(Bloomberg) — Alibaba Group Holding Ltd. soared as much as 13% on Tuesday in New York after ramping up its share buyback program to $25 billion, fueling hopes that Beijing is easing off an internet crackdown that wiped out $470 billion of the e-commerce giant’s value.

The board approved the program, which will run for two years through to March 2024, the company said.

It also appointed a new independent director in Shan Weijian, chairman of alternative asset management house PAG. Shan, a longtime investor in Chinese companies, will replace Ericsson Chief Executive Officer Börje Ekholm from March 31.

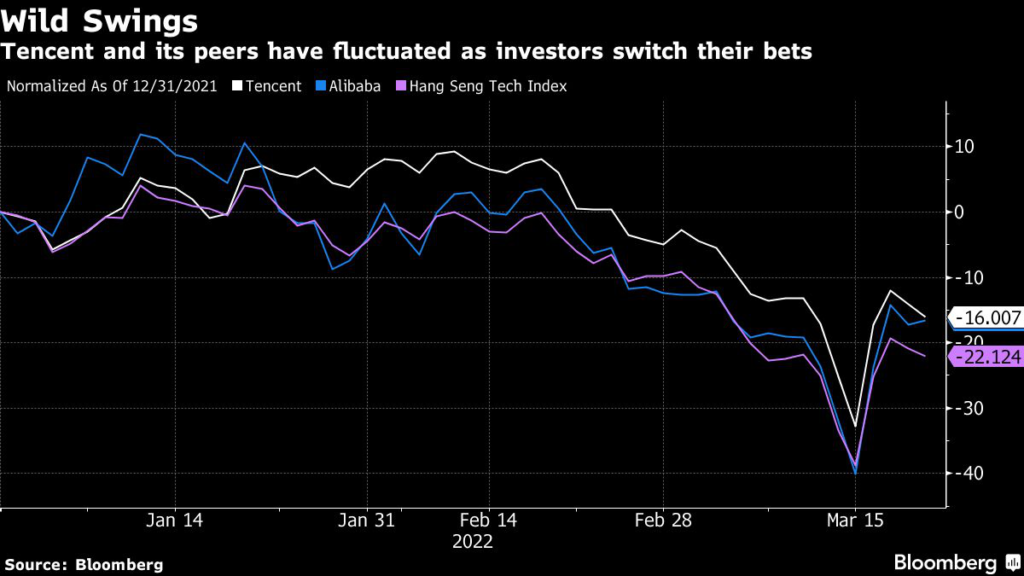

Alibaba’s up-sized buyback represents one of the largest shareholder-reward programs in China’s giant internet industry, and coincides with a re-calibration of sentiment after Xi Jinping and his deputy Liu He pledged to support the economy and markets and finish the clampdown on the tech sector “as soon as possible” — triggering a historic rally in Chinese stocks.

China’s largest companies are only just starting to emerge from a year of unparalleled regulatory scrutiny into sectors from online commerce to social media.

Alibaba’s shares closed at their highest in almost a month in Hong Kong on Tuesday, and the U.S. depositary receipts were trading at $113.66 at 9:47 a.m. in New York.

The buyback “signals where company management sees value, and it may also be a bellwether for where they see regulatory action — perhaps we are coming closer to the end of it,” said Justin Tang, head of Asian Research at United First Partners in Singapore.

Read more: Alibaba’s $9 Billion Buyback Fails to Revive Battered Shares

Chinese tech corporations have until recently rarely resorted to big shareholder-return programs like dividends or stock repurchases.

But the country’s largest corporations have resigned themselves to a new era of cautious expansion, nearly two years into a bruising internet crackdown that quickly engulfed everything from e-commerce to ride-hailing and online education.

Alibaba grew its buyback arsenal for the third time since Beijing’s tech crackdown started in late 2020 — twice in under a year.

It acquired 56.2 million American depositary shares under its previously announced share buyback program for about $9.2 billion. That means it’s spent more on repurchases than any other tech firm since the sector’s downturn began.

But that’s done little to boost the stock’s fortunes.

Read more: Tencent Stays in Beijing’s Sights Even After $490 Billion Drop

Alibaba reported its slowest growth on record during the December quarter, and Tencent Holdings Ltd.

is expected to do the same on Wednesday. E-commerce rival Pinduoduo Inc. reported revenue that missed estimates for the third straight quarter.

Alibaba Chief Executive Officer Daniel Zhang has sketched out how China’s e-commerce leader will now prioritize user retention over acquisition — a significant shift for a company that achieved massive scale by vanquishing rivals like EBay Inc.

and fought rivals in arenas from media to the cloud and commerce.

The about-face underscores a growing realization of the speed with which up-and-coming competitors from ByteDance Ltd. to PDD are drawing users from traditional leaders Alibaba and JD.com Inc., even as the Chinese economy struggles to recover during punishing Covid-Zero lockdowns.

“The Chinese generally believe you shouldn’t waste the bullet when the tide is against you,” Kamet Capital Partners Chief Investment Officer Kerry Goh said.

“Could this be a signal that the management believes the worst is behind them especially since Liu He’s announcement last week?”

Read more: Alibaba Plans for New Normal of Low Growth as Crackdown Bites

(Updates shares in U.S.

trading in fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.