(Bloomberg) — China’s surprisingly robust economic data for the first two months of this year sparked heated discussions among analysts struggling to reconcile the figures with underlying indicators showing a much weaker picture.

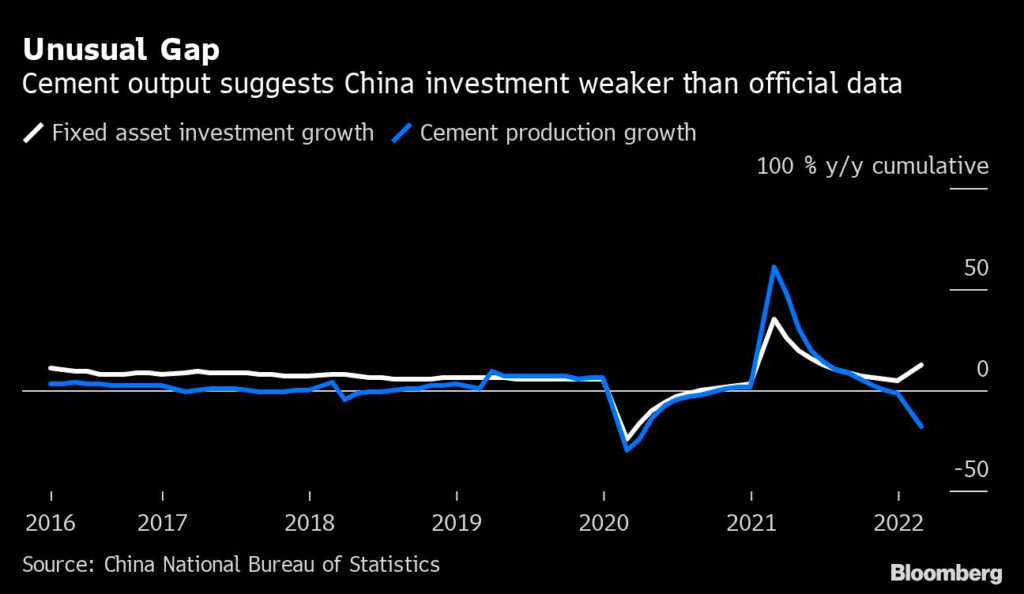

Some of the strong headline numbers in the release by the National Bureau of Statistics are not supported by a detailed breakdown of the data, several economists have highlighted. A common problem raised is the diverging trend between the 12.2% jump in fixed-asset investment and the slump in the output of key construction materials like cement and crude steel, which fell 17.8% and 10%, respectively.

“Digging deep into the breakdown data, we feel there are multiple contradictions behind the better-than-expected economic data,” Shen Jianguang, chief economist at online retailer JD.com Inc., and his colleagues wrote in a report late Tuesday. “The true economic situation may not be so rosy.”

Social-media users also expressed skepticism over the official data. One post on WeChat mocking how the surprising figures caught a fictional economist off guard and left him frustrated in finding reasonable answers was read more than 100,000 times.

The official data brought only limited relief to a stock market rout Tuesday, with a sell-off in onshore stocks continuing to deepen, leaving the benchmark CSI 300 Index to close the session 4.6% lower, the steepest drop since July 2020.

The rebound in retail sales conflicts with the pickup in the jobless rate, sluggish consumer inflation and a drop in new short-term household loans, the JD.com analysts said.

While investment in real estate development recovered, new property construction starts, land purchases, property sales and sources of funds for developers contracted across the board, they added.

In an apparent attempt to address the questions, the NBS spokesman Fu Linghui elaborated on factors that led to the better-than-expected performance of the economy in an article posted on the agency’s official website on Wednesday. The positive drivers include policy front-loading, eased power supply bottlenecks, strong foreign demand, more targeted Covid policies and advanced stocking of companies to prepare for uncertainties amid geopolitical tensions, he wrote.

Less Grim Data

Some of the NBS’s figures were less grim than data provided by private firms measuring similar economic activities. Residential property sales, for example, fell 22% on year in the first two months, according to the official data. However, figures from China Real Estate Information Corp. showed home sales at the 100 biggest Chinese developers plunged 47% last month after dropping 40% in January.

“These data will certainly evoke market concerns over how to reconcile the widening discrepancy between high-frequency data from alternative sources and the NBS data,” Nomura Holdings Inc.’s economists led by Lu Ting wrote in a note.

Also calling out the “mismatch” between the “macro and micro” numbers was Ren Zeping, China Evergrande Group’s former chief economist. He said in a Tuesday note that the underlying categories rather than the headline numbers are “more reliable” and the disparity showed the economic slump hasn’t bottomed out yet.

Ren was recently banned from social media platform Weibo days after posting comments recommending the central bank print trillions of yuan a year to pay for subsidies to raise the birthrate.

Other economists said the divergence in the data highlights concern about the growth outlook.

The unresolved discrepancies between the macro and micro, monthly and high-frequency figures for January and February “bury hidden risks for whether the economic strength can be sustained,” Huatai Securities Co. analysts led by Zhang Jiqiang wrote in a report.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.