(Bloomberg) — The worst-performing exchange-traded fund in the U.S. over the past year is still managing to lure cash as investors place high-risk bets on “uninvestable” Chinese tech companies.

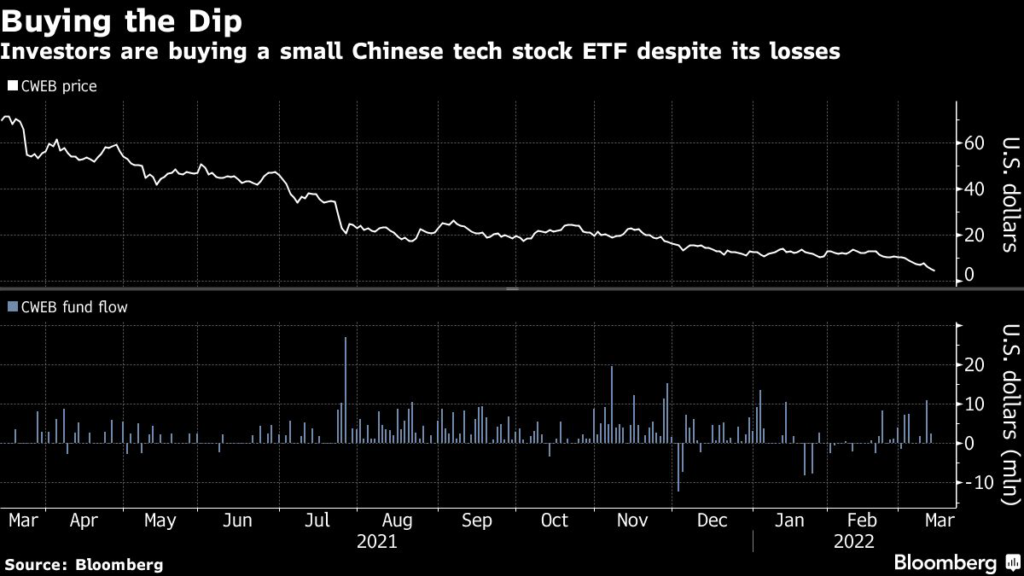

Investors poured $15 million into the Direxion Daily CSI China Internet Index Bull 2X Shares ETF (ticker CWEB) last week, the third consecutive week of net inflows for the fund that uses leverage to amplify the returns on the CSI Overseas China Internet Index. That’s despite the fund tumbling by 93% in the past 12 months, the worst-performance among U.S.-listed ETFs over the span.

Chinese stocks have slumped this year amid concerns about Beijing’s close relationship with Russia, its crackdown on tech giants and the growing risk of U.S. delistings.

A lockdown in the Chinese tech hub of Shenzhen also weighed on sentiment, and dragged down some of the largest holdings in CWEB’s index on Monday, including Tencent Holdings Ltd. and Alibaba Group Holding Ltd. Meanwhile, the Hang Seng China Enterprises Index closed down 7.2% in Asian trading Monday, its biggest drop since November 2008.

The flows into CWEB suggest that traders are hungry for a leveraged bet on the beaten-down sector. The $161 million ETF lured $589 million over the past year, according to data compiled by Bloomberg. The assets of a leveraged ETF can often be smaller than its flows because investors tend to hold such ETFs for a shorter period.

“Despite the poor recent performance, a subset of investors have high confidence that the Chinese Internet sector will sharply rebound in the near term,” said Todd Rosenbluth, head of ETF research at CFRA. “This is a very high risk to achieve reward approach.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.