(Bloomberg) — Wall Street has grown more optimistic about technology profits this year, but that has done little to lift the stocks out of a slump amid fears about higher interest rates from the Federal Reserve.

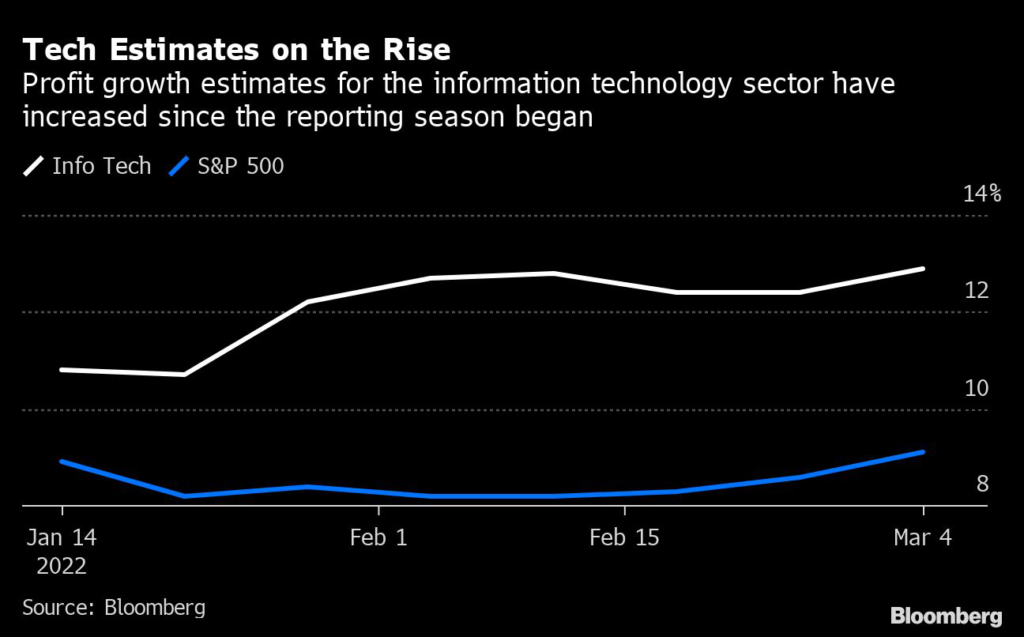

Analysts have raised their 2022 earnings growth estimates for tech companies in the S&P 500 Index by two percentage points since the reporting season started in January, while projections for the broader index have barely budged, according to data compiled by Bloomberg Intelligence. The tech-heavy Nasdaq 100 Index remains down 17% from its peak even after rallying Wednesday by the most in a year.

The disconnect between falling stock prices and rising profit expectations speaks to the level of anxiety about the effects of anticipated rate hikes by the Fed combined with risks posed by soaring inflation and Russia’s invasion of Ukraine. Tech stocks may not be cheap enough if the economic outlook deteriorates.

“Things have been good from an earnings perspective but stocks are still in a rocky spot,” said Michael Casper, an equity strategist with Bloomberg Intelligence. “While the fundamentals for tech look good, there’s this longer-term valuation story that’s playing out.”

While the 13% profit increase expected for tech is better than the 9% estimated for the S&P 500, it pales in comparison to last year’s expansion and groups like consumer discretionary and energy, whose growth is expected to exceed 40% in 2022. That’s tarnished tech’s appeal with rate hikes looming. Higher rates reduce the present value of future earnings, and many tech companies are valued on the promise of profits that are years away.

In all, the fourth-quarter earnings season has been a strong one for tech with companies like Apple Inc. and Microsoft Corp. giving upbeat forecasts. About 87% of the sector has beaten profit estimates, according to Bloomberg data. While that’s down from the third quarter’s stellar 92% showing, it was good enough to top all the other main sectors in the S&P 500.

Bryan Reilly, a portfolio manager and senior investment analyst for CIBC Private Wealth Management, is among investors who are taking a cautious approach in light of risks to the economy.

“I don’t see anything derailing earnings growth over the next 18 months, but there’s still a lot of uncertainty and valuations remain above average,” he said in an interview. “It will take time to be sure that, going into mid-2022, consumer spending won’t retrench and that there is a reason to be confident about tech earnings.”

Tech Chart of the Day

Another day, another Amazon.com Inc. chart. We pointed out Wednesday in this space that analyst price targets on the e-commerce giant pointed to a 52% jump in the stock price, the most bullish brokers have been since 2018. That’s largely because the stock has slumped while analyst targets remained elevated. Well, now the company is taking steps to close that gap, announcing a $10 billion share buyback and an always-crowd-pleasing stock split. The shares have a long way to rally before they catch up with the performance of Amazon’s trillion-dollar peers.

Top Tech Stories

- Amazon shares jump premarket after the e-commerce giant said it is planning to split its stock for the first time in more than two decades and buy back $10 billion of stock

- JD.com posted 23% growth in revenue, after China’s second-largest e-commerce operator managed to grow users despite intensified competition and slowing consumption

- Sony Group’s PlayStation business and Nintendo have suspended shipments to Russia, joining an exodus of multinational companies withdrawing from the country in response to its invasion of Ukraine

- Three of China’s largest smartphone brands, Xiaomi, Oppo and Vivo, have opened discussions with Indian manufacturers about making phones locally for global export

- Toshiba’s proposal to split into two companies has been dealt a blow after a prominent shareholder advisory firm came out against the plan

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.