It’s not some dystopian reality where a Mad Max-like scenario is in full swing and South Africa has become a barren wasteland and fuel rationing is the order of the day.

It could soon be reality. Okay, it won’t get that bad, but there is the very real prospect of government enforcing fuel quotas as surging fuel prices and dwindling supplies start to affect the status quo.

On Tuesday, the department of mineral resources and energy told lawmakers high fuel prices are driven by the Russia-Ukraine conflict and that it would consider mitigating measures including limiting the amount of fuel each motorist is allowed per visit.

The department gave the example of limiting motorists to 50 litres of fuel per visit and said other mitigating measures like enforcing speed limits and encouraging work from home again would be on the table.

It did stress that rationing of fuel would be a “worst-case scenario.”

What’s more, the fuel price is set to increase by record margins next month with petrol increasing by over R2 a litre while diesel is set to increase by over R3 a litre.

The fuel prices are mainly affected by two key components – the rand/dollar exchange rate and changes to the international petroleum product costs, primarily driven by oil prices.

In a somewhat contradictory presentation, the treasury department told lawmakers (after the doom and gloom of the energy department presentation) that it had come up with four considerations for easing the price of fuel.

These options included:

- A once-off reduction of the Basic Fuel Price of between 3 cents and 18 cents would be implemented immediately.

- A review of the Regulatory Accounting System (RAS) methodology for petrol, would bring about a significant reduction of R1.03 a litre by 2028 but would take much longer to implement and requires further investigation.

- A review of the Road Accident Fund levy to decrease the current Basic Fuel Price.

Treasury said its levies account for 30% of the total fuel price and that changes to the RAF levy should be possible with operational changes and improvements implemented over the next few years.

- A fuel price cap consideration but this will require further investigation.

Speaking to Bloomberg, economist Iraj Abedian said the government had become “addicted” to the current fuel pricing structure as it is the third-largest source of tax revenue.

Abedian said the fuel price formula should have been updated regularly and that the structure of energy pricing changed rapidly as far back as 15 years ago.

For now, all we can do is wait and see and throw ourselves at the mercy of the fuel pump.

Here’s hoping that the global turmoil and instability find peace so that lives are saved, and the economic hurt lets up.

In the markets, the dollar initially weakened against major currencies during the European trading session but ended the day reasonably flat.

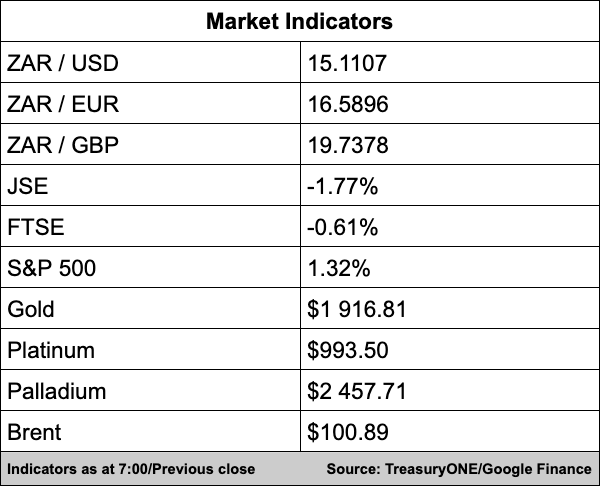

The rand closed at R15.10 and is trading relatively unchanged in Far East trading this morning. The local unit is currently trading at R15.11/$.

On the commodity front, prices continue to be volatile with precious metals all trading down yesterday.

This morning gold is flat at $1,917, while platinum and palladium are both up over 1.0% at $995 and $2,456, respectively.

The price of Brent crude fell 5.15% yesterday, closing below the $100.00 level, and is trading marginally higher at $101.00 this morning, with WTI currently quoted at $97.02, comments TreasuryONE.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

SAA assures customers it won’t increase prices amid demand for domestic flights – EWN

Ramaphosa: buy locally – it is more important than ever – Fin24

How Russia’s war in Ukraine is pushing up prices in South Africa – BusinessTech

Global Business

Elon Musk sounds the inflation alarm as Tesla raises prices amid a squeeze in nickel – Business Insider

The Sanctions Imposed So Far on Russia From the U.S., EU and U.K. – Bloomberg

Apple Park partially evacuated after envelope with white powder substance was discovered – The Verge

Markets

Gold Down, but Caution Reigns Ahead of Fed’s Decision – Investing.com

Asian Stocks Up as Chinese Shares Selloff Eases, but Volatility Remains – Investing.com

Oil boom turns Angolan kwanza into world’s top-performing currency – Bloomberg/Fin24

Tech

China Tech Stocks Rebound on Dip Buying After Historic Rout – Bloomberg

Kenya-based fintech 4G Capital to scale lending after raising $18.5M from Lightrock – Tech Crunch

NFTs will be on Instagram soon, according to Mark Zuckerberg – The Verge