Chinese tech firm Tencent posted its slowest growth since 2004 with revenue only increasing by 8% for the three months to end-December, the first-time quarterly growth has been in the single digits, reports Bloomberg.

Tencent has lost more than $470 billion since its peak in 2021, Naspers (-9.45%), which is Tencent’s largest shareholder slumped 5% in morning trade before dropping further. Naspers-owned Prosus, which is regarded as a proxy for Tencent, lost 9.00%.

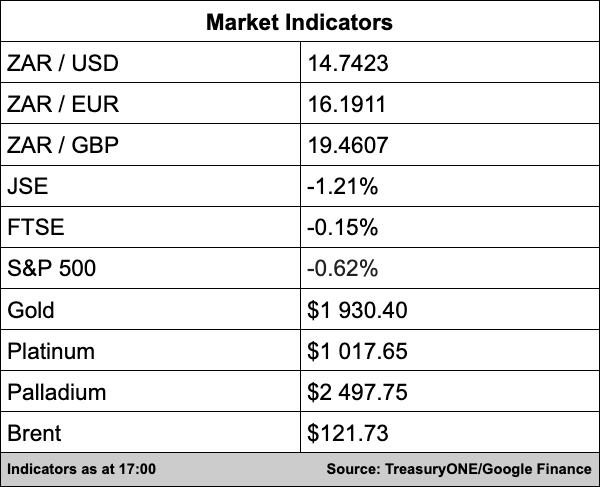

The local bourse wasn’t helped by two of its largest listings losing value due to their exposure to Tencent and lost 1.21% to see the All Share Index close on 74,838 points.

In the currency markets, the Turkish lira’s decline against the rand reached a new milestone this week, reports Bloomberg with the much-tried strategy of shorting the rand against the lira potentially being replaced by the opposite strategy as the new standard for the pair.

The local unit, for its part, solidified its break below the R14.85/$ level and threatened to break below R14.75/$ in the afternoon session. The rand is currently hovering around the R14.76/$ mark with a strengthening bias firmly entrenched, comments TreasuryONE.

“The global picture with higher commodity prices should work in the rand’s favour, but we believe gains will be harder to come by, and we do expect the rand to give up some of its gains. It is still surprising that we have seen the rand continue its resilience in the wake of a stronger US dollar.”

There could be some movement tomorrow after the interest rate decision is announced by the monetary policy committee, especially in the wake of inflation coming in lower than what was expected.

On the commodity front, the markets were relatively calm today except for the price of brent crude, which is up by almost 5%.

“The oil price is trading a bit more volatile after there was a disruption of the Russian and Kazakh crude exports via the CPC pipeline. Gold is trading at $1,933, platinum at $1,020 and palladium at $2,491 per ounce. Brent crude is trading above $120 per barrel,” says TreasuryONE.