(Bloomberg) — Tencent Holdings Ltd. pledged to embrace China’s new paradigm of stricter government oversight after reporting its slowest growth on record, declaring the end of an era that nurtured some of the world’s largest and most profitable corporations.

Co-founder Pony Ma and President Martin Lau led executives in endorsing Beijing’s year-long crackdown on everything from gaming to online commerce. They pointed out it mirrored a backlash against the enormous power of internet giants globally and argued more regulation will lead to healthier growth in the long run.

“We are proactively embracing changes to better align ourselves with the new industry paradigm,” Lau said on a conference call after the results. “We have a long term oriented corporate culture that focuses on user value, social responsibility, technology innovations and compliance, the key elements for sustainable and healthy growth.”

The company also waved aside speculation it will embark on a share-buyback program like rival Alibaba Group Holding Ltd. announced this week, saying it will focus instead on core businesses like international games, cloud services and its WeChat messaging service, developing new games for its pipeline when the regulatory environment stabilizes later in 2022.

Click here for a live blog on Tencent’s earnings.

Tencent joins Alibaba and other rivals in recognizing a new phase of cautious expansion, more than a year after the start of a bruising crackdown that eventually engulfed every internet sphere from ecommerce to online gaming and education. Tencent followed Alibaba in reporting its slowest pace of quarterly growth on record as online advertising sales missed analysts’ projections after they declined for the first time on record. And domestic gaming revenue grew a mere 1% — reflecting a months-long licensing halt that along with curbs on playtime for minors have sapped Tencent’s biggest division.

Revenue rose just 8% to 144.2 billion yuan ($22.6 billion) in the quarter versus the 145.3 billion yuan average forecast — the first time that quarterly sales have grown by single-digits. Net income rose to 95 billion yuan, surpassing the 31.5 billion yuan projected, but only because of a big one-time gain. Yet non-IFRS profit dropped a worse-than-feared 25%, and gross margins narrowed under an international expansion.

Shares in Naspers Ltd., which as Tencent’s biggest external shareholder is regarded as a proxy for the company, fell 6%.

Read more: Alibaba Plans for New Normal of Low Growth as Crackdown Bites

Tencent has lost more than $470 billion from its peak in 2021, even though it has largely escaped Beijing’s direct scrutiny. The company has studiously endorsed the government’s efforts, saying it was better in the long run to curb the excesses of the past that have led to disorderly competition in areas like ride-hailing, e-commerce and food delivery. Alibaba and Meituan were two of the more prominent companies fined for monopolistic practices over the past year.

“For several years, industry participants have over-emphasized zero-sum competition, aggressive marketing, reckless expansion, short-term growth and corporate benefits, overlooking the most important elements of sustainable growth,” Lau said. “As a result, the industry’s growth has become frothy and unhealthy.”

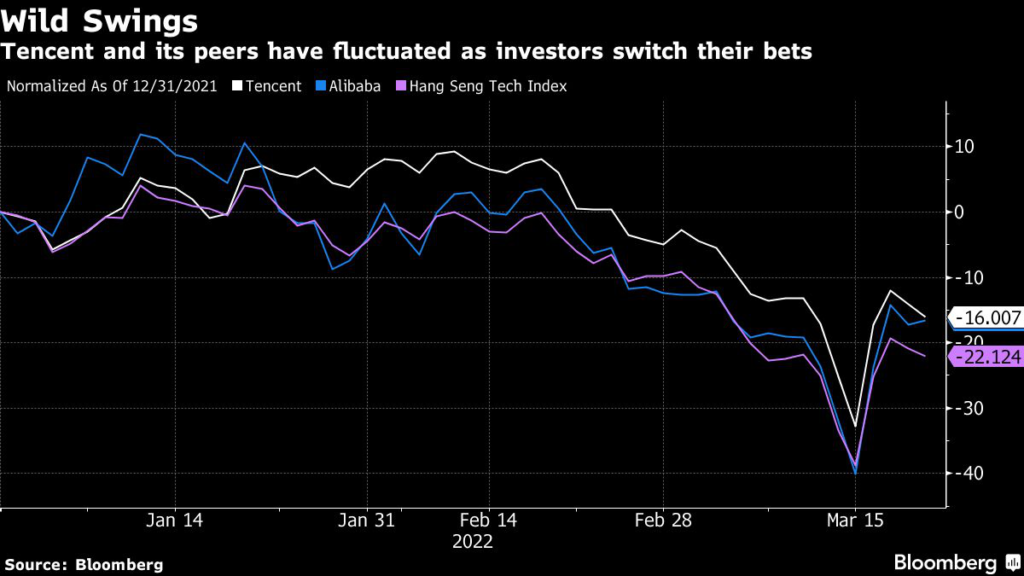

Investors are re-calibrating their approach to the market after Xi Jinping and his deputy Liu He pledged to support the economy and markets and finish the clampdown on the tech sector “as soon as possible” — triggering a historic rally in Chinese stocks last week.

But for Tencent, several unresolved issues remain.

“Macro and regulatory headwinds aside, Tencent is having its own challenges,” said Shawn Yang, analyst at Blue Lotus Capital Advisors. “It has yet to create its next gaming hits, and advertising sales were affected by ByteDance’s Douyin a lot.”

Regulators are considering requiring Tencent to fold its WeChat Pay service into a newly established financial holding company, Bloomberg reported last week, part of an overhaul of its giant fintech arm that could undermine the appeal of its entire social media business. On Wednesday, Lau said the company remains in talks with regulators on restructuring requirements, adding Tencent will comply with all regulations.

Read more: China Weighs Tencent Payments Overhaul, New License Requirement

A freeze in new releases in the world’s largest gaming market is entering its eighth month, reviving fear of a 2018 crackdown that plunged Tencent’s most lucrative business into contraction.

Given the regulatory hurdles at home, Tencent is increasingly turning outward. While scooping up slices of game studios in places across Europe and Asia, it’s working with Western gaming giants to adapt their beloved franchises to mobile – the latest example being Electronic Arts Inc.’s Apex Legends. In December, Tencent launched a new publishing division for global markets, with offices in Singapore and Amsterdam.

At the center of Tencent’s sprawling online businesses is still the WeChat messaging platform, used by a billion-plus people for everything from a League of Legends purchase to a TikTok-style video feed and meal delivery. Monthly active users on WeChat grew 3.5% to 1.27 billion in the period. Daily active users of the app’s mini-programs — download-free lite services within the main platform — grew about 12.5% to 450 million in 2021, executives said in January.

Executives have stressed they see the domestic gaming challenges as “temporary” and that the company has a big stockpile of titles ready for launch as regulatory uncertainties ease. On Wednesday, Lau said the company expects Beijing to continue handing out new gaming licenses once the industry resolves protections for minors, without giving a timeline.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.