Stocks rallied on Wednesday on the back of hopes for a peaceful resolution in Ukraine and Chinese authorities pledging support to stabilise troubled markets, ahead of the US Fed rate hike decision expected later today.

The Asian stock market found some cheer on during trade in the Far East with the Hong Kong Hang Seng having its best day in 13 years on Wednesday following bruising losses in the previous session.

Tech stocks, which were behind most of the losses on Monday and Tuesday, surged today with Tencent adding over 23% to its share price and aiding local JSE-listed stocks in their recovery.

Prosus, which has a 29% stake in Tencent, surged as much as 18% in morning trade while parent, Naspers climbed by the same margin. Thanks to the surge, Naspers added R119 billion to its market capitalisation within an hour.

By the end of the day, Naspers and Prosus both added 21.07%.

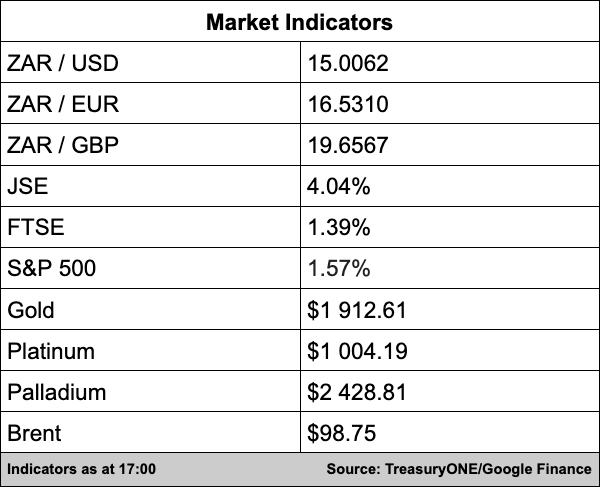

The heavyweights lent support to the bourse, closing 4.04% up with the All Share Index up to 73,484 points.

Bytes Technology shares surged 16.63% on the back of news its full-year income is expected to grow a quarter. The group expects to release its full-year results in May. In December, Bytes listed on the London Stock Exchange.

Growthpoint Properties (2.64%) reported a 5% increase in its interim dividend to 62 cents. The group cited momentum in the retail and industrial sectors operating environment as a contributing factor.

In the currency markets, the rand traded sideways for most of the morning and briefly broke below the R15.00/$ mark but soon moved back to slightly above this level.

“EM’s across the board are trading slightly stronger this afternoon, with sentiment around Russia and Ukraine improving. We eagerly await tonight’s address by Jerome Powell, which could be the catalyst for momentum in either direction in the short term,” comments TreasuryONE.

Commodities held stable with platinum and palladium trading higher in the afternoon, however, gold has been under pressure since the beginning of the week. Brent crude fell just over 1% for the day. The drop in crude prices is a welcome relief with local fuel prices likely to rise sharply next month.