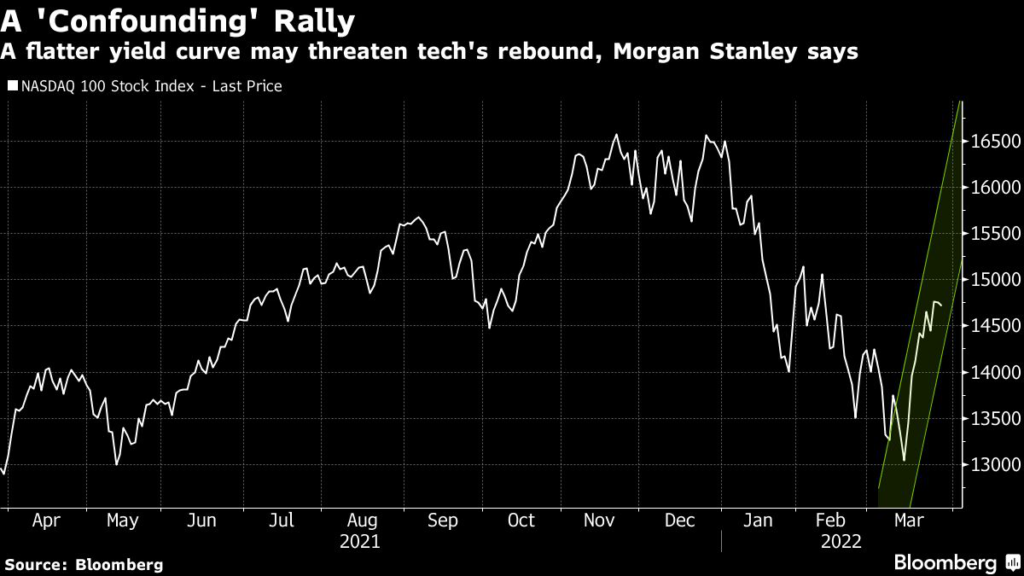

(Bloomberg) — Major U.S. technology and internet stocks have staged a sharp rebound in recent weeks, but the group’s rally could be at risk amid a flattening yield curve, according to Morgan Stanley Wealth Management.

The Nasdaq 100 Index has climbed about 13% off a low hit earlier this month, with the rally fueled by double-digit percentage gains in market leaders like Apple Inc. and Alphabet Inc. Amazon.com Inc. has been especially strong. Amazon gained more than 20% off a low hit earlier in March and erased its year-to-date decline. Nvidia Corp., the largest chipmaker by market capitalization, is up almost 30% off its own March low.

Lisa Shalett, chief investment officer of Wealth Management at Morgan Stanley, wrote that this advance has been “confounding,” as it comes at a time of higher interest rates as the Federal Reserve takes steps to fight inflation.

The slope of the five-year and 30-year US Treasury yield curve is flattening, and “as this and other yield curves head toward inversion, the nascent rebound in megacap tech stocks may stall,” she wrote in a report. “We are not sanguine about stocks at current valuations and level of earnings expectations, to say nothing of the execution risk in the Fed’s new policy path.”

Among Monday movers, Amazon rose 1% and Microsoft Corp. added 0.8%. Apple slipped 0.6% following a report that it is cutting production of its iPhone SE.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.