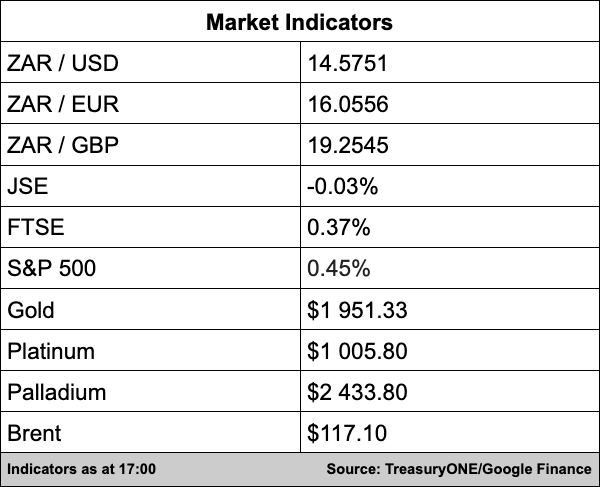

The rand has given back some of yesterday’s gains slowly and steadily throughout the day. The local unit is now trading at R14.58/$ after opening at R14.50/$.

“This weakness can be seen as a form of consolidation, and we would need to watch how the market moves next week for further direction. Other EM’s have all been following a similar path today, with the Mexican Peso our closest comrade at the moment,” comments TreasuryONE.

Palladium has been the major mover in the commodity space giving up over 2% for the day. Platinum has also lost some ground and just trading above $1,007. Gold is slightly softer but holds on to the $19,50 handle at the moment. Oil prices did trackback lower during the day as Brent crude gave up 1.8% with the EU and US agreeing on an energy supply deal. Currently, Crude is priced at $117 while WTI is at $112.

On the JSE, the bourse traded flat and lost a small 0.03% by the close of trade. The All Share Index is at 74,325 points.

Nedbank shares gained 1.48% on the back of news the banking group would follow in the footsteps of peers Standard Bank and Investec with a listing on A2X Markets. Shares will be available for trade from April 1 and the bank group will also keep its secondary listing on the Namibian Stock Exchange as well as its listing on the JSE.

Banking peers, Absa (0.28%), FirstRand (0.74%), Investec (0.30%), and Capitec (0.45%) all gained.

The total number of instruments listed on A2X will hit 62 with the Nedbank listing to bring the combined market capitalisation to R4.2 trillion.