuesday.

“I’m ready for dialogue, we’re not ready for capitulation.”

Zelenskiy referred to the territories as “pseudo-republics,” or temporarily occupied territories, unrecognized by anyone but Russia.

“So the question is more difficult than simply acknowledging them,” he said. “This is another ultimatum and we are not prepared for ultimatums.”

(A previous version was corrected to remove reference to fighter jets being made in the U.S.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.