The Philippines on Monday eased restrictions to allow foreign ownership of airline, telecommunications and shipping operators, as it seeks to boost jobs and spur activity in the virus-hit economy.

The archipelago nation has long struggled to attract foreign money, as red-tape, corruption and political uncertainty scared off investors who instead pumped billions of dollars into neighbouring nations.

The amendments to the 85-year-old Public Service Act are the latest effort to woo foreign investment and increase competition in sectors long dominated by a few local players.

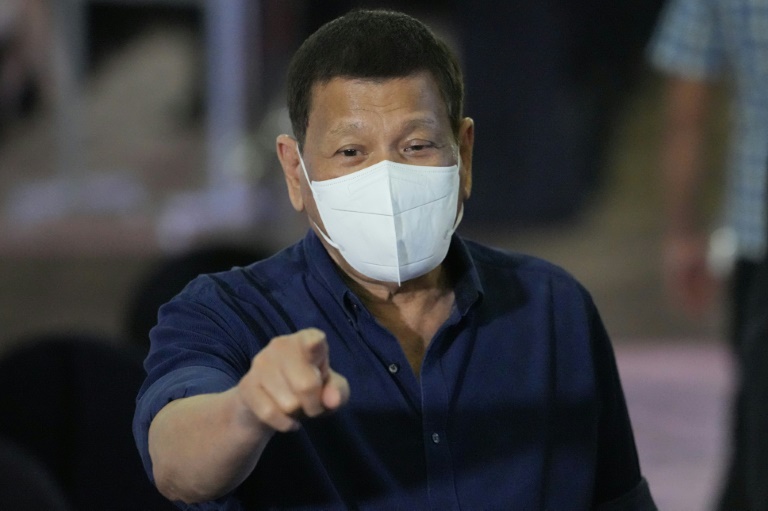

“I believe that with this law, the easing of foreign equity restrictions will attract more global investors, modernise several sectors of public service and improve the delivery of essential services,” outgoing President Rodrigo Duterte said as he signed off on the changes.

Trade Secretary Ramon Lopez said foreign equity restrictions would be “eased out” in several sectors, including telecommunications, shipping, airlines, railway and subways.

The amendments do not apply to sectors classified as public utilities, such as water and electricity distribution, where foreign equity remains capped at 40 percent.

The president retains the power to block a proposed foreign takeover of a public service.

Experts welcomed the relaxation but cautioned more needed to be done to boost confidence in the country’s investment environment.

“Opening the door does not necessarily mean they will all enter, because it will depend on their review on the feasibility of coming in,” said Alvin Ang, an economics professor at Ateneo de Manila University.

“They might ask for something else, so that may require fixing or renovating … that could be ease of doing business, that could be governance, that could be regulatory capacity, that could be quality of support.”

A 2020 index published by the Organisation for Economic Cooperation and Development shows the Philippines has some of the most restrictive foreign direct investment rules in the world.

The Philippines ranked 95 out of 190 countries in the World Bank’s “Doing Business 2020” report.

“In itself, it’s good, but then you also have to consider other factors that will affect investment sentiment,” said Filomeno Sta.

Ana, executive director of Action for Economic Reforms.

“The outcome of the 2022 elections will be very critical in shaping investments and the economy. If we can get a good leader, interventions like the Public Service Act will provide an additional boost to investor sentiment optimism.”

Filipinos are set to elect a new president on May 9.

In recent months, the Philippines has lowered barriers to foreign investment in other business sectors as the country tries to revive an economy devasted by the coronavirus pandemic.