The JSE was down as much as 3% in morning trade but rebounded later in the day to close 1.77% down with the All Share Index sitting on 70,628 points.

At one point during the day tech-heavy Naspers and Prosus dragged the bourse below 70,000 as the pair extended their losses from the previous session into Tuesday’s session.

Naspers were down as much as 10% at one point during the day but clawed its way back to settle on a 4.12% loss for the day. Subsidiary Prosus lost 6.14% after facing a similar spiral as Naspers.

The downward trend follows from yesterday’s drubbing that saw Naspers lose R100 billion in valuation due to their exposure to Chinese conglomerate Tencent, which face a fine that could run into the millions of yuan for breaching anti-money laundering rules in China.

Tencent gave up 10% on Monday and lost a further 9% in today’s trade.

According to Bloomberg data, Naspers and Prosus have lost 41.5% and 46.3% in value from the start of the year to date.

Chinese stocks suffered another selloff on Tuesday with investors concerned about ties to Russia and persistent regulatory pressures, reports Bloomberg. The Hang Seng China Enterprises Index sank as much as 7.7%.

Old Mutual (0.38%) doubled its headline earnings in 2021 despite paying out R6.8 billion in Covid related death claims, the insurer said. The doubling of earnings could be attributed to more policy sales, higher shareholder investment returns, and the value of new business jumping 109% up.

The green insurer said headline earnings had increased to R5.4 billion compared to R2.48 billion the previous year.

Peers Sanlam and Clientele lost 2.27% and 1.84% respectively, while Discovery added 0.50%

Homechoice surged 7.06% after recording an annual revenue increase of 4.8% R3.4 billion with a ramping up of its online shopping strategy. The group said its trading profit had grown by 43% to R386 million while operating profit dropped 2.6% to R263 million.

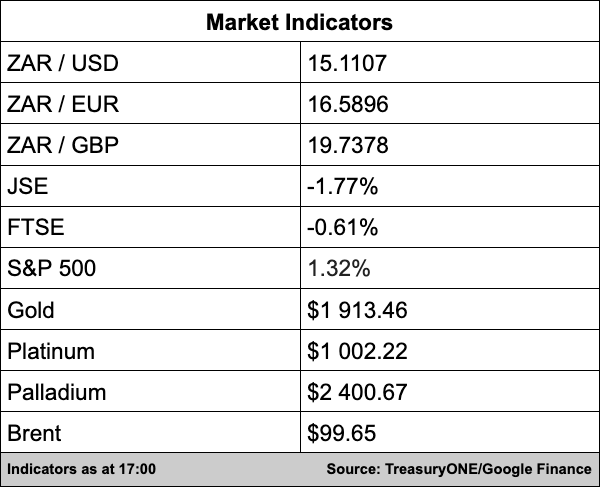

In the currency markets, the rand is moving between the R15.00/$ to R15.50/$ level and is currently trading at R15.11 and will probably stay at these levels ahead of the US Fed meeting and interest rate decision tomorrow.

“We expect the Rand to start drifting slightly weaker as we head to the meeting, and it would need a sudden about-turn by the FOMC for the Rand to trade significantly stronger. We have also seen significant resistance at the R15.00 (level) in the recent past, hampering any rand strength,” comments TreasuryONE.

Commodities are encompassed by red today, only palladium ended the local session in the green. Palladium is up by 1.5% today and currently trading at $2,437 per ounce. Gold and platinum are down by 2% today, with gold trading at $1,911 and platinum below $1,000 per ounce at $997. The biggest faller for the day is the brent crude price, which has lost around 8% and is currently below $100 per barrel at $ 98.71. This is also the first time that brent has been below $100 a barrel for the month.