(Bloomberg) — Like the little Coinbase QR code that bounced around within the outlines of your TV during the Super Bowl, Bitcoin’s been stuck in a stubborn trading range for months. Some market-watcher have a theory as to what might be going on.

Consider this explanation: long-term investors are wading in whenever prices fall, according to Brett Munster at Blockforce Capital. “This group of market participants have been repeatedly willing to step in and accumulate coins at these lower prices, thus setting a floor for Bitcoin over the past couple months,” he wrote.

On the other hand, short-term holders are underwater as long as Bitcoin stays below $47,000, and most are currently holding their coins at a loss. “Every time we start to approach that mark, there appears to be increased sell pressure likely caused by those investors excited to simply get their initial investment back,” Munster, who analyzed Glassnode data, said.

The result? Bitcoin’s been clinging to a range between $32,000 and $47,000, which is proving tricky to break out of.

Matt Maley, chief market strategist at Miller Tabak + Co., has noticed the trend too. “The long-term players are keeping a bid under the market,” he said. “However, a lot of people who bought Bitcoin last year are underwater. They seem to be using every bounce as an opportunity to take some chips off the table with so much uncertainty surrounding its ability to become a hedge against inflation.”

Cryptocurrencies, like many other risk assets, have lost their luster in recent weeks as global central banks start to lift interest rates and Russia’s war on Ukraine stirs all manner of anxiety. Bitcoin, the largest digital asset by market value, has lost 15% since the start of the year and is down roughly 40% since its November record high.

Chris Gaffney, president of world markets at TIAA Bank, says there’s one cohort of crypto investors who bought the coin a long time ago, they’ve seen tremendous gains and they don’t trade or sell it.

“Those that bought it cheap and are sitting on big gains are just going to sit on it,” he said by phone. “But then the traders, if they bought cheap and it’s run up, they sell and they keep it within that range.”

Crypto prices have for the most part mirrored moves of the U.S. stock market, where consternation over the war in Ukraine, diminishing growth prospects and skyrocketing commodities prices are blunting sentiment. Investors have pruned many of their riskier bets, including in digital-asset markets, though a long-awaited crypto executive order from the Biden administration was celebrated on Wednesday with a big rally.

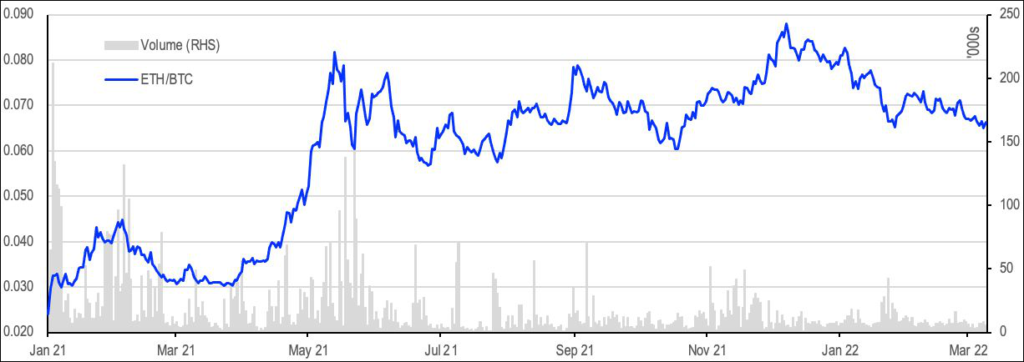

But despite the better-than-expected news around the executive order, “crypto spot performance overall remains somewhat directionless,” wrote David Duong, head of institutional research at Coinbase Global Inc. He cites the Ether-Bitcoin crossrate, which has continued to trend lower and “which we often use as a risk barometer for crypto assets more broadly,” he said. “What it seems to be telling us is that risk appetite away from the perceived ‘safe havens’ of the asset class is still somewhat low.”

Meanwhile, Kraken is seeing buying interest from both retail and institutional investors, according to Juthica Chou, head of OTC options trading at the crypto exchange. Some more-active institutional investors might be making opportunistic moves. “These moves, when you’re up 8%, down 8% present a lot of opportunity,” she said on Bloomberg’s “QuickTake Stock” broadcast. “On the other side are some of the institutions that are accumulating over time and are looking at some of these entry points.”

There’s been a lack of catalysts to drive further investments into the space, Chou added. While some investors are coming in now, there’s still a lot of global uncertainty so some participants will hold their money in cash until there’s a positive catalyst.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.