(Bloomberg) — China’s economy started the first two months of the year on a strong footing, although risks are growing as the number of local coronavirus cases surge and global energy prices spike due to Russia-Ukraine tensions.

Industrial output grew 7.5% in the two months through February, figures from the National Bureau of Statistics showed Tuesday, compared with 4.3% in December. Economists had expected 4% expansion.

Retail sales rose 6.7%, accelerating from 1.7% in December and beating a 3% increase projected by economists. Investment climbed 12.2% during the two-month period, better than the 5% estimate and last year’s 4.9% growth. The surveyed jobless rate rose to 5.5% last month, mainly due to seasonal factors.

“Overall the economy had good recovery momentum in January and February,” NBS spokesman Fu Linghui said in a statement. However, the “external environment still remains complex and grim, and there are many risks and challenges faced by China’s economy,” it added.

Data in the first two months are usually distorted by the Lunar New Year holidays and also complicated by the high base of comparison from last year.

China’s benchmark CSI 300 Index pared a loss of as much as 2.9% after the data, with a sub-gauge of consumer staples trimming its decline by more than half. The futures contract on 10-year government bonds dropped 0.32% as of 10:56 a.m. local time.

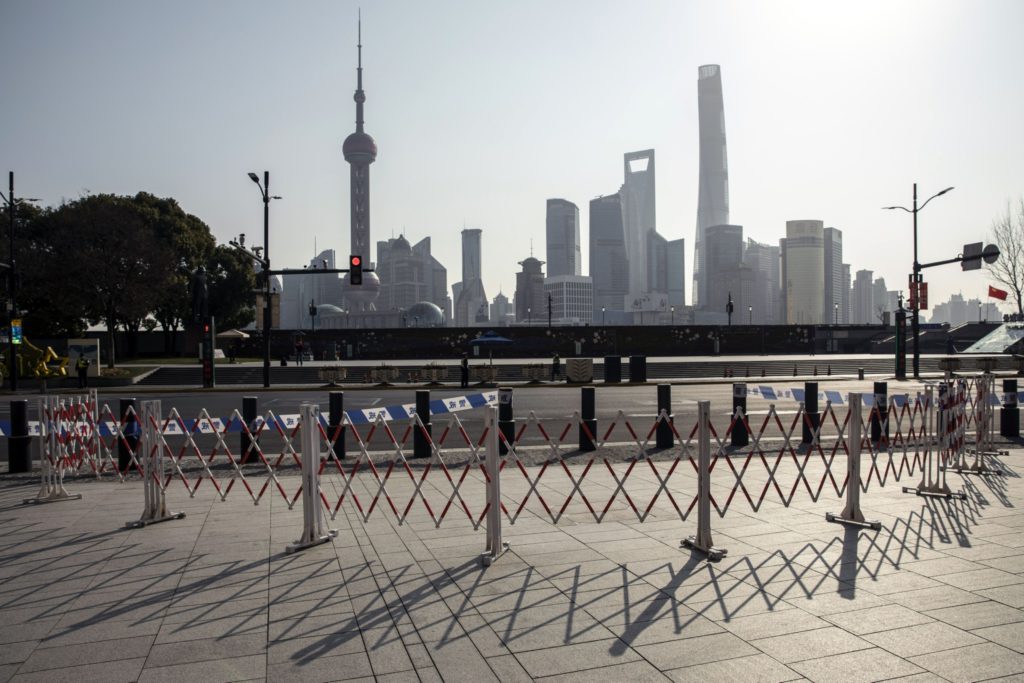

The data showed a strong recovery in household spending and investment by state-owned companies in the first two months of the year before the country was hit by widespread coronavirus outbreaks, but a slump in the housing market persisted. China is facing its worst Covid outbreak since the peak of the first wave in Wuhan, with lockdowns in places like Shenzhen and Jilin province causing disruption to technology and other manufacturing.

“China’s economy is still moving around the bottom,” said Lu Ting, chief China economist at Nomura Holdings Inc. “There’s no clear sign of a significant rebound. The quality of data during the Lunar New Year isn’t very high anyway, plus the rapidly spreading Covid cases over the past three weeks, we cannot assume data for March will be naturally good.”

The worsening outlook will make it hard for the government to achieve its ambitious growth target of around 5.5% this year, which Premier Li Keqiang acknowledged won’t be easy to achieve.

What Bloomberg Economics Says…

“The Chinese economy made a surprisingly strong start to the year — momentum that it will need to contend with a mounting range of threats to growth.”

“The government’s policy support is kicking in — and probably boosting sentiment. But with increasing downside risks, the government and central bank will have to step up support further.”

Chang Shu and Eric Zhu

The government has pledged to step up fiscal and monetary support, although the People’s Bank of China signaled Tuesday it’s not rushing to add more stimulus just yet. The central bank surprised many by refraining from lowering its one-year medium-term lending facility rate, as expected by a majority of economists in a Bloomberg survey. Instead, the PBOC added monetary stimulus by injecting a net 100 billion yuan ($15.7 billion) of funds into the financial system.

“The Jan.-Feb. data are quite strong, which may be a reason why the PBOC didn’t cut rate today,” said Larry Hu, an economist at Macquarie Capital Ltd. in Hong Kong. “But there’s certainly big downside risk in March as the government is likely to have prioritized Covid control before economic growth. So there’s still downside pressure in the first quarter and more policy support will be needed.”

Property Slump

The data showed ongoing weakness in the property market, with residential property sales contracting 22.1% in the first two months of the year from the same period in 2021. Data Friday showed a slump in credit expansion with a key indicator of home mortgages declining for the first time in at least 15 years despite efforts to boost borrowing by cutting rates and lowering down payments.

The Covid lockdowns present a substantial threat to China’s outlook and the world. Australia & New Zealand Banking Group Ltd. estimates about half of China’s gross domestic product would be affected if lockdowns become more widespread, and could subtract 0.8 percentage point from the GDP growth rate.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.