(Bloomberg) — Investors are bracing for more delays in Chinese developers’ 2021 results as Ronshine China Holdings Ltd. becomes the latest to announce the resignation of its auditor.

Ronshine said it won’t file audited results by the end of March deadline as PricewaterhouseCoopers LLC was unable to complete its audit work partly because the supply of requested information had fallen behind schedule, the real estate firm said in a Monday filing to the Hong Kong stock exchange.

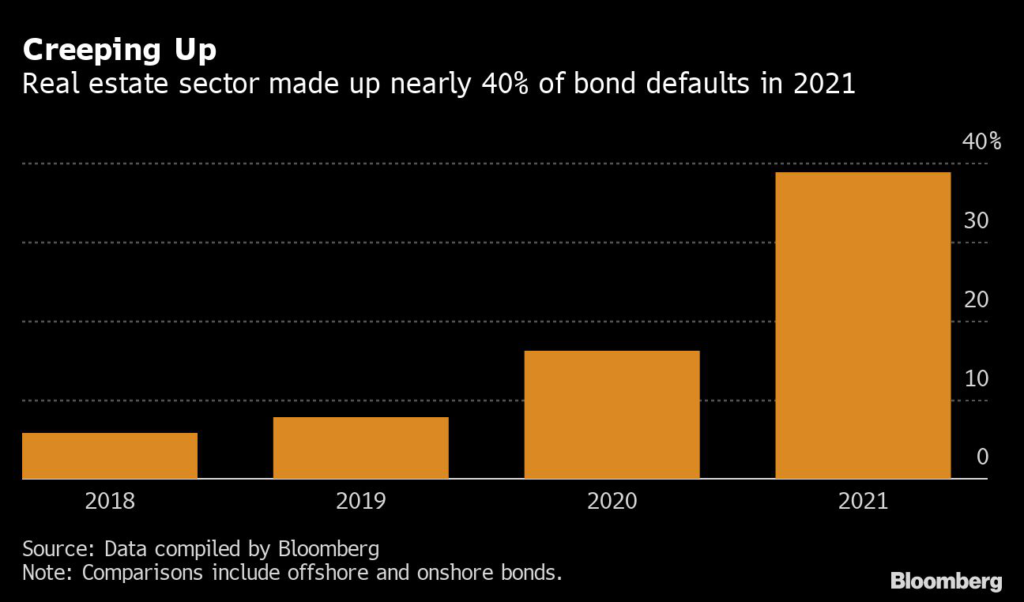

Chinese property firms listed in Hong Kong face a March 31 deadline to file annual results, their first audited financial statements since the industry’s liquidity crisis spread. Transparency and governance concerns have cropped up alongside worries about developers’ ability to repay debt following a record number of defaults last year. At least four auditors have resigned or been replaced by builders since the start of this year, and global ratings firms have also pulled some assessments on property bonds due to insufficient information.

“It looks like Ronshine could be just a start,” said Bloomberg Intelligence analyst Andrew Chan. “We should expect more to come,” he said, predicting that such announcements may further hit investor sentiment in the wake of debt-servicing concerns.

Ronshine, China’s 25th largest developer last year by contracted sales according to China Real Estate Information Corp. figures, said that 82% of its land reserve was in so-called first- and second-tier cities as of mid-2021. It has $4.5 billion of bonds outstanding, according to Bloomberg-compiled data. The firm’s dollar note due 2025 fell 5.3 cents on the dollar Monday morning to 13.4 cents.

Time Running Out for China Developers to Come Clean on Debt

Because of the change in auditor and the recent Covid-19 outbreak in China, Ronshine said it doesn’t anticipate being able to complete the necessary procedures to finalize audited financial results by March 31. It does plan to release unaudited 2021 figures that day. The process of hiring a new auditor is ongoing. A spokesperson for PwC declined to comment.

Firms listed on the Hong Kong Stock Exchange typically see their shares halted if they are unable to release audited annual figures three months after their fiscal year ends. Dozens of companies’ stocks had trading stopped April 1, 2021 for not meeting the requirement, notably China Huarong Asset Management Co. It remained halted for nine months.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.