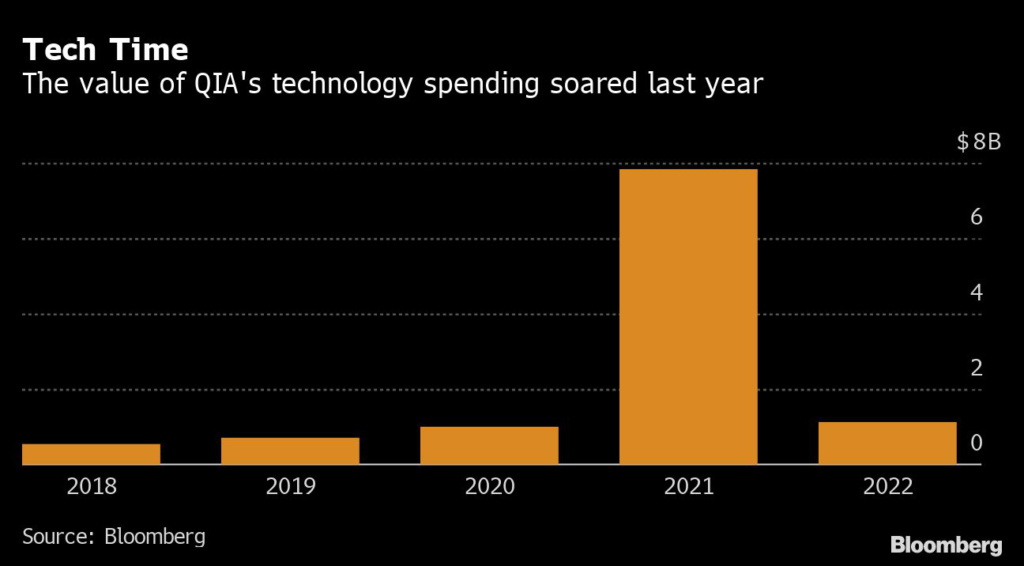

(Bloomberg) — The Qatar Investment Authority is trimming stakes in listed trophy assets and turning to closely-held technology companies in growth markets in a major strategy shift for one of the world’s largest sovereign wealth funds.

Qatar is among the world’s richest countries because of the size of its gas exports. It’s been taking steps to diversify its economy and the $450 billion QIA, founded in 2005, has vowed to plow more money into Asia and the U.S. after years of substantial investment in Europe.

To help fund this pivot, it has pared back positions in blue-chip names like Glencore Plc, in which it sold a $1 billion stake this week. It also reduced its holding in Barclays Plc in 2021. QIA hasn’t reported meaningful new positions or additions to holdings in listed firms over the past year.

Instead, the wealth fund has been active in markets like India, where it’s invested in food-delivery platform Swiggy and cloud kitchen startup Rebel Foods. It’s also committed as much as $1.5 billion to a James Murdoch-backed venture aiming to invest in media and consumer tech opportunities in Southeast Asia, with a particular focus on the subcontinent.

Elsewhere, QIA has led a funding round for a Turkish artificial intelligence unicorn, invested in a U.K. digital lender, and bought a minority stake in a firm that builds aerospace tech.

This all marks a significant shift for the QIA, which, in the years following the 2008 global financial crisis, was a first port of call for large public companies seeking much-needed capital.

The QIA became known for its penchant for so-called trophy assets; it took a stake in Swiss lender Credit Suisse Group AG and splashed out on other big-ticket investments, including London Stock Exchange Group Plc and the iconic Harrods department store in London’s upmarket Knightsbridge neighborhood.

Another force behind the recent change in strategy is Qatar’s efforts to bolster food security. As one of the most water-stressed countries in the world, its wealth fund has put money into indoor farming and firms that make plant-based meat alternatives.

The QIA ranks as the world’s ninth-largest sovereign wealth fund, according to SWF Institute data. Other Middle Eastern funds, including those in Saudi Arabia and Abu Dhabi, have also stepped up tech investments in recent years.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.