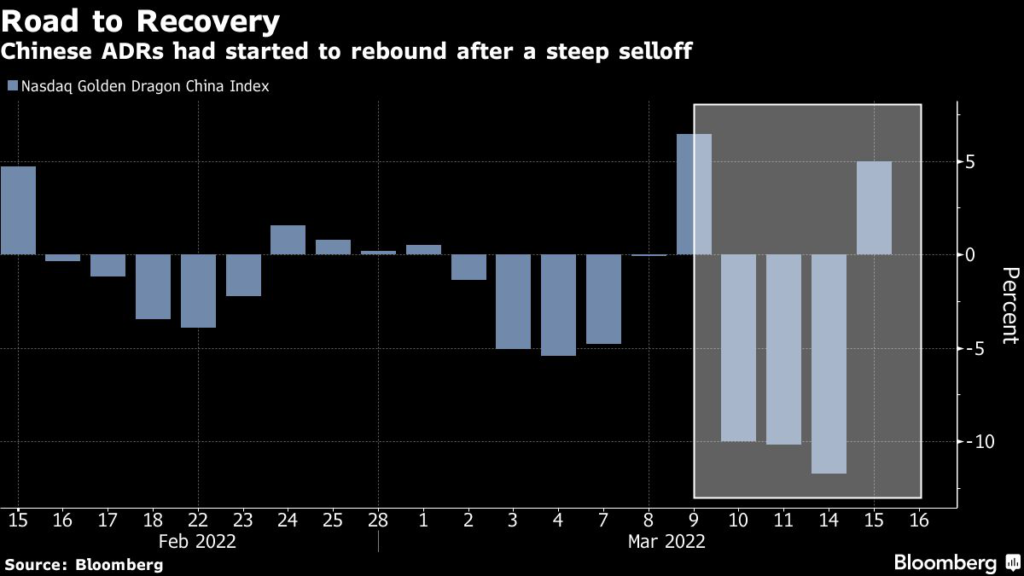

(Bloomberg) — Chinese stocks listed on U.S. exchanges soared, rebounding from a steep selloff, after China vowed to keep its stock market stable and support overseas share listings.

Alibaba Group Holding Ltd. and JD.com Inc. both soared about 20% in U.S. premarket trading, while Didi Global Inc. jumped more than 40%. The American depository receipts are tracking a rally in Asian stocks after China’s announcement, with the Hang Seng Tech Index surging 22%, the most on record.

China Stocks Jump Most Since 2008 as State Council Vows Support

China also said it’s keeping a good dialog with U.S. regulators over ADRs, the official Xinhua news agency reported on Wednesday, citing a meeting of the State Council’s financial stability and development committee. Adding to positive sentiment on the region was a report from the same news agency that China will not expand its property tax trial this year.

Shares in live-streaming platform operator Bilibili Inc., which said today it plans to pursue conversion to a dual-primary listing on the Hong Kong Stock Exchange, jumped 33%. China-linked exchange-traded funds soared too, with the KraneShares CSI China Internet Fund gaining 20% and the Invesco China Technology ETF up 18%.

“We see some long-only funds starting to search for bargains, and it’s very distinct over those companies who can do a dual listing and those who cannot,” said Sean Darby, chief global equity strategist at Jefferies. “Investors want companies who have positive free cash flows.”

Chinese stocks in the U.S. saw renewed weakness last week after the U.S. Securities and Exchange Commission identified five Chinese companies that could be subject to delisting, adding to a growing list of regulatory concerns. The prospect of sanctions for China amid Beijing’s relationship with Russia and a lockdown in tech hub Shenzhen have also weighed on sentiment.

Investors have been split on the fate of Chinese stocks after the rout. While analysts at JPMorgan Chase & Co. said that some Chinese Internet names have turned “uninvestable” in the short term, others said the selloff was overdone.

“There were plenty of encouraging messages, but markets will be looking for action such as rate cuts, more fiscal spending, and easing regulations, to follow words otherwise the selling pressure may resume,” Mitul Kotecha, chief emerging Asia and Europe strategist at TD Securities, said.

For Marvin Chen, a strategist at Bloomberg Intelligence, actions will also speak louder than words.

“We do have a solid base for a U-shaped recovery, supported by the policy shift and valuations,” he said. “For a next leg, we need to see policy makers follow through on easing measures and supporting growth going forward.”

Separately, Reuters reported today that Alibaba and Tencent Holdings Ltd. are preparing to cut tens of thousands of jobs combined in 2022 amid China’s regulatory crackdown.

(Adds ETF moves, news on Bilibili, Jefferies strategist. A previous version of this story corrected the second paragraph to say JD.com, not Baidu, rose 20%.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.