(Bloomberg) — China’s Alibaba Group Holding Ltd. has spent more on share buybacks than any other tech firm since the sector’s downturn began. But that’s done little to boost its stock’s fortunes.

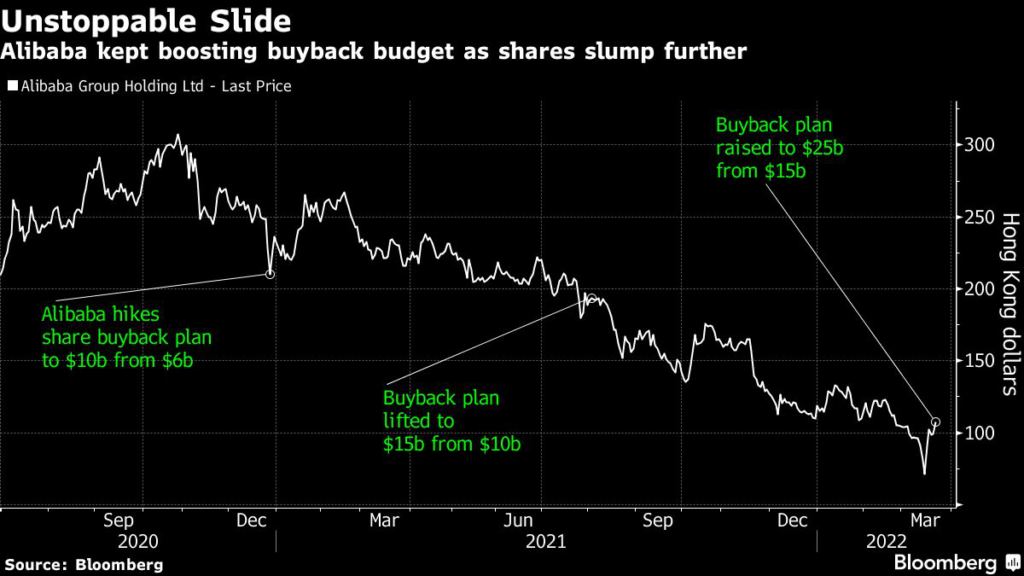

The e-commerce giant’s shares are trading about 60% below last year’s peak even after the company deployed more than $9 billion to repurchase its stock, according to Bloomberg’s calculation. The Hangzhou-based firm unveiled a plan on Tuesday to boost its buyback plan to $25 billion — the third increase since Beijing’s tech crackdown started in late 2020.

The stock’s lackluster performance reflects lingering worries about the impact of China’s crackdown, which has left virtually no corner of Alibaba’s core business untouched. It also mirrors the broader weakness in Chinese equities, where a fresh virus outbreak and slowing economic growth have hurt sentiment.

To be sure, Alibaba’s shares jumped as much as 9.8% to HK$108.80 in Hong Kong on Tuesday after the buyback was announced. But, that’s still a distance from the peak of HK$267 reached in February last year. The stock’s losses of $450 billion are the world’s biggest after those of its peer Tencent Holdings Ltd., according to data compiled by Bloomberg.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.