(Bloomberg) — For close to four decades, one Japanese company has been trusted to move silicon wafers around inside the factories of the world’s biggest chipmakers. Now it’s going back to the drawing board and redesigning its ubiquitous overhead conveyors to handle an “exponential” surge in data usage and global chip demand.

Daifuku Co. has over its 85 years in business gone from ferrying documents between offices and hospital wards to handling the world’s most delicate microelectronics, making the conveyor belts and boxes that zip across the ceilings of modern semiconductor plants. Those containers and rails, which shuttle chips to different parts of the fabrication process at speeds surpassing 5 meters per second, will need to bear 100kg (220 pounds) or five times their current load within years, Chief Executive Officer Hiroshi Geshiro said.

“Many in the industry are optimistic that growth is here to stay, as the amount of data that society must deal with has increased exponentially,” he told Bloomberg News in an interview. “Our system is like blood vessels connecting all the important organs” and will need to handle that explosion in demand. The company stockpiled materials at the start of the pandemic, but may face challenges if global supply shortages intensify or prolong, he added.

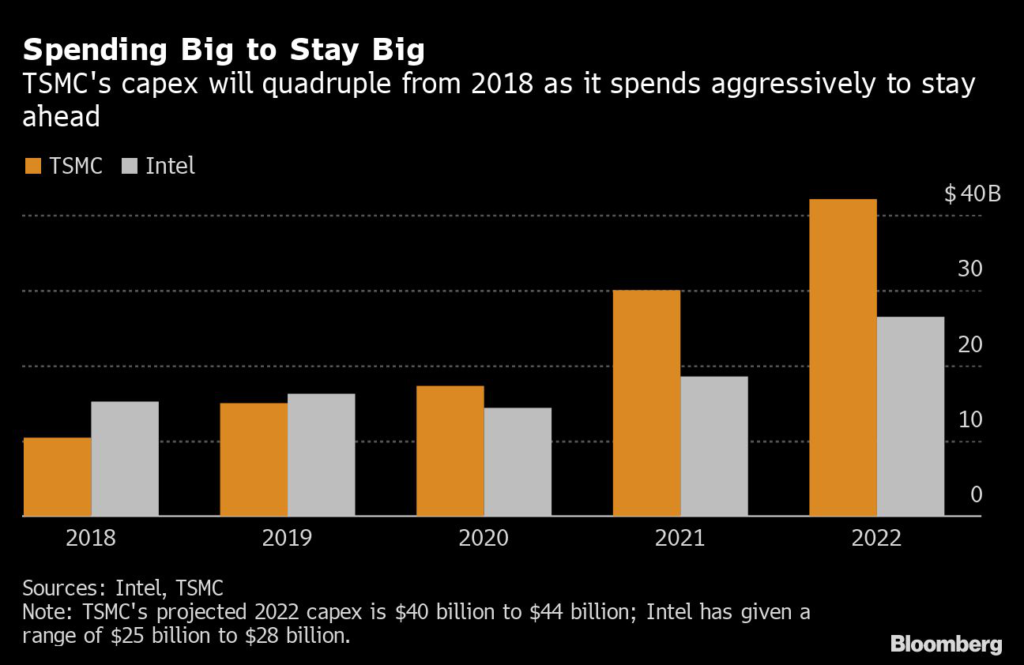

The 63-year-old’s remarks underscore the bullishness of global chipmaking leaders such as Intel Corp. and Taiwan Semiconductor Manufacturing Co., which have been spending unprecedented sums of money to capture a wave of new demand from industries such as electric vehicles, connected home devices and internet servers. Between them, the two companies have committed to spending roughly $70 billion on new manufacturing equipment and facilities this year. Intel announced two giant new chipmaking campuses — one in Ohio and another in Germany — in recent months, as it joins rivals in preparing for a doubling of the $550 billion industry over the next decade.

Chip Industry Sales to Reach $1 Trillion in 2030, TSMC Says

At the heart of that impending explosion will be Osaka-based Daifuku, founded in 1937 as a maker of forging machines before scoring its first big break 20 years later when Toyota Motor Corp. came calling. Today, analysts say its systems power everything from Amazon.com Inc.’s giant fulfillment centers to the plants of Intel and TSMC.

Its factory conveyance systems are among the world’s most sophisticated. Its overhead vehicles are powered wirelessly and can cover 320 meters (350 yards) in a minute without shaking or disturbing their contents. A routing system aided by artificial intelligence helps plot paths for hundreds of containers across a complex intertwined network without creating a jam.

“There are no competitors that can match Daifuku when it comes to speed in meeting customer requests for production lines,” said Omdia analyst Akira Minamikawa. The company’s long track record has “built a high level of trust and confidence among semiconductor makers. In chipmaking, minimizing travel time between processes is key to maximizing output.”

While Geshiro declined to disclose the names of his customers, SMBC Nikko Securities analyst Satoshi Taninaka wrote in a report this month that Daifuku’s transport system is used in almost every factory making chips with the most advanced fabrication processes of 7nm and smaller.

What Bloomberg Intelligence Says

Semiconductor development and production need strong tie-ups with equipment suppliers such as Daifuku, which may be one reason for its competitiveness in the industry. History of providing transfer systems for chipmaking materials makes them a strong partner to the industry where barriers to entry for other producers have become high.

— Takeshi Kitaura, analyst

Geshiro, who joined Daifuku a year before it got into chipmaking in 1984, sees demand for its transports expanding to include the so-called back-end of chip manufacturing — which features heavier, less sensitive loads. This push has been driven in part by the increasing adoption of stacked-chip manufacturing techniques that put more silicon into every module. Daifuku’s current systems carry loads of roughly 20kg, but customers have been asking for ones that can work with loads between 70kg and 100kg and the company is developing new rails and carriers to handle such weight.

The entire transport system for a given fab is less costly than a single unit of the most advanced semiconductor-making machines, but Geshiro considers his machinery every bit as essential to the final product. Chipmaker fabs are more demanding than other industries, the CEO said, asking for installations to be completed in half the time that others, such as automakers, would allow.

“There won’t be a day when semiconductor makers will be completely satisfied with what we offer as they constantly ask us for more,” he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.