(Bloomberg) — Tencent Holdings Ltd.’s revenue grew at the slowest pace since its 2004 listing, revealing the financial toll of China’s crackdown on its most lucrative businesses from gaming to advertising.

Revenue rose 8% for the three months ended December — the first time that quarterly sales have grown by single-digits. Online advertising sales missed analysts’ projections after they declined for the first time on record. And domestic gaming revenue grew a mere 1% — reflecting curbs on playtime for minors that have sapped Tencent’s biggest division.

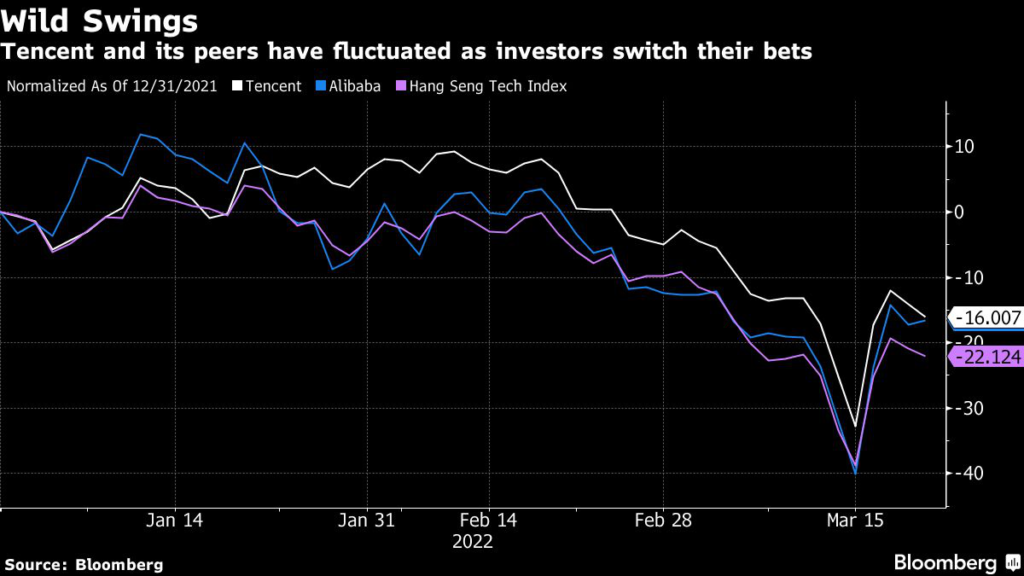

China’s largest internet corporations have resigned themselves to a new era of cautious expansion, more than a year after the start of a bruising crackdown that eventually engulfed every internet sphere from ecommerce to online gaming and education. Tencent’s main rival Alibaba Group Holding Ltd. delivered its slowest topline growth on record in the December quarter.

Shares in Prosus NV, which as a unit of Tencent’s biggest external shareholder is regarded as a proxy for the company, fell 1.6%.

Revenue rose to 144.2 billion yuan ($22.6 billion) in the quarter versus the 145.3 billion yuan average forecast. Net income rose to 95 billion yuan, surpassing the 31.5 billion yuan projected, thanks in part to a big one-time gain.

Tencent has lost more than $470 billion from its peak in 2021, even though it has largely escaped Beijing’s direct scrutiny. Investors are re-calibrating their approach to the market after Xi Jinping and his deputy Liu He pledged to support the economy and markets and finish the clampdown on the tech sector “as soon as possible” — triggering a historic rally in Chinese stocks last week.

Click here for a live blog on Tencent’s earnings.

But for Tencent, several unresolved issues remain.

Regulators are considering requiring Tencent to fold its WeChat Pay service into a newly established financial holding company, Bloomberg reported last week, part of an overhaul of its giant fintech arm that could undermine the appeal of its entire social media business. A freeze in new releases in the world’s largest gaming market is entering its eighth month, reviving fear of a 2018 crackdown that plunged Tencent’s most lucrative business into contraction.

Given the regulatory hurdles at home, Tencent is increasingly turning outward. While scooping up slices of game studios in places across Europe and Asia, it’s working with Western gaming giants to adapt their beloved franchises to mobile – the latest example being Electronic Arts Inc.’s Apex Legends. In December, Tencent launched a new publishing division for global markets, with offices in Singapore and Amsterdam.

At the center of Tencent’s sprawling online businesses is still the WeChat messaging platform, used by a billion-plus people for everything from a League of Legends purchase to a TikTok-style video feed and meal delivery. Monthly active users on WeChat grew 3.5% to 1.27 billion in the period. Daily active users of the app’s mini-programs — download-free lite services within the main platform — grew about 12.5% to 450 million in 2021, executives said in January.

Executives have stressed they see the domestic gaming challenges as “temporary” and that the company has a big stockpile of titles ready for launch as regulatory uncertainties ease. Meanwhile, Tencent is exploring new drivers, especially in international games as well as in the metaverse, which Lau called a “real opportunity.”

Just like Mark Zuckerberg’s Meta Platforms Inc., the Chinese company is prepping for a technological leap into the virtual realm, registering relevant trademarks for the metaverse and hiring developers for open-world games. Still, executives cautioned that the concept may take longer than expected to realize.

(Updates with sales from the second paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.